Should You Compare Your Portfolio to the S&P 500?

If you haven’t noticed, we’ve been on a blog roll lately, explaining common mishaps investors face when assessing how their investments are performing in ever-turbulent markets. We’ve covered Time-Weighted vs. Internal Rates of Return and Confusing Cost Basis with Fund Performance. Today, we’ve got one more area to explore: Comparing your returns to popular benchmarks such as the Dow Jones Industrial Average (DJIA) or the S&P 500 indexes.

Compared to What?

“How am I doing so far?” is a fair question. But it’s also important to complete the thought: “Compared to what?” Without having an appropriate benchmark against which to compare your investment interests, you risk getting numerically accurate, but off-base answers. Inappropriate comparisons can cause you more harm than good if they tempt you to bail on an otherwise solid approach whenever the grass seems greener elsewhere.

Human behavior tempts many of us to compare our personal performance numbers to those being reported by the popular press. These typically reflect the returns of public benchmarks such as:

- The DJIA or “the Dow” (invented by Charles Dow in 1896, it is a price-weighted average of only 30 U.S. blue chip stocks),

- The S&P 500 (a market value weighted index, which tracks 500 of the larger U.S. companies),

- The NASDAQ Composite (which tracks the more than 3,000 stocks listed on the Nasdaq stock exchange and includes the world’s –not just U.S.– technology and biotech giants).

The challenge is, the DJIA is not the same as the S&P 500, which is not the same as the NASDAQ – and none of these indexes is likely to match your own distinct mix of assets and their expected returns, especially if you own a globally diversified portfolio with exposure to stocks and bonds, large and small companies, value and growth companies, and U.S. and non-U.S. based companies.

On top of that, index returns tell us how a market has performed, free of any trading costs. Even if an index’s performance has been 5 percent, for example, we mere mortals have to spend money to invest in it, which means the index investor’s realistic returns would be 5 percent minus his or her costs.

You Are Unique

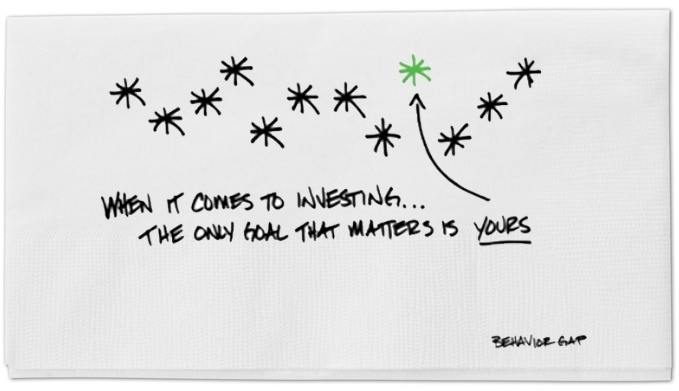

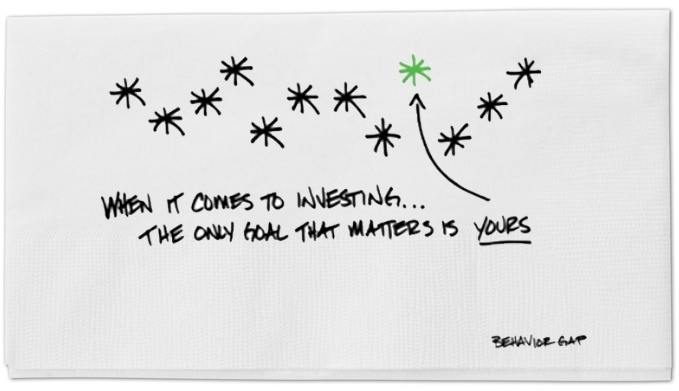

Behavior Gap “Sketch Guy” Carl Richards illustrates the downside to fixating on comparing your own, unique portfolio to common benchmark returns. Your own goals – and the right portfolio with the right expected returns for helping you achieve them – rarely lend themselves to copy-catting any off-the-shelf product.

Behavior Gap “Sketch Guy” Carl Richards illustrates the downside to fixating on comparing your own, unique portfolio to common benchmark returns. Your own goals – and the right portfolio with the right expected returns for helping you achieve them – rarely lend themselves to copy-catting any off-the-shelf product.

In his post, “When Competition Obscures Financial Goals,” Richards refers to attempts to outperform index returns as an “investment performance derby,” and asks: “If, by some miracle, you managed to beat everyone else, in every quarter, and didn’t meet your financial goals, would you be happy? On the other hand, what if you never won the investment performance derby, but met all your personal financial goals. Would you be happy then?”

Bottom line, common index benchmarks may offer a ballpark idea of how various corners of the market have been performing, but it’s best to think of that ballpark as an enormous stadium, in which your particular investment goals are more the size of home plate. To play a truly winning game, we suggest you skip the derby and keep your eye on your own performance ball.

Sage Serendipity: While too much comparison to others can be damaging, this Guy Winch TED talk, “Why we all need to practice emotional first aid,” addresses the flip side of independence – i.e., loneliness. In all things, it seems balance is best. (Thanks for sharing this talk with us, Tom!)

Sage Serendipity: While too much comparison to others can be damaging, this Guy Winch TED talk, “Why we all need to practice emotional first aid,” addresses the flip side of independence – i.e., loneliness. In all things, it seems balance is best. (Thanks for sharing this talk with us, Tom!)

Secure Document Sharing

Secure Document Sharing