Ongoing Planning provides you with confidence and reassurance that you are optimizing relevant planning opportunities and have a professional watching over your “stuff”. You get the benefit of having on-demand meetings or calls for urgent life planning matters as well as unlimited phone and email support.

Giving 403(b) Plan Participants Their Due – Part 2

Part II: The 403(b) Plan: Pocket Change or Life’s Savings? As touched on in Part 1 of our two-part series on 403(b) plans, “A Call for 403(b) Plan “Higher Education,” it was initially assumed that the 403(b) would serve as a supplement – not a replacement – for participants’ traditional pension plan benefits. This may have made sense in the 1950's when the 403(b) plan was introduced and pension plans ruled...Giving 403(b) Plan Participants Their Due

Part I: A Call for 403(b) Plan “Higher Education” When seeking financial advice for managing your retirement plan assets, it seems the 401(k) receives a lot more press than the similar, but different 403(b) plans used by government and tax-exempt groups such as schools, hospitals and churches. Some sound advice does cover all retirement plan ground – and all investing, for that matter. But if anyone in your family participates in...The Gift of Multiple Careers

January 29, 2014

in Financial Life Planning, Gratitude, Mindful living, Retirement Planning, SageBroadview News

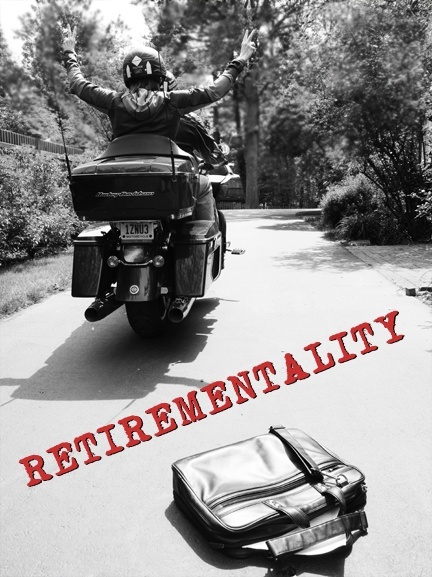

Raise your hand if you’ve had multiple careers. Or does yours more closely resemble Alfred Feld’s? He joined Goldman Sachs in 1933 and remained there for 80 YEARS(!), until he passed away at age 98 last fall. Whenever he was asked about his longevity, he is reported to have replied, “I’m just lucky.” While all of us at SAGEbroadview come to financial life planning via more circuitous routes, we have...

Secure Document Sharing

Secure Document Sharing