Building Blocks – Rebalancing

What is rebalancing? Why and when should an investor do it?

“Buy low, sell high.” The expression is so familiar that it’s become a cliché. And yet, few investors actually follow this most basic rebalancing advice. Instead, they panic and sell (low) during market crises and chase already-hot stocks at premium (high) prices.

Deliberate rebalancing is one of the best ways we know of to more consistently buy low and sell high while staying on track toward your personal goals.

How Rebalancing Works

As we described in our previous posts about asset allocation and diversification, a sensible way to participate in the market’s long-term growth is to invest in a globally diversified mix of individual asset classes that reflects your goals and risk characteristics, using a portfolio of low-cost funds that are structured for this purpose.

In doing so, you’re off to a great start. But, even if you maintain your resolve and avoid additional, unnecessary trades, the markets themselves shift around, with various asset classes out- or underperforming others over time. As these shifts occur, your holdings stray off-balance from their original, intended “weights” or allocations. If they stray too far for too long, you can end up taking on too much, or insufficient, market risk.

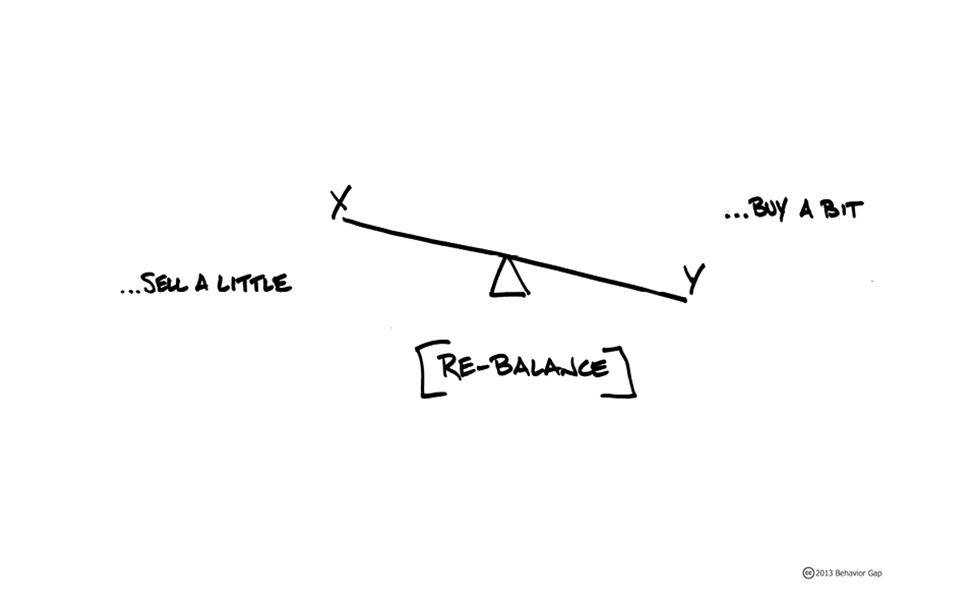

Rebalancing is the act of shifting your allocations back to where they belong, according to your personal plans. To rebalance, you sell some of the now-overweight assets (at higher prices than you paid for them) and use the proceeds to buy assets that have become underrepresented (at relatively low prices), until you’re back at or near your desired mix. Not only are you keeping your portfolio on track toward your goals but, as a bonus, you’ve just bought low and sold high!

Challenges and Opportunities

If rebalancing is such a great deal, why isn’t everyone doing it?

First, you need a reference point. To employ rebalancing, you must first have a personalized investment plan and a structured portfolio. Without these touchstones in place, there are no reference points to rebalance toward.

It’s scary to do in real time. Everyone understands the theory of buying low and selling high. But when it’s time to do so, your emotions can get in the way. An understanding adviser can help you combat your doubts with rebalancing. When times are bad, your adviser should remind you that it may be time to sell some of your assets that have been doing okay and buy the unpopular ones. That sounds scary, but you’re actually selling high and buying low. When times are good, you must avoid the temptation to pile up on (or stay overweighted in) the high-flyers. At the time, this may feel counterintuitive, but it’s actually a good practice to periodically shift some of your captured returns to safer grounds.

Costs must be considered. If trading were free, we could rebalance your portfolio daily. In reality, trading incurs transaction fees and potential tax liabilities. You and your adviser should have good guidelines for when and how to cost-effectively rebalance. You also can use any new money added to your portfolio to rebalance with at lower costs.

A Recap

Overall, sensible rebalancing makes a lot of sense: It gives you a clear, evidence-based process for staying on course toward your personal goals through rocky markets. It also ensures you are buying low and selling high along the way. At the same time, rebalancing requires both emotional resolve as well as informed management, to ensure it is being effectively applied. Helping you periodically rebalance your portfolio is another vital way an informed adviser can add value to your investment experience.

Secure Document Sharing

Secure Document Sharing