Investment Basics Series: What Is Diversification?

What is diversification and why does it matter to you as an investor?

Risk, Return and Diversification

If market risk is the fuel that drives expected returns, diversification is your steering wheel for navigating more assuredly toward your desired destination.

As we covered in our last post, if you want to earn a return on your capital, you must put it to work in one or more markets. This also means you must expose yourself to a measure of market risk, or volatility, as defined by standard deviation.

Fortunately, diversification is your super power to help you manage that market risk by spreading it around, widely and globally. Properly applied across your entire portfolio, diversification not only helps you avoid the danger of concentrating too many eggs into a single basket, it can actually help you stretch for a bit of extra expected return while controlling the volatility risks otherwise involved. What could be more potent than that?

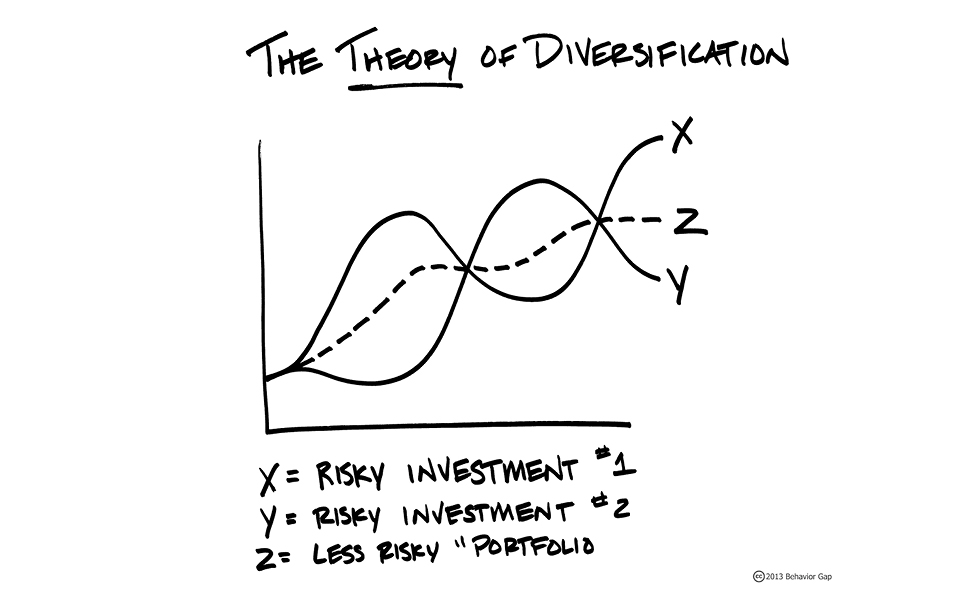

Here’s how it works. When you crunch the numbers, diversification is shown to help minimize the leaps and dives you must endure along the way to your expected returns. Imagine several rough-and-tumble, upwardly mobile lines that represent several kinds of holdings. Individually, each represents a bumpy ride. Bundled together, the upward mobility by and large remains, but the jaggedness along the way can be dampened (albeit never completely eliminated).

We do want to address a common misperception about diversification. Too often, investors assume they are well-diversified because they hold a number of securities or funds across several accounts. But a problem arises if most of those holdings share similar risk/return characteristics. For example, if you hold 10 funds in several accounts, but eight of those funds hold mostly U.S. large-company stocks, your eggs still have not been properly spread.

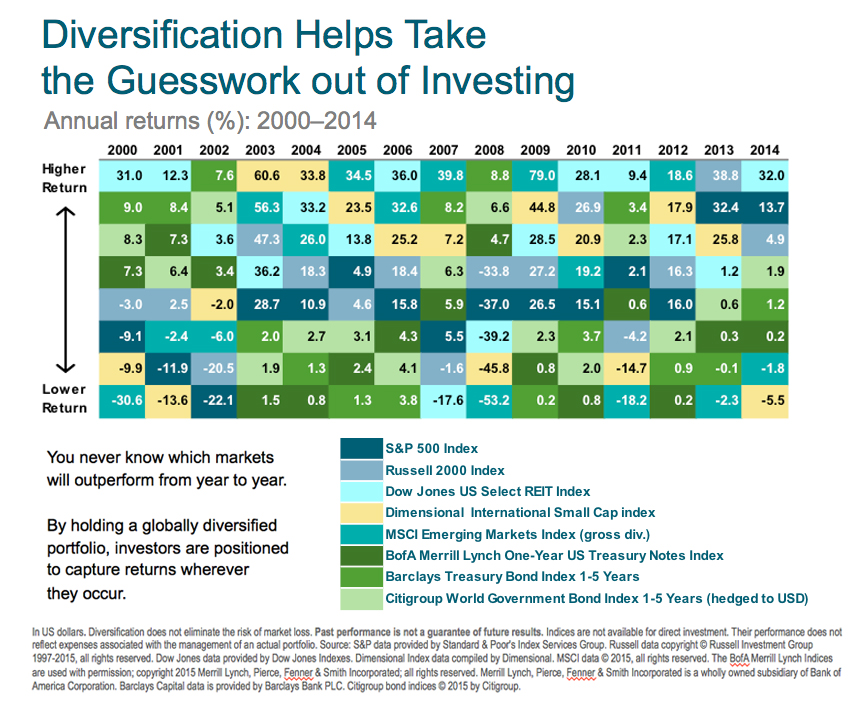

Consider this chart depicting 15 years of returns from various kinds of investments around the world. Note how differently each asset class “color” has performed from one year to the next, compared to its own annual returns as well as to the varied returns from other asset classes. (For a review on what we mean by asset classes, revisit our earlier post, “What Is an Asset Class?”)

To capture the spectrum of all that the markets have to offer, it’s important to diversify your investments into not just a lot of investments, but a lot of kinds of investments. If you’re unsure what is actually in all those funds you hold, it’s worth obtaining a detailed portfolio analysis from an objective professional who is qualified to help you determine whether you have achieved true diversification, or only the appearance of it.

Win a copy of Carl Richards’ new book, One-Page Financial Plan

As we mentioned in our Investment Basics introduction, send us an e-mail with a question or comment about today’s post, and you’ll be entered to win this week’s drawing for a copy of Carl Richards’ One Page Financial Plan. Happy summer reading!

Sage Serendipity: In case you missed it…the Empire State Building was illuminated Saturday night for three hours with images of endangered species. This was the first time this type of video projection was used on the building. Check out this NBC newscast to see the building come to life and the inspiration behind the display.

Sage Serendipity: In case you missed it…the Empire State Building was illuminated Saturday night for three hours with images of endangered species. This was the first time this type of video projection was used on the building. Check out this NBC newscast to see the building come to life and the inspiration behind the display.

Secure Document Sharing

Secure Document Sharing