Building Blocks – Asset Allocation

WHAT IS ASSET ALLOCATION AND WHY DOES IT MATTER TO YOU AS AN INVESTOR?

Asset allocation combines individual asset classes to build and manage a portfolio that reflects your personal goals, risk tolerance, and risk capacity.

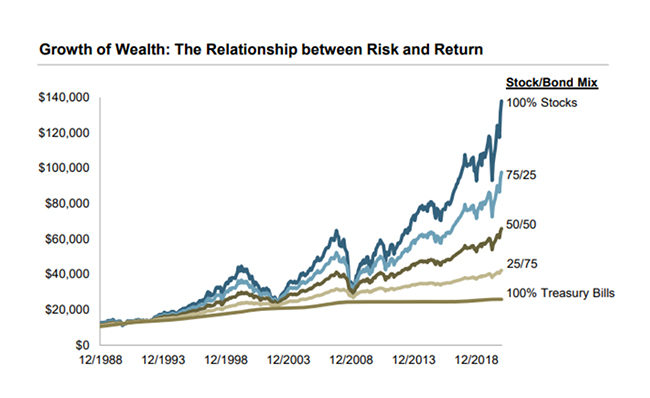

Step One: Stocks vs. Bonds – We begin by determining an appropriate balance between stocks and bonds. Bonds help you preserve your wealth, but they are unlikely to help you build a great deal more of it. Stocks are useful for growing wealth, but they do so by exposing you to greater price fluctuations than bonds.

Source: Dimensional’s Quarterly Market Review (page 17)

Diversification does not eliminate the risk of market loss. Past performance is not a guarantee of future results. Indices are not available for direct investment. Index performance does not reflect expenses associated with the management of an actual portfolio. Asset allocations and the hypothetical index portfolio returns are for illustrative purposes only and do not represent actual performance. Global Stocks represented by MSCI All Country World Index (gross div.) and Treasury Bills represented by US One-Month Treasury Bills. Globally diversified allocations rebalanced monthly, no withdrawals. Data © MSCI 2021, all rights reserved. Treasury bills © Stocks, Bonds, Bills, and Inflation Yearbook™, Ibbotson Associates, Chicago (annually updated work by Roger G. Ibbotson and Rex A. Sinquefield).

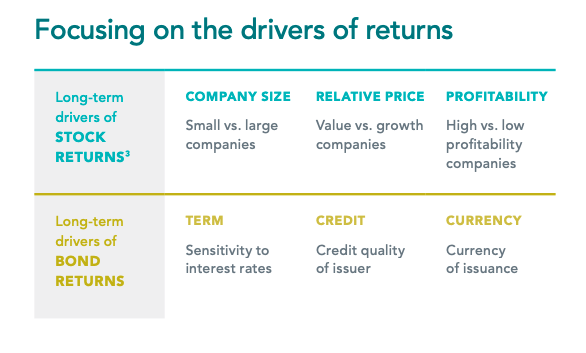

Step Two: Fine Tune – Inside your stock and bond allocations, we can use the narrower asset classes to improve on expected returns while better managing overall risks. For example, over time, investing globally and tilting toward small-cap, value, and/or profitable company stocks is likely to increase expected returns while also smoothing out results. This is accomplished by harnessing the power of diversification.

Source: Dimensional At A Glance MKT-18567 07/21 1874111

3. Relative price is measured by the price-to-book ratio; value stocks are those with lower price-to-book ratios. Profitability is measured as operating income before depreciation and amortization minus interest expense scaled by book.

Step Three: Stay the Course – Once your portfolio is built, it is important for your asset allocation to remain close to its original design, throughout the years and across shifting markets. This means staying put by: (1) avoiding behavioral temptations to chase hot returns, or flee downturns in the markets, and (2) periodically rebalancing back to your planned allocations when market performance moves you off-target.

Secure Document Sharing

Secure Document Sharing