Ongoing Planning provides you with confidence and reassurance that you are optimizing relevant planning opportunities and have a professional watching over your “stuff”. You get the benefit of having on-demand meetings or calls for urgent life planning matters as well as unlimited phone and email support.

DIMENSIONAL’S QUARTERLY MARKET REVIEW (Q1 2019)

April 18, 2019 Ideal vs. Imaginary Investing “There’s one robust new idea in finance that has investment implications maybe every 10 or 15 years, but there’s a marketing idea every week.” – Nobel Laureate Eugene Fama Nobel laureate and Dimensional Fund Advisors board member Eugene Fama has offered an abundance of quotable insights during the 50+ years he’s been studying financial economics. The quote above is one of our favorites – and as fitting as ever as...3 Things: Don’t look at your portfolio, say no to themed funds, and dealing with market pullbacks

Don’t look at your portfolio – and here is why 1. How to Improve Your Risk-Adjusted Returns (The Irrelevant Investor, 4/11/2019) “The more you look at your portfolio, the more likely you are to see red, and the more likely you are to see red, the more likely you are to do something you will regret later. This can be seen clearly in the GIF below, courtesy of Nick Maggiulli.” Graphic Courtesy...3 Things: How to be happier, read more, and why you should start meditating

April 10, 2019

in Mindful living

Bill Gates does 4 simple things to be happier

1. Bill Gates says he’s happier at 63 than he was at 25 because he does 4 simple things (Business Insider, 3/12/2019)

1) Follow through on your commitments.

2) Have a mindset of giving.

3) Treat your body like a sacred temple.

4) Put family first.

How to read more

2. Read more books: how to get started (Abnormal Returns, 4/4/2019)

• Don’t finish a book if you don’t like it

• Have a book handy on your phone

• Read books you love

Meditating...

3 Things: Really Cool Infographics

April 2, 2019

in Articles

Big Five tech companies are bigger than Saudi Arabia’s entire economy

1. How Tech Giants Make Their Billions (Visual Capitalist, 3/29/2019)

Source: Annual Reports Filing 2018 - Visual Capitalist

Visualizing the world’s population

2. The World’s 7.5 Billion People, in One Chart (Visual Capitalist, 3/28/2019)

Graphic from The Visual Capitalist

Technological advances that are pushing the boundaries of modern healthcare

3. Visualizing the Healthtech Revolution (Visual Capitalist, 3/26/2019)

Graphic from The Visual Capitalist

SAGE Serendipity:...

3 Things: The Lost Decade, Amazon & the Traditional Supermarket, and Spam Is Taking Over Our Phones

Diversification is a strategy designed to help you avoid unnecessary mistakes 1. The Easiest Decade for DIY Investors (The Belle Curve, 3/17/2019) "Do you remember all the hoopla about “The Lost Decade” for US stocks? Over a ten-year period the S&P 500 had a negative return. That is a very long time to be down in stocks. But what rarely gets mentioned is that investing in different types of stocks provided positive...Dimensional Advisors: Getting to the Point of a Point

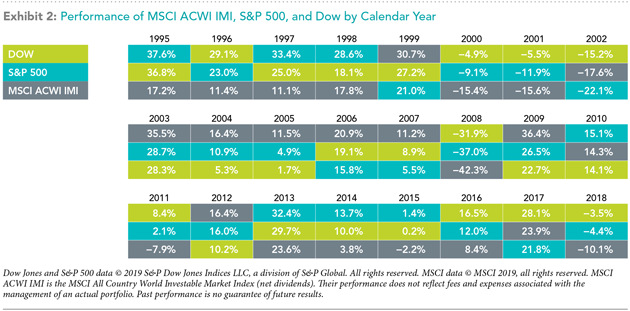

How Does The Dow Relate To Your Portfolio? March 2019 While the Dow and other indices are frequently interpreted as indicators of broader stock market performance, the stocks composing these indices may not be representative of an investor’s total portfolio. For context, the MSCI All Country World Investable Market Index (MSCI ACWI IMI) covers just over 8,700 large, mid, and small cap stocks in 23 developed and 24 emerging markets countries with...Announcing a Fresh New Look for the SAGEbroadview Website

March 11, 2019

in SageBroadview News

To better reflect what’s fresh as well as what’s familiar about us, SAGEbroadview is delighted to share our redesigned website with you. We hope you find the modern design, color palette and photos better convey our firm’s personality and services, as well as our company’s evolution from January 2014 when Larry and I merged our firms.

KEY FEATURES

Quickly navigate where you need to go — You will find links to Secure Document...

Secure Document Sharing

Secure Document Sharing