Portfolio Management

Portfolio Management

We blend different, complementary funds representing the various asset classes, to create a globally diversified portfolio reflecting your personal goals, cash flows, risk characteristics, and tax situation. Then we monitor your portfolio, and periodically rebalance when needed.

How SAGEbroadview Helps You Optimize Your Investing

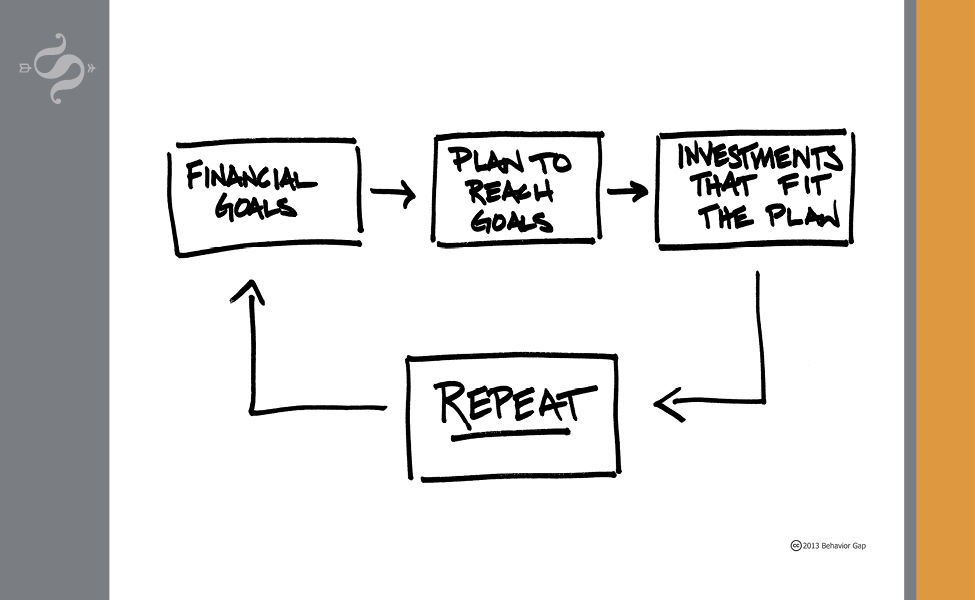

1. Why invest to begin with?

Your goals and your planning are where it should begin.

Think of it like this: You wouldn’t expect your doctor to write a prescription without first diagnosing a condition. And she wouldn’t make that diagnosis without first asking you where it hurts and examining you accordingly. Similarly, if you’ve got an investment portfolio but you’ve never explored what it’s intended to “do,” how will you know when it’s doing a good job for you?

So first, we get to know you and your financial situation. What are your goals and timeframes? Are you adding to your portfolio or taking distributions? Are your circumstances likely to change in the next few years?

2. We design your investing plan…

…using academically-sound, evidence-based principles, and based on your financial goals and needs.

RISK

We measure your tolerance for risk i.e. your emotional capacity to withstand losses without panicking and assess your risk capacity, i.e. your ability to absorb losses without affecting your lifestyle.

ASSET CLASSES & ASSET ALLOCATION

We determine the appropriate asset classes (stocks, bonds, cash, and real estate) and the mix of these asset classes (% in stocks, bonds, cash, and real estate – the asset allocation.)

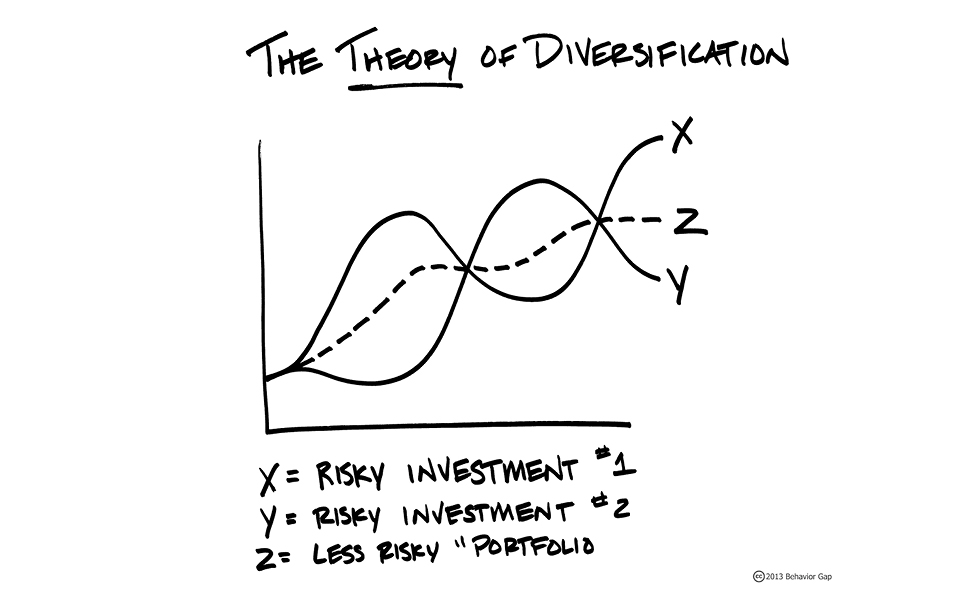

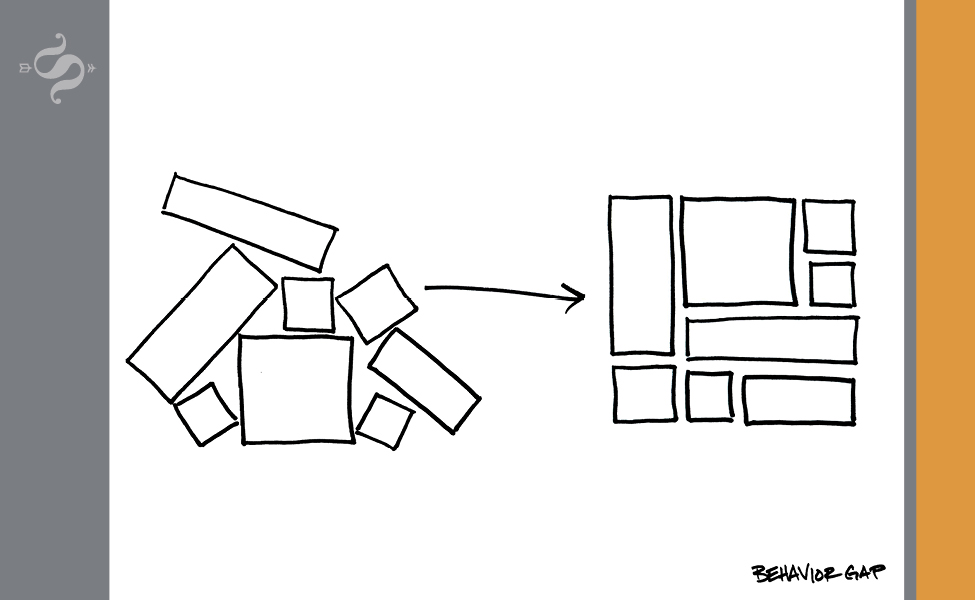

DIVERSIFICATION

We select the investments within the asset classes to spread market risk widely and globally. Diversification helps smooth out the returns of your overall portfolio, and you are better positioned to capture returns wherever they occur.

ASSET LOCATION

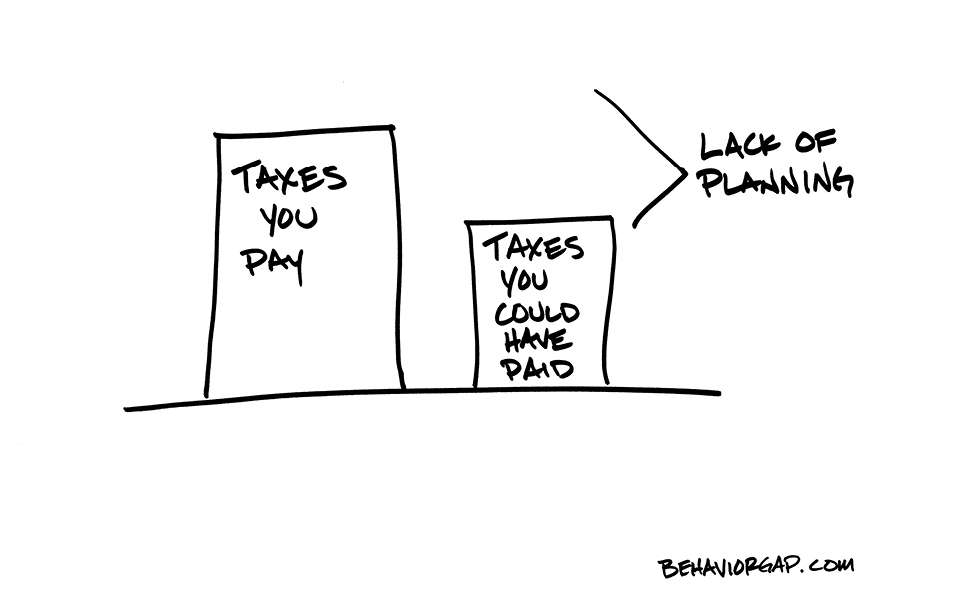

We also review your tax situation. Are you in a high tax bracket? Do you have investments in both taxable and tax-sheltered accounts? If so, we will typically use asset location for you.

Asset location is a tax minimization strategy that takes advantage of the fact that different types of investments and accounts receive different tax treatments. Using this strategy, we determine where to locate your stocks, bonds, and other holdings within your taxable and tax-sheltered accounts to help improve after-tax returns.

3. We create an Investment Policy Statement.

Finally, we document this in an Investment Policy Statement, a written agreement, signed by you and SAGEbroadview, when it is created as well as whenever it is updated. It includes descriptions of the factors influencing your investing plan.

4. We implement and monitor your portfolio.

We make the necessary trades to implement your investing plan.

You receive account statements directly from the custodian. Confirmation statements will be issued by the custodian for all trading activity.

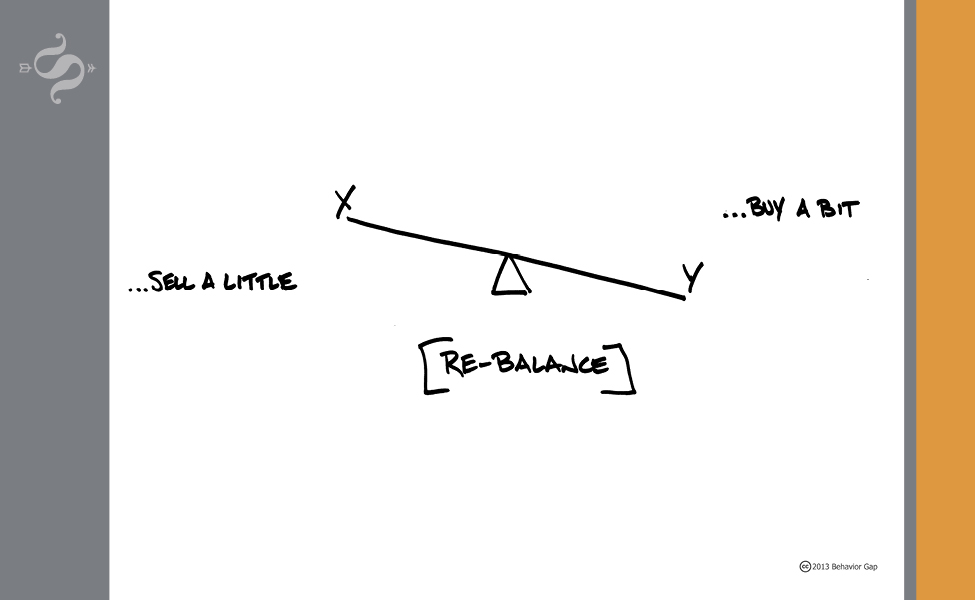

From time to time, market conditions may cause the various asset classes to out- or underperform others. As these shifts occur, your holdings stray off-balance from their original, intended “weights” or allocations. If they stray too far for too long, you can end up taking on too much or insufficient market risk.

Rebalancing is the act of shifting your allocations back to where they belong, according to your personal plans. To rebalance, we sell some of the now-overweight assets and use the proceeds to buy assets that have become underrepresented until you’re back at or near your desired mix.

Summary

SAGEbroadview will blend different, complementary funds representing the various asset classes to create a globally diversified portfolio that reflects your personal goals, cash flows, risk characteristics and tax situation. We will periodically rebalance the chosen asset classes to maintain a more consistent risk-reward profile.

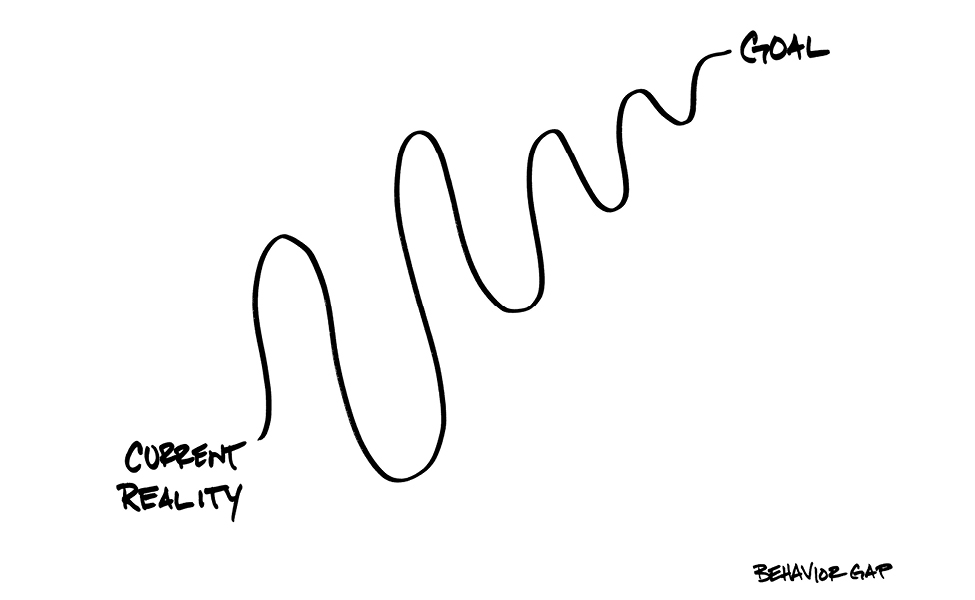

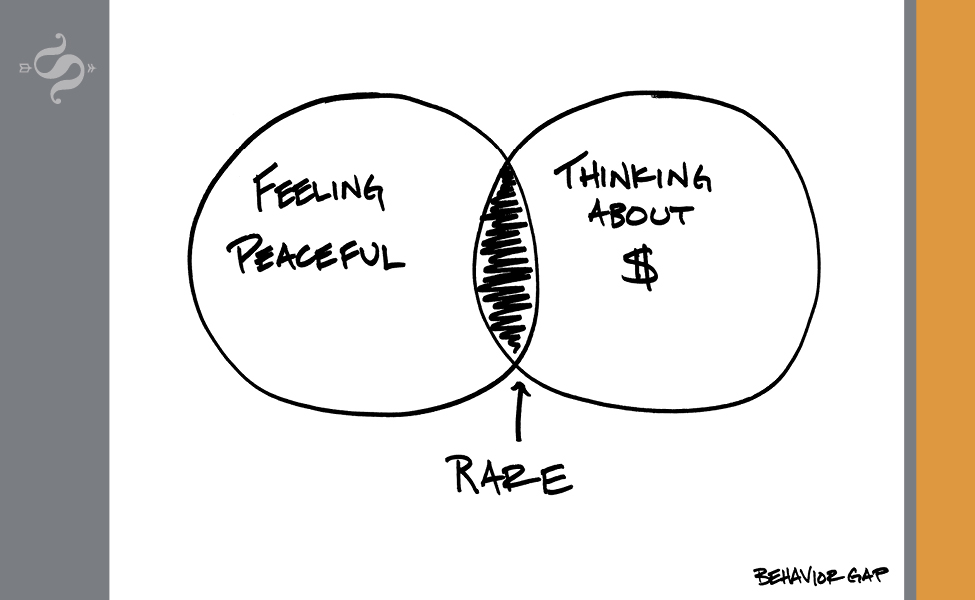

Remember, all investments go through cycles and, therefore, there will be periods of time in which your investment objectives are not met. In the absence of certain circumstances requiring immediate action, patience and a longer-term perspective should be employed when evaluating your investment performance.

Our Investing Partners

Funds & Research

Dimensional’s investment approach is grounded in economic theory and backed by decades of empirical research.

Their internal team of researchers works closely with leading financial economists to better understand where returns come from.

Research has shown that securities offering higher expected returns share certain characteristics, which are called dimensions. To be considered a dimension, these characteristics must be sensible, persistent over time, pervasive across markets, and cost-effective to capture.

We highly encourage you to visit their Home page to learn more.

Secure Document Sharing

Secure Document Sharing