Building Blocks- Diversification

Diversification simultaneously dampens your exposure to a number of investment risks while potentially improving your overall expected returns.

What is diversification?

In a general sense, diversification is about spreading your risks around, widely and globally. In investing, that means it’s more than just ensuring you have a lot of holdings, it’s also about having many different kinds of holdings.

If we compare this to the adage of not putting all your eggs in one basket, a concentrated portfolio is the undiversified equivalent of baskets of plain, white eggs. In contrast, a diversified portfolio would be ensuring your baskets contain not only eggs but also a bounty of fruits, vegetables, grains, meats, and cheese.

Here’s how diversification works.

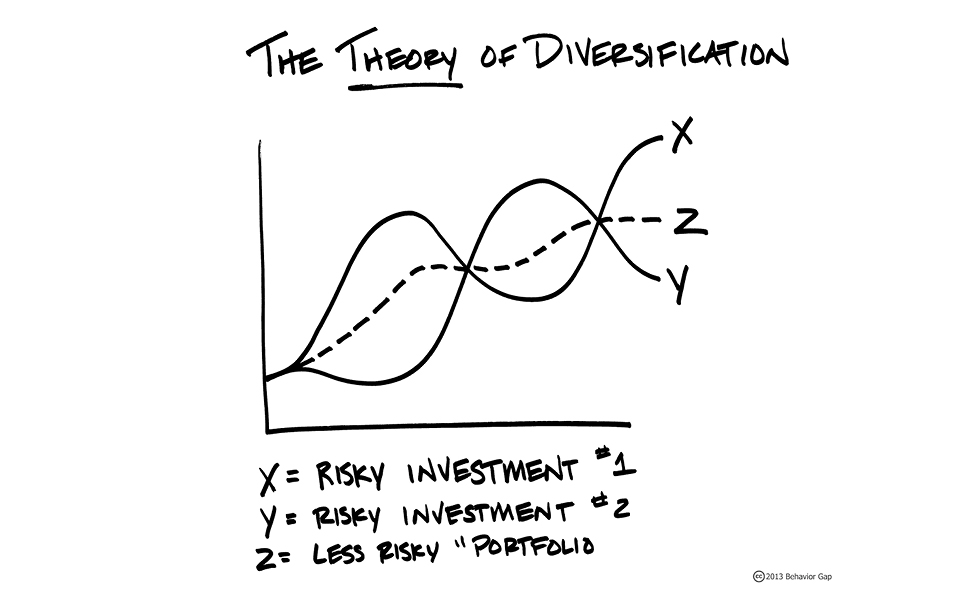

When you crunch the numbers, diversification is shown to help minimize the leaps and dives you must endure along the way to your expected returns. Imagine several rough-and-tumble, upwardly mobile lines that represent several kinds of holdings. Individually, each represents a bumpy ride. Bundled together, the upward mobility by and large remains, but the jaggedness along the way can be dampened (albeit never completely eliminated).

Secure Document Sharing

Secure Document Sharing