Ongoing Planning provides you with confidence and reassurance that you are optimizing relevant planning opportunities and have a professional watching over your “stuff”. You get the benefit of having on-demand meetings or calls for urgent life planning matters as well as unlimited phone and email support.

Kick-start Your Child’s Financial Journey with a Roth IRA

Summer break is here, and many young people will be working at a summer job or internship. While earning a paycheck is exciting, it can also be an excellent time to consider opening a Roth IRA and contributing a portion of their summer earnings. Not only does this jump-start retirement savings from an early age, but it can also serve as a positive learning experience about the principles of saving,...How Much Do You Need To Retire?

May 17, 2024

in Financial Life Planning, IRA, Money Management, Retirement Planning, Social Security

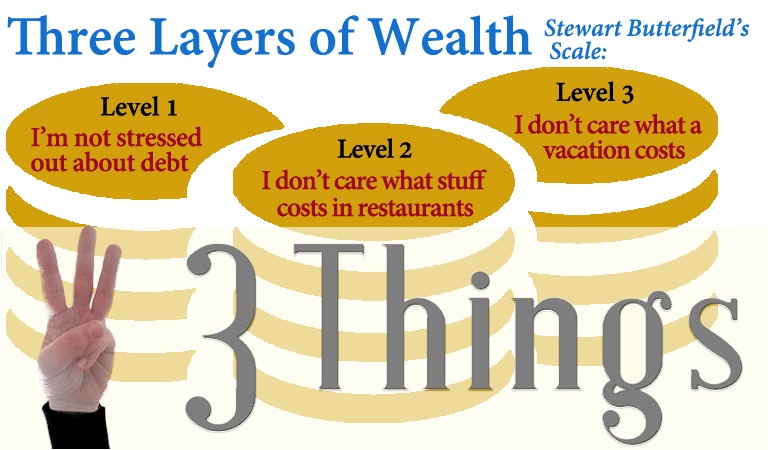

A few years ago, there were ads from financial services companies asking, “What’s your number?” The number was the money you needed to retire comfortably. This was an effective way for financial services companies to get people thinking about retirement and encouraging them to strive toward a specific monetary goal.

But is asking for a number the right question? If you are serious about retirement, it’s not simply about how much...

Strategies to Protect Your Wealth with Estate Tax Changes Looming

April 8, 2024

in Charitable Giving, Estate Planning, Family Money, Financial Life Planning, Money & Finance, Tax Management

At the end of 2025, portions of the Tax Cuts and Jobs Act (TCJA) are set to expire. Many changes will come with the sunsetting of many rules, including the possibility that federal estate and gift tax exemption levels will revert to pre-TCJA levels.

What’s changing?1

Currently, you are subject to federal estate tax only if your individual estate is worth more than $13,610,000 for individuals or $27,220,000 for married couples. These...

Secure Document Sharing

Secure Document Sharing