We use a nifty planning tool called MoneyGuidePro® to create your Retirement Lifestyle Plan.

You can learn more by watching this short video.

Or, if you prefer, you can check out this brochure “Get the Most Out of Retirement”.

Retirement Planning

Retirement Planning

We use a nifty planning tool called MoneyGuidePro® to create your Retirement Lifestyle Plan.

You can learn more by watching this short video.

Or, if you prefer, you can check out this brochure “Get the Most Out of Retirement”.

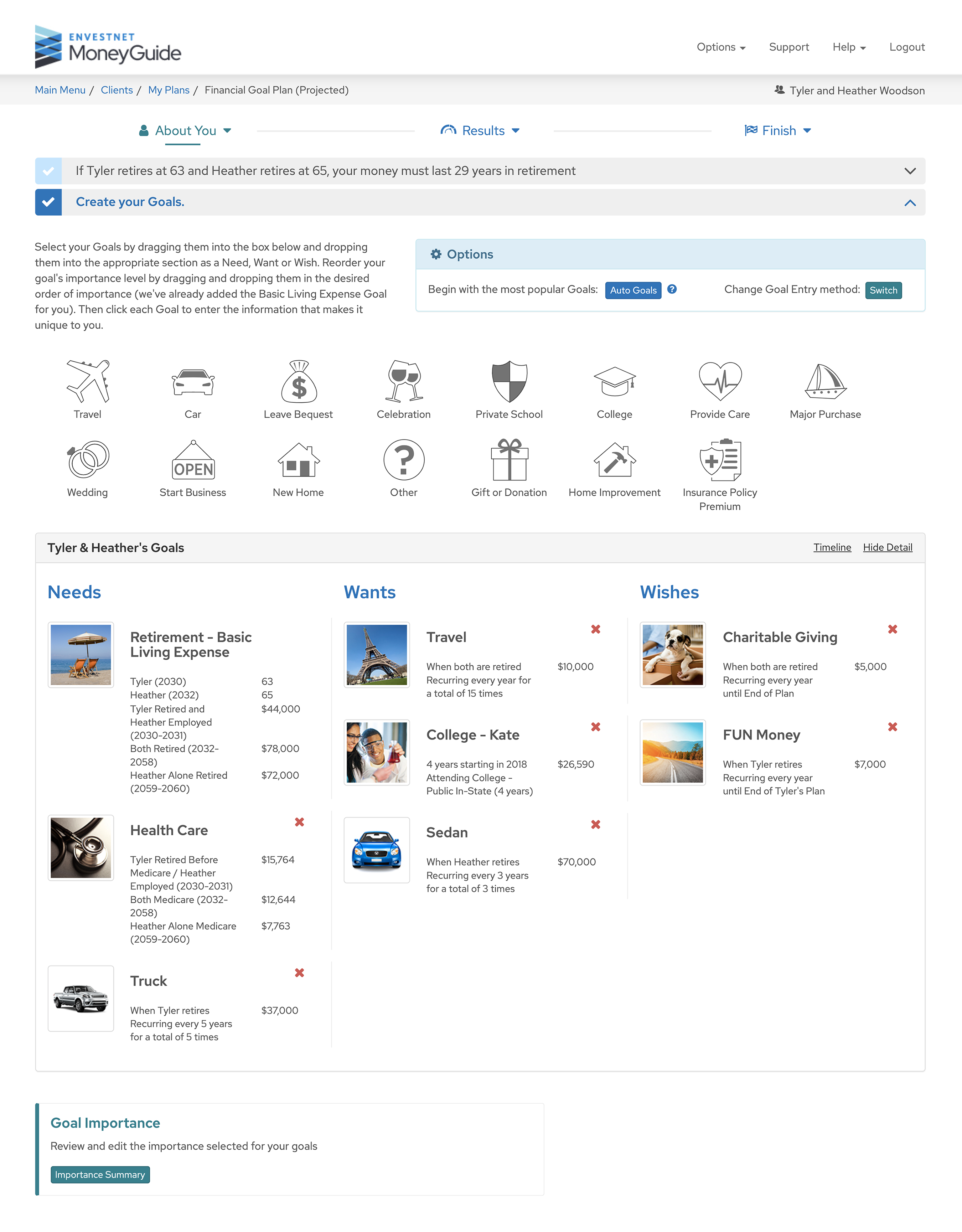

First, we help you determine your goals, assigning timeframes and $ values to each. We also work with you to prioritize these goals into Needs, Wants and Wishes.

© MoneyGuide, Inc. Reproduced with permission. All rights reserved.

Next, we identify the Resources you might tap to help you realize these goals. We also work with you to aggregate your accounts, so your account values automatically update each time you log into your Client Portal.

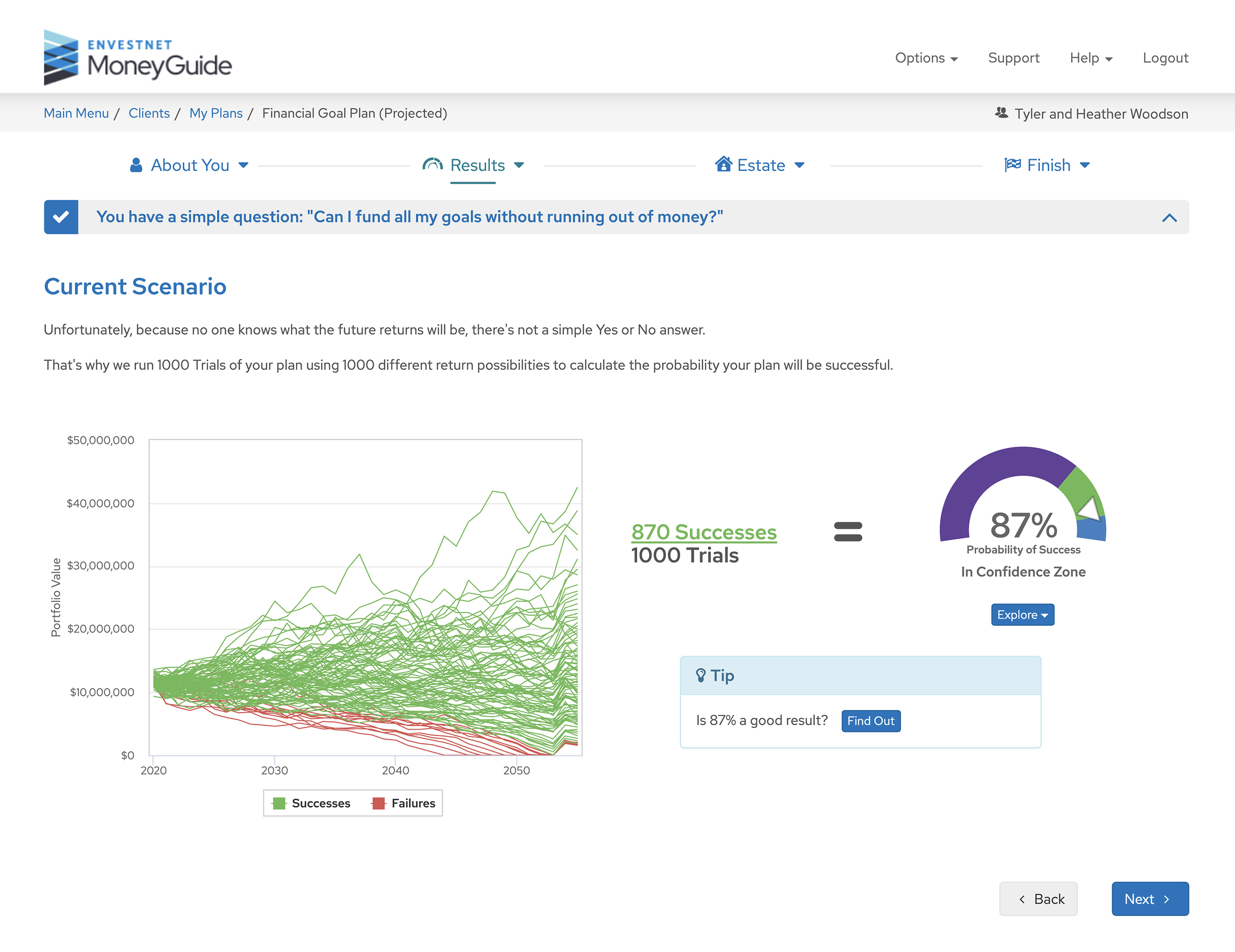

Next, we run calculations to determine if you might reach your goals. The Probability of Success is calculated using a Monte Carlo Simulation.

What Is A Monte Carlo Simulation?

Simulates thousands of trials using different return sequences. Each trial represents one possible outcome for the plan. The Probability of Success equals the percentage of trials (e.g., 87%) that funded all the goals.

© MoneyGuide, Inc. Reproduced with permission. All rights reserved.

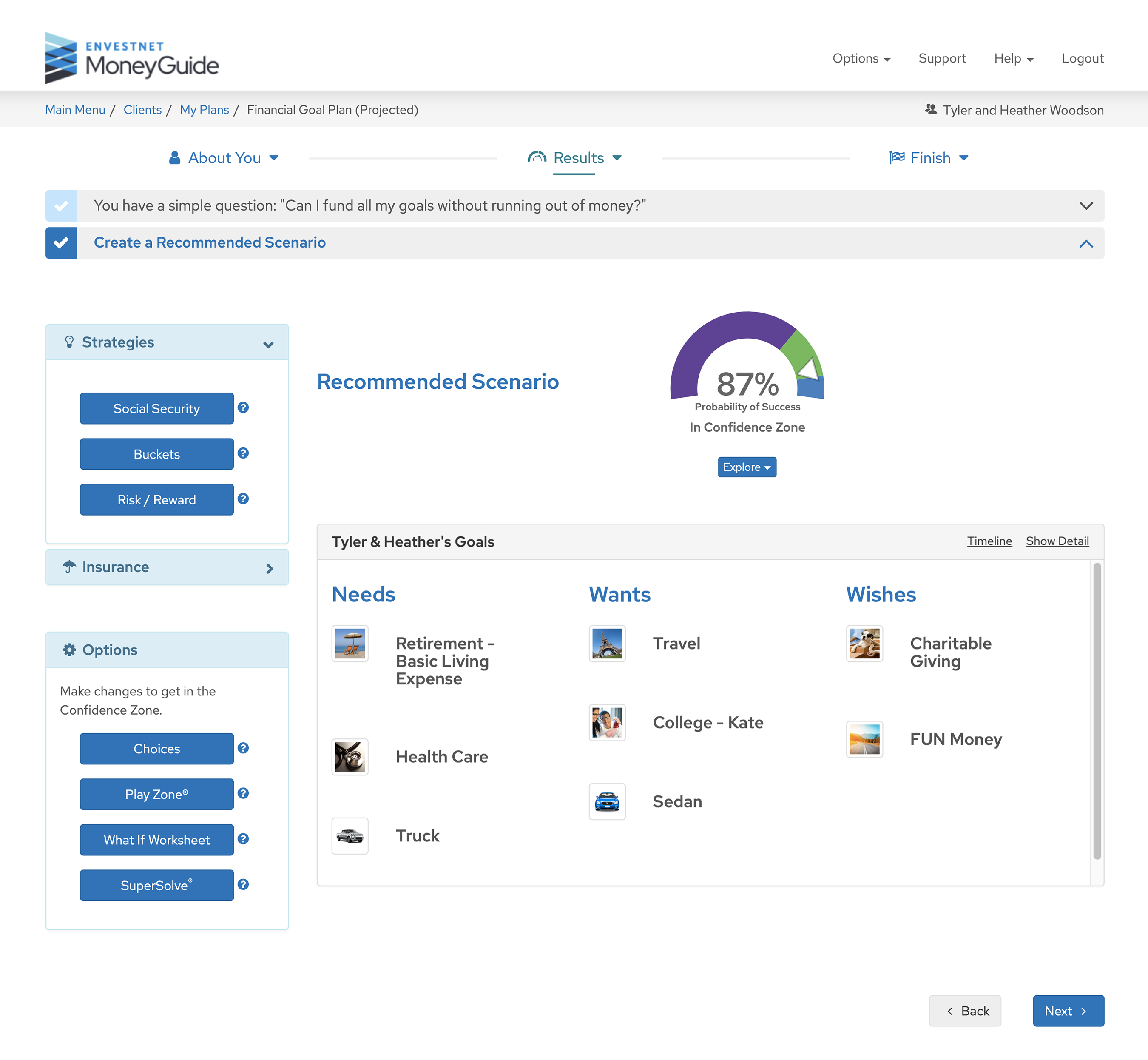

© MoneyGuide, Inc. Reproduced with permission. All rights reserved.

We work with you, as needed, to tweak your assumptions to create a Recommended Scenario that will land in your Confidence Zone. These tweaks may include saving more in your retirement accounts, adjusting spending goals, changing your target Asset Allocation, delaying the start of Social Security, etc. Our wealth management team will work with you as needed to implement these changes.

While you certainly can’t ignore today’s challenges, you also don’t want to overreact to them. Your current well-being and your long-term enjoyment during retirement are dependent on your ability to make well considered financial decisions during good markets and bad.

As illustrated, a Retirement Lifestyle Plan can help you feel more confident about your future.

Your Retirement Lifestyle Plan is a living document, so your SAGEbroadview wealth managers will update your plan regularly with you, and especially when you experience significant life changes such as changing jobs, inheriting monies, having children or grandchildren, moving to another state, etc.

Remember, planning is an ongoing process. Updating your plan regularly is the best way to put current events in perspective, decide what changes are appropriate, and strengthen your confidence in the future.

Ongoing Planning provides you with confidence and reassurance that you are optimizing relevant planning opportunities and have a professional watching over your “stuff”. You get the benefit of having on-demand meetings or calls for urgent life planning matters as well as unlimited phone and email support.