Investment Basics Series: What Are Market Risks?

What are market risks, and how should you approach them an investor?

Nothing Ventured, Nothing Gained

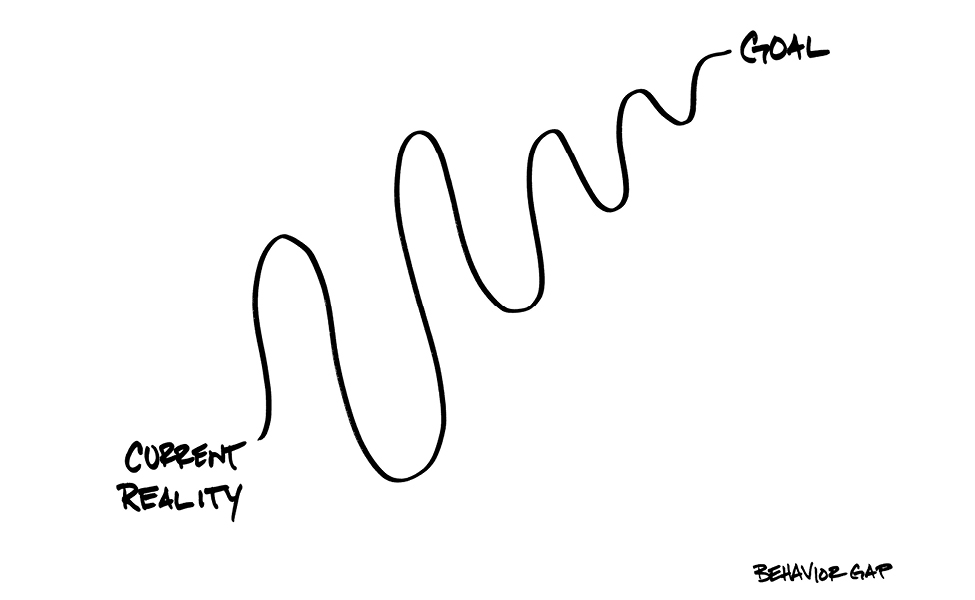

We’re all familiar with how risk is a double-edged sword. Those who are willing to take on daring risks improve their odds for reaching the greatest rewards. But they also can fall the hardest by stretching beyond the safety net of the status quo. In investing, this means that market risk can be your strongest ally and your most powerful foe. To optimize the opportunities and minimize the threats, it helps to understand the nature of the beast.

The Risks Worth Taking

Some market risks are worth taking because they have been shown to drive expected returns. Others are best avoided as simply being foolhardy, with little or no expected reward. You can liken this concept to the risks a tightrope walker takes in her career. She knows she must be on the high wire to succeed; there’s no avoiding that. But she also has a safety net in place in case she slips. There’s no glory in preventable injury.

As an investor, how do you know which risks are worth incurring in pursuit of desired wealth? They are the ones that every investor must take in order to participate in the market and its expected returns. (In contrast, too many investors also open themselves up to preventable harm by taking on unnecessary risks that are easily guarded against with diversification; we’ll explain that in our next post).

Volatility and Standard Deviation

Taking on your appropriate level of market risk is the equivalent of making edgier or more conservative moves in your personal financial high-wire act. It all depends on your goals and capabilities. To help you determine which moves are right for you, it’s important to know the relative risks involved. That’s where volatility and standard deviation come into play.

Volatility is how widely an investment swings up and down from its average over time. For example, U.S. Treasury bills don’t yield much, but they offer comfortably low volatility, closely hugging their ongoing, average return. At the other end of the spectrum, emerging market stocks have yielded much higher returns over time, but with wildly giddy highs, sickening lows and no telling which is coming next.

Standard deviation is the numeric measure of volatility. In other words, just as an inch measures distance, standard deviation measures volatility. The standard deviation for those aforementioned Treasuries can round to zero. Emerging market investments, on the other hand, can see standard deviations well into the double digits. A high or low standard deviation isn’t “good” or “bad” in itself; it simply helps you assess where an investment fits into your plans.

There’s a nifty trick about volatility that we’ll explore in our next post about diversification. For now, suffice it to say that diversification offers a powerful way to wring the greatest benefits from volatile investments while actually reducing the risk involved. Intrigued? Stay tuned.

Win a copy of Carl Richards’ new book, One-Page Financial Plan

As we mentioned in our Investment Basics introduction, send us an e-mail with a question or comment about today’s post, and you’ll be entered to win this week’s drawing for a copy of Carl Richards’ One Page Financial Plan. Happy summer reading!

Sage Serendipity: One of our greatest challenges, day in and day out, is to try to see opportunity where others see limitations. At work, at home, at play, remember the glass is always half full. And if you’re feeling otherwise click here and be inspired by those who have overcome.

Sage Serendipity: One of our greatest challenges, day in and day out, is to try to see opportunity where others see limitations. At work, at home, at play, remember the glass is always half full. And if you’re feeling otherwise click here and be inspired by those who have overcome.

Secure Document Sharing

Secure Document Sharing