Want Success? Emulate Successful People

With his worth estimated at around $40 billion (as of mid-February), at least as measured in dollars, Michael Bloomberg is among the most successful people alive.

How does this sort of success happen? It’s unlikely there is a single recipe for amassing billions. (And personally, we’d be okay with, say, a mere $500 million to our name.) But this recent post by Gillian Zoe Segal describes seven traits that successful people possess. They are based on her extensive interviews with Bloomberg and other leaders across a range of disciplines in preparation for her new book, Getting There: A Book of Mentors.

We couldn’t help but notice that her seven traits are similar to the ones we encourage investors to employ as they navigate the rocky road to financial independence. We encourage you to read Segal’s post directly. She spent more than five years compiling the information, and you can benefit from her wisdom in less than five minutes. But here are those seven traits in summary, along with our take on how you can apply them to your investment management.

- Segal: “They [successful mentors] understand their ‘circle of competence’”

SAGEbroadview: Decades of academic inquiry into behavioral finance tells us that most investors tend to be overconfident of their stock-picking and market-timing skills. While a degree of optimism can help you remain resilient during dark times, overconfidence tricks you into believing you can outsmart the market at its own game. The wiser course is to embrace the market’s efficiencies as the most competent way to pursue its expected returns.

- Segal: “They harness their passions”

SAGEbroadview: Sure, making money is one of the more obvious measures of investment success, but it really shouldn’t be your driving force. As we’ve seen lately, investing entails unpleasant risks along as well as rewards, so it’s better to harness your investment “success” to your personal passions. What are your life’s true desires? How much market risk do you want or need to withstand to be able to fund them? Whether you can position your financial worth to confidently pursue your passions is perhaps a more meaningful measure of success than a specific dollar amount.

- Segal: “Their career paths are fluid”

SAGEbroadview: Investment success begins with careful planning, followed by disciplined action, with a diversified portfolio that helps you maintain your footing in volatile markets. That said, your own goals and circumstances can change – for better or for worse. When they do, it’s important to have the foresight to be flexible, and adjust your actions accordingly. An objective advisor can help you differentiate the market’s damaging distractions from appropriate adjustments that make sense for you and your personal well-being.

- Segal: “They create their own opportunities”

SAGEbroadview: Nothing says “opportunity” like knowing what you’d like to achieve to begin with. That’s why, when it comes to investing, your best opportunities are created by sticking to your financial plan. When the markets are scary and the news is filled with doom and gloom, stick to your personalized plan. When a hot stock (or bond or commodity or whatever) is soaring and everyone’s jumping on that bandwagon, stick to your personalized plan. While there are no guarantees, we recommend ignoring the voluminous calls to action that are forever tempting you off-course and sticking to your personalized plan.

- Segal: “They question everything”

SAGEbroadview: We’re on record on this one, as evidenced by our past “question authority” post. In fact, if there were a theme to our evidence-based approach to investing, it’s that no assumption, no matter how commonly accepted it may be, should be blindly pursued when robust, academic evidence indicates that it’s just not true.

- Segal: “They don’t let fear or failure deter them”

SAGEbroadview: If there is a trait to reiterate given this year’s markets, this would be the one. We get it. Fear happens. When it does, it’s no fun. Likewise, failure never feels good at the time. But the most successful people and investors alike are the ones who are prepared to press forward on their desired course, withstanding the fear when it comes. They’re the ones who turn temporary setbacks into lessons learned and permanent resolve for guiding their future success. They’re the ones who heed the words of Thomas Edison, when he observed, “Many of life’s failures are people who did not realize how close they were to success when they gave up.”

- Segal: “They are resilient”

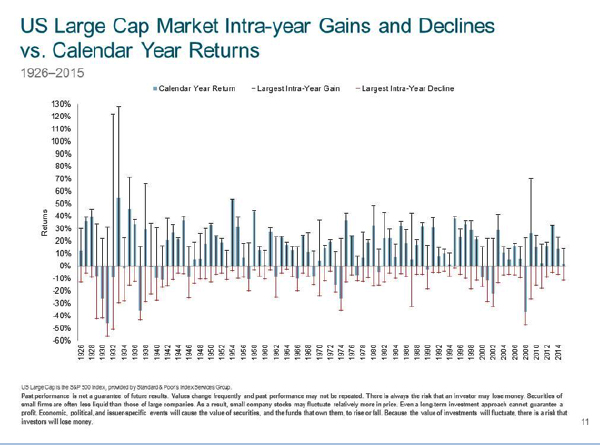

SAGEbroadview: As Segal says in her post, and we couldn’t have said it better ourselves, “**This one is the real clincher!**” Here’s a visual to help you embrace investment resiliency.

Our point may not be obvious at a glance, so let me explain. The solid blue bars show the annual return (or loss) available from US Large-Company stocks since 1926. The thinner “whisker” lines show the highest and lowest gains and declines that occurred during the course of each of those years. While the intra-year highs and lows can generate fear and confusion as they occur, the evidence reveals that, overall, this and other similar markets have rewarded those who simply held tight for the longer ride. Based on the evidence, we expect the same moving forward.

So, come what may in 2016 and beyond, sage investors should remain resilient. The best tool for that job remains a solid plan based on your own goals and risk tolerances, implemented with a globally diversified portfolio, structured to capture expected returns while minimizing the expected risks involved. Clinch that, and the rest is a relative cinch.

SAGE Serendipity: The # 6 trait in our post discusses failure. We came across two articles recently on failure that are interesting — The Art of Failing Upward in The New York Times review section and The head of England’s most famous private school says spoiled children need to fail in Quartz. Both articles take on the importance of learning from your mistakes, both in business and in school.

SAGE Serendipity: The # 6 trait in our post discusses failure. We came across two articles recently on failure that are interesting — The Art of Failing Upward in The New York Times review section and The head of England’s most famous private school says spoiled children need to fail in Quartz. Both articles take on the importance of learning from your mistakes, both in business and in school.

Secure Document Sharing

Secure Document Sharing