Ongoing Planning provides you with confidence and reassurance that you are optimizing relevant planning opportunities and have a professional watching over your “stuff”. You get the benefit of having on-demand meetings or calls for urgent life planning matters as well as unlimited phone and email support.

What is a Financial Advisor Worth? A Nerd’s Eye View of an Advisor’s Value

The credentials alone may say it all about Michael Kitces and his Nerd’s Eye View on financial planning. With two master’s degrees in financial services and taxation, a CFP® mark, and five other financial certifications to his name, that’s some serious nerd power. But what’s decidedly cool about Kitces is his passion for sharing his “journey of continuous education” with fellow advisors as well as with investors looking for a...You and Your Investments: How Are You Doing? Part II: Your Portfolio and Its Parts

Part II: Your Portfolio and Its Parts In our last post, we discussed why it’s best to avoid comparing your own investment returns to “the market” or the latest popular portions of it. There’s one more misleading measurement that can trip up an investor: [message_box title="Your Portfolio" color="gray"] = Pursing the market’s expected returns (by investing in asset classes with higher expected returns but higher volatility) + Managing the risks involved (by investing in asset classes with more...You and Your Investments: How Are You Doing? Part I: Coveting Your Neighbors’ Returns

Part I: Coveting Your Neighbors’ Returns It’s ironic. One of the biggest questions we ask ourselves as investors is: “How am I doing?” While the question is a good one, if the answers are off-base, you risk changing course when you should be sitting tight, or sitting tight when you should be considering a change. This is not only frustrating, it can detract from … how you are doing. It’s a...Inspiring Insights, Invigorating Ideas

One of the reasons I read as much as I do is to be inspired by others. There’s nothing I love more than discovering an intriguing new way to frame an old idea, and then sharing what I’ve learned, hoping to inspire others as well. On the flip side, there’s nothing more demoralizing than falsehoods or opinions being spread as facts. They remind me of a shopping channel infomercial. Watch it...You, Your Wealth, and Some Springtime Playtime

Whether or not the weather is entirely on board with the program, the calendar never lies: Spring has sprung! As we prepare to shed a layer or more of winter-wear, let’s take a moment to peel back the layers of your busy life as well: Do your financial plans include making time for some playtime? The subject may seem lighthearted, but I’m very serious about this. It’s a question we pose...Want Success? Emulate Successful People

With his worth estimated at around $40 billion (as of mid-February), at least as measured in dollars, Michael Bloomberg is among the most successful people alive. How does this sort of success happen? It’s unlikely there is a single recipe for amassing billions. (And personally, we’d be okay with, say, a mere $500 million to our name.) But this recent post by Gillian Zoe Segal describes seven traits that successful people...Dimensional Fund Advisors: Why Should You Diversify?

Still Going Global We’ve said it before and we’ll no doubt say it again. In fact, because it’s so important, we dedicated one of last summer’s Investment Basics Series installments to global diversification, “your super power to help you manage that market risk by spreading it around, widely and globally.” In this year’s markets, the message bears repeating so disparate global returns don’t tempt you to concentrate your holdings too close to home....Sheri’s Best Of “101” Investing Insights

As we mentioned in a recent post, Taking a Twitter Tonic, it’s important to be selective about the financial news you choose to peruse. That said, there are islands of sensible advice out there as well. We try to share as many of them as we can in our own blog and social media posts. We also are honored when we are invited to participate in useful forums like Fund...A Restricted Stock Unit (RSU) Review

February 17, 2016

in Company Stock Plans, Corporate Executives, Investing, Restricted Stock, Stock Options, Tax Management

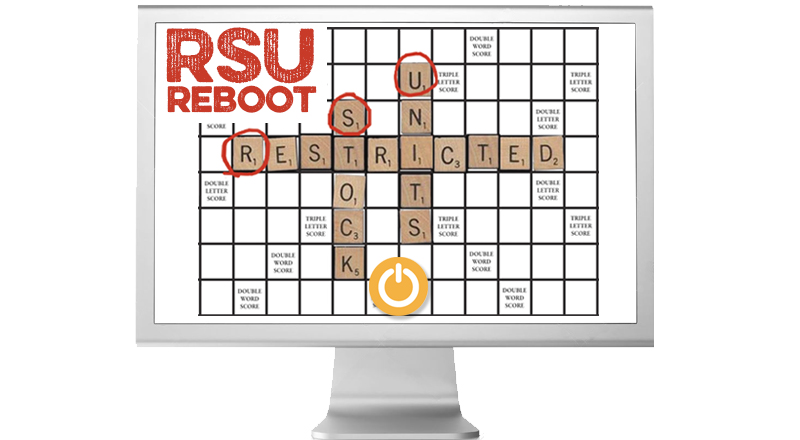

Normally, we love to crank out fresh weekly blog posts, just as we’ve been doing since August 2012. That was before Sage and Broadview had even joined forces to become the unified firm we are today. One of our earlier posts from March 2013 happens to be an important one, on a subject that doesn’t receive as much coverage as it should: What should you do when Restricted Stock Units...

Secure Document Sharing

Secure Document Sharing