Why we integrate financial planning & portfolio management

(and don’t offer one service without the other)

Why Most Investors Could Use Good Advice

Achieving balance among building your life’s wealth, responding to change, and minimizing the time and stress involved calls for a series of “good, better and best” qualities that typically justify partnering with the right financial advisor.

GOOD: Overseeing the Logistic Details

While it’s essential to keep an eye on the “big picture,” a financial advisor can also help you manage the demanding details along the way. For example, an advisor can help you:

GET ORGANIZED – Assemble, prioritize and optimize your far-flung investments, estate plans, insurance policies, mortgages, executive compensation packages, retirement accounts and the rest of the mishmash of financial complexities in your busy life; ensuring no important money is being left behind or overlooked.

REMAIN CALM – Many investors face challenges in deciding when to buy, sell or hold tight. An objective advisor can help you avoid costly, unnecessary and nerve‐wracking trades that work against your financial goals.

INVEST TAX-WISELY – Particularly if your advisor is a CPA, or has access to CPA services (we do!), they can help you with year‐round tax‐sensitive investing, and ensure that taxes are carefully integrated into your financial planning.

BUILD YOUR DEDICATED TEAM – Most families’ complex lives call for a team approach to fully manage their wealth. If you’re investing on your own, it can be hard to create the right financial team, let alone ensure everyone is working together on your behalf. A good advisor should have relationships already in place to ensure coordinated coverage for both the routine and unusual financial challenges you may face throughout your life.

BETTER: Subtle Rewards

Beyond the hard‐dollar values described above, there are other ways a good advisor should contribute to your bottom‐line results.

FINANCIAL CLARITY – Your advisor should be enthused about helping you understand financial concepts, so you can achieve those critical “ah ha!” moments that let you participate in your own success.

TIMELY SUPPORT – Your advisor should take over many of the paperwork- pushing details, saving you hours otherwise sacrificed to filling out forms. He or she should continually monitor and manage your wealth and share the critical results that matter in a digestible format. You should receive prompt, helpful responses to your questions or requests.

Best: An Immense Immeasurable

Let’s say you were prepared to perform all of the above functions on your own. There is still the larger consideration. Is this how you want to spend your time? Also, is this how you would want your spouse or other family members to have to spend their time if you are no longer in the picture? It can be an immeasurable comfort to have an advisor who is deeply familiar with your personal wealth, ready and able to assist with shifting your family’s financial roles when needed, smoothly, deliberately and in everyone’s best interests.

Studies on Advisor Value

- Vanguard’s ‘Advisor Alpha’ Study

If you were trying to manage your financial affairs and investments in the absence of your advisor, how much better or worse off would you be over time?

Understandably, it’s challenging to quantify “success,” when the definition is that broad. Fortunately, Vanguard has been researching and advancing the concept of advisor alpha and has shared an overview of its findings in a report, “The added value of financial advisors.”

Vanguard’s analysis looked at several areas in which an advisor’s value can shine through, such as: portfolio construction, behavioral coaching, and wealth management. According to its report, an advisor “may add about 3 percentage points of value in net portfolio returns over time,” largely by adhering to the types of best practices described here.

- Quantifying the Value of Financial Planning Advice

Michael Kitces created this great summary:

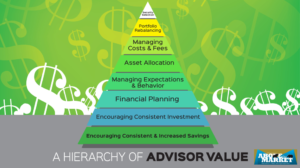

- A Hierarchy of The Value A Financial Advisor Provides

Bob Seawright created this great graphic:

Chart from “A Hierarchy of Advisor Value” on RPSeawright.com

Are You Ready for More SAGE Advice?

If you’d like to explore an advisor relationship with SAGEbroadview — or if you simply have questions or comments you’d like to discuss — please reach out.

Secure Document Sharing

Secure Document Sharing