What is SAGEbroadview Wealth Management for a Young Professional?

Our wealth management process is ongoing, and integrates financial planning & portfolio management, with tax planning carefully woven throughout.

You can only escape reality for so long.

You can only escape reality for so long.Our wealth management process is ongoing, and integrates financial planning & portfolio management, with tax planning carefully woven throughout.

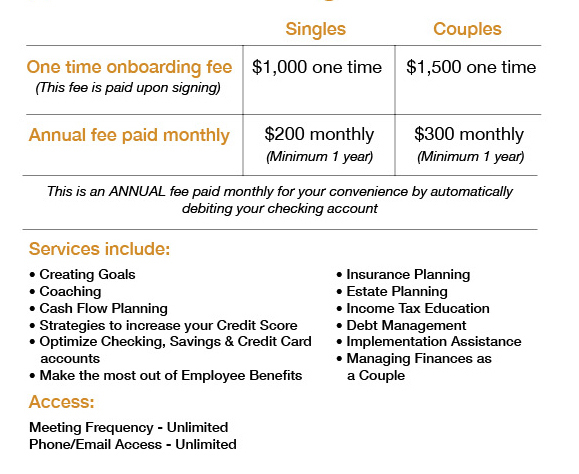

Singles |

Couples |

|

|---|---|---|

One-time onboarding feeDue upon signing, non-refundable |

$1,000 one-time |

$1,500 one-time |

Monthly recurring financial planning fee starting at:Fees are automatically deducted from your checking account. |

$300 monthly |

$350 monthly |

Quarterly portfolio management feeFees are automatically deducted from your investment accounts. |

The quarterly cost for Portfolio Management services is just 0.125% of the investment accounts we manage for you. That is $1.25 for every $1,000 in your portfolio. |

|

Please note: We do not offer financial planning services without also managing your investments. Click here to learn more.

Additionally, we do not offer hourly or project-based advice at this time.

*Income Tax Preparation service is also available separately through our affiliated firm SAGEbroadview Tax

| Singles | Couples | |

|---|---|---|

| One-time onboarding fee (Due upon signing, non-refundable) |

$1,000 one-time | $1,500 one-time |

| Monthly recurring fee starting at: | $200 monthly | $300 monthly |

| Fees will be automatically debited from your checking account. | ||

| Access to your financial planner between meetings as urgent or important questions arise |

The annual cost for Portfolio Management services is just 0.50% of the investment accounts we manage for you. That is $5 for every $1,000 in your portfolio.

Fees are deducted from your accounts.

Before we talk numbers, we ask questions. What are your likes and dislikes? What are your goals for the next 1, 5, and 10-years? Are you a spender or a saver? The more we know, the more we can create a custom-tailored plan to help you achieve the life you imagine.

Everyone wants to ‘live the dream’. Thing is, everyone’s idea of that dream is different. Through conversation, questions and analysis, we’ll help you clearly define your dream so together we can create a working plan to achieve it.

Once we’ve defined your long-term goals, we will craft an individualized, holistic plan that will allow you to travel the road of life with focus, clarity and confidence.

Our aim is to earn your trust and gain your confidence. As a trusted partner, we’ll be there to help guide, advise and inform you as you navigate the various stages of life and all that comes with it.

Ongoing Planning provides you with confidence and reassurance that you are optimizing relevant planning opportunities and have a professional watching over your “stuff”. You get the benefit of having on-demand meetings or calls for urgent life planning matters as well as unlimited phone and email support.