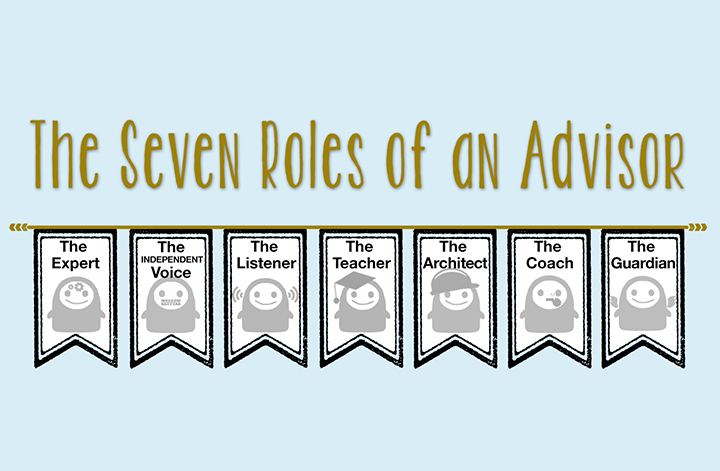

Ongoing Planning provides you with confidence and reassurance that you are optimizing relevant planning opportunities and have a professional watching over your “stuff”. You get the benefit of having on-demand meetings or calls for urgent life planning matters as well as unlimited phone and email support.

What’s On Your Mind? Investor Questions

Is the US market due for a correction? If you Google that question, you will see people have been predicting a correction in the US stock market for years now. A healthy market will experience corrections, so rather than trying to predict them or live in fear of them, investors are better off incorporating them into their long-term strategies. Our investing philosophy is built on the knowledge that markets go both...SBV In The News: Why Benchmarks Don’t Matter

“How am I doing so far?” is a fair question every investor asks. Our human nature tempts us to compare our performance numbers with the benchmarks the popular press reports on, such as the Dow Jones Industrial Average, the Standard & Poor’s 500 and the Nasdaq Composite index. Inappropriate comparisons can cause more harm than good if they tempt you to bail on an otherwise solid approach. See what Sheri has to...What Sheri’s Been Reading: June 2015 Edition

Can your portfolio survive rising interest rates? (Fortune) It’s the question that everyone has been asking. Here’s a guide to whether your portfolio will be able to withstand the coming rate hike cycle, whether it begins this fall or sometime in early 2016. (Hint: You should be fine as long as you are properly diversified.) The 5 Rules of Personal Finance That Everyone Should Memorize (themuse) “Most people spend their 20s...Article by Dimensional Fund Advisors: Outside The Flags – Gravel Road Investing

May 2015 Gravel Road Investing [column col="1/4"][/column] [column col="3/4"] By Jim Parker Vice President DFA Australia Limited “ Owners of all-purpose motor vehicles often appreciate their cars most when they leave smooth city freeways for rough gravel country roads. In investment, highly diversified portfolios can provide similar reassurance. " To read more: OPEN PDF[/column][divider scroll_text=""] ...Advice That’s Worth the Price

Have you ever noticed that the best humor usually has an edgy element of truth to it? Take, for example, this StockCats “Headline Generator” spoof on the commentary that floods our sensibilities every time the market moves a whisker. Admittedly, we financial professionals may be hard up for humor, but I got a good belly laugh out of their creative spin on what (sadly) often passes for intelligent observations. So, yes, there is an abundance...SBV In The News: What is dollar cost averaging?

NJMoneyHelp.com asked Sheri Cupo to answer a reader's question: “What is dollar cost averaging? I’ve heard it’s a good way to invest so I don’t have to worry about the ups and downs of the stock market. Will it protect my money?” Read the answer here: NJMoneyHelp.com ...Should You Compare Your Portfolio to the S&P 500?

April 28, 2015

in Investing

If you haven’t noticed, we’ve been on a blog roll lately, explaining common mishaps investors face when assessing how their investments are performing in ever-turbulent markets. We’ve covered Time-Weighted vs. Internal Rates of Return and Confusing Cost Basis with Fund Performance. Today, we’ve got one more area to explore: Comparing your returns to popular benchmarks such as the Dow Jones Industrial Average (DJIA) or the S&P 500 indexes.

Compared to What?

“How...

Confusing Cost Basis with Fund Performance

In our last post, we introduced two investment terms that are a little more technical than we normally prefer, but worth knowing when you want to accurately measure your portfolio’s performance: Time-Weighted Rate of Return (TWR) and Internal Rate of Return (IRR). Since calculating rates of return and portfolio performance requires complex formulas and computer software that may not be readily available, we often see investors turning to an investment’s cost basis...Weird Words, Worthy Ideas: Time-Weighted vs. Internal Rates of Return

April 14, 2015

in Investing

If you’ve been reading our blog posts for a while, you know that we try to avoid financial-speak whenever possible. But until the rest of the world follows our lead, sage investors are best served by familiarizing themselves with two weird, but worthy terms: Time-Weighted Rates of Return (TWR) vs. Internal Rates of Return (IRR).

We’ll explain what we’re talking about in a moment. But first let’s talk about why it...

Secure Document Sharing

Secure Document Sharing