Investment Basics Series: What Is an Asset Class?

What is an asset class, and why does it matter to you as an investor?

Asset classes are categories (classes) by which we organize individual securities (assets) that share significant factors. Significant factors are the ones that help us associate an investment with a particular level of risk and expected return. For example:

Significant – Stocks vs. Bonds: Owning (stocks) is inherently riskier than lending (bonds). That’s why stocks and bonds are two distinct asset classes, with two distinct levels of expected return.

Insignificant – Corkscrews vs. Computers: Whether a company sells corkscrews or computers tells us nothing about its expected, long-term returns. That’s why there are no distinct asset classes for particular goods and services.

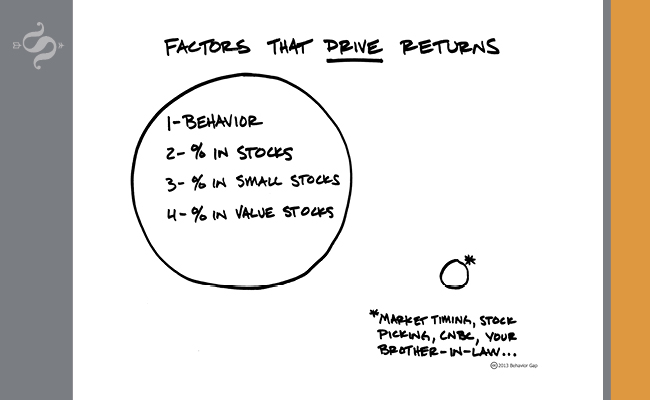

You may wonder how we sorted out which characteristics are expected to matter. That’s where the “evidence-based” component of evidence-based investing comes in. Beginning in the 1960s (with Nobel laureate William Sharpe’s Capital Asset Pricing Model), a body of academics has been meticulously identifying what distinguishes asset classes from a noisy distractions. The exploration continues but, to date, the following asset classes have been identified as the most durable candidates across global markets:

– Equities (Stocks)

- Large vs. small company stocks

- Growth vs. value company stocks

– Fixed Income (Bonds)

- Bonds with near or distant due dates (terms)

- Bonds with higher or lower credit ratings

– Real Estate

Do you remember that Periodic Table of Elements from your high school science class? Just as elements are essential to the make-up of the universe, these core asset classes are elemental to wealth management. Without asset class management, it’s too easy to become distracted by irrelevant events and emotional reaction when choosing your holdings. By ensuring that your investments represent an appropriate mix of globally diversified asset classes that reflect your personal goals and risk tolerance, you stand the best chance for eliminating chaotic guesswork and bringing order to your investment universe.

Win a copy of Carl Richards’ new book, One-Page Financial Plan

As we mentioned in our Investment Basics introduction, send us an e-mail with a question or comment about today’s post, and you’ll be entered to win this week’s drawing for a copy of Carl Richards’ One Page Financial Plan. Happy summer reading!

Sage Serendipity: Recently Misty Copeland became the first African-American female principal dancer with the American Ballet Theatre. Her story is magically inspirational, from living in poverty in a California motel room where she used the outdoor railing as a barre, to her historic position at ABT. Her commercial for Under Armour went viral with over 8 million hits. 60 Minutes recently told her story and it’s worth watching.

Sage Serendipity: Recently Misty Copeland became the first African-American female principal dancer with the American Ballet Theatre. Her story is magically inspirational, from living in poverty in a California motel room where she used the outdoor railing as a barre, to her historic position at ABT. Her commercial for Under Armour went viral with over 8 million hits. 60 Minutes recently told her story and it’s worth watching.

Secure Document Sharing

Secure Document Sharing