Ongoing Planning provides you with confidence and reassurance that you are optimizing relevant planning opportunities and have a professional watching over your “stuff”. You get the benefit of having on-demand meetings or calls for urgent life planning matters as well as unlimited phone and email support.

A wealth of information at your fingertips.

A wealth of information at your fingertips.

Got a Minute? Get an Economic Edge (Trade Deficits)

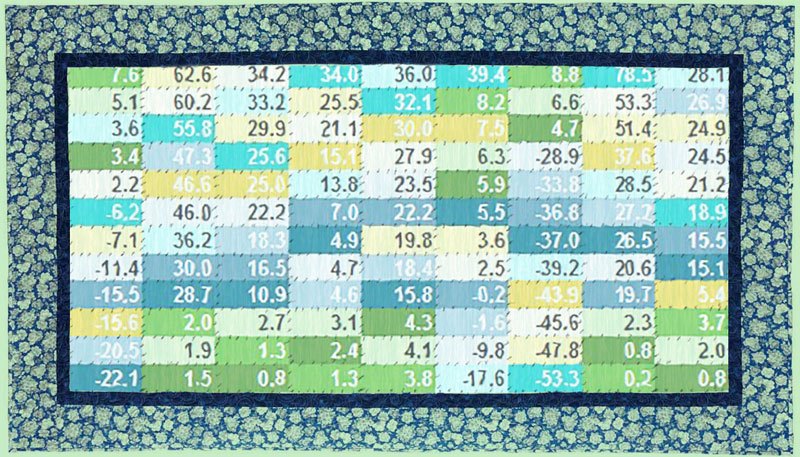

Today we share a series of charts on trade deficits. Reminder: These charts come to us compliments of independent economist Fritz Meyer, a seasoned economic and markets analyst whose insights appear regularly on CNBC, Bloomberg TV and the Fox Business Network. Here is what Fritz has to say about trade deficits: … A trade deficit isn’t a debt that must be repaid. It is often a sign of economic prosperity. … It means...What Sheri’s Reading: March 2017 Edition

March 15, 2017

in SAGE Reads

A curated list for your reading pleasure -- some light-hearted articles, some that are thought-provoking, and some of a more practical nature:

This Bull Market Isn't as Old as Some Seem to Think (BloombergView) “Why is this important? Understanding how old a bull market is may very likely affect your expectations of future returns, your risk appetite, even your investment allocations. Misunderstanding when a bull market began is potentially a...

Dimensional Fund Advisors: Going Global Is Still in Vogue

Here’s a trick question: When does 5,000 = 3,600? The answer is: when you’re counting how many companies the Wilshire 5000 Total Market Index is actually tracking these days. The name suggests there are at least 5,000 publicly traded, U.S.-listed companies in the total market, but that number has been shrinking for a couple decades. That’s one of several fascinating insights shared in a recent report from our friends at Dimensional...Dimensional Fund Advisors: Investment Shock Absorbers

FEBRUARY 17, 2017 Investment Shock Absorbers JIM PARKER, VICE PRESIDENT Ever ridden in a car with worn-out shock absorbers? Every bump is jarring, every corner stomach-churning, and every red light an excuse to assume the brace position. Owning an undiversified portfolio can trigger similar reactions. TO READ MORE: OPEN PDF ARTICLE ...Three Cheers to Three Years at SAGEbroadview

February 8, 2017

in SageBroadview News

Whenever the world rings in a new year, we are privileged to reach another milestone that, in our opinion, seems almost as worthy of global celebration. Happy third birthday to us! On January 1, 2014, SAGE Advisory Group of Morristown, NJ and Broadview Financial Planning of Farmington, CT merged and became (drumroll from Devon please …) SAGEbroadview Financial Planning.

Combining two seasoned teams scattered across multiple states into one cohesive group...

Secure Document Sharing

Secure Document Sharing