Ongoing Planning provides you with confidence and reassurance that you are optimizing relevant planning opportunities and have a professional watching over your “stuff”. You get the benefit of having on-demand meetings or calls for urgent life planning matters as well as unlimited phone and email support.

Inherited IRA Rule Changes

Inherited IRA Rule Changes The rules regarding inherited IRAs have changed in the last five years, and failing to comply with the new requirements may result in IRS penalties. These changes affect people inheriting IRAs and those looking to leave retirement accounts to heirs.1 How the SECURE Act Impacted the Retirement Landscape In 2019, the SECURE Act was signed into law. It was a major piece of retirement legislation that contained important changes...How Do You Turn Retirement Savings into a Reliable Income Strategy?

You’ve likely spent years building your retirement nest egg—saving diligently, investing wisely, and contributing to retirement accounts along the way. But transitioning from earning a paycheck to relying on your savings can feel overwhelming. It’s a major life change, and having a clear strategy can help ease the stress. As financial professionals, we help clients navigate this shift by developing strategies that turn the wealth they’ve accumulated into reliable retirement...The Four Most Dangerous Words In Investing

“The Four Most Dangerous Words In Investing Are: ‘This Time It’s Different.’” – Sir John Templeton Despite those who say the conventional wisdom that has guided investor actions over the years is no longer valid in 2025, remember the famous quote from legendary investor Sir John Templeton: "The four most dangerous words in investing are: 'This time it’s different.'" While the underlying cause of market volatility may differ from what we experienced...Tax Season Brings a New Wave of Identity Theft Risks

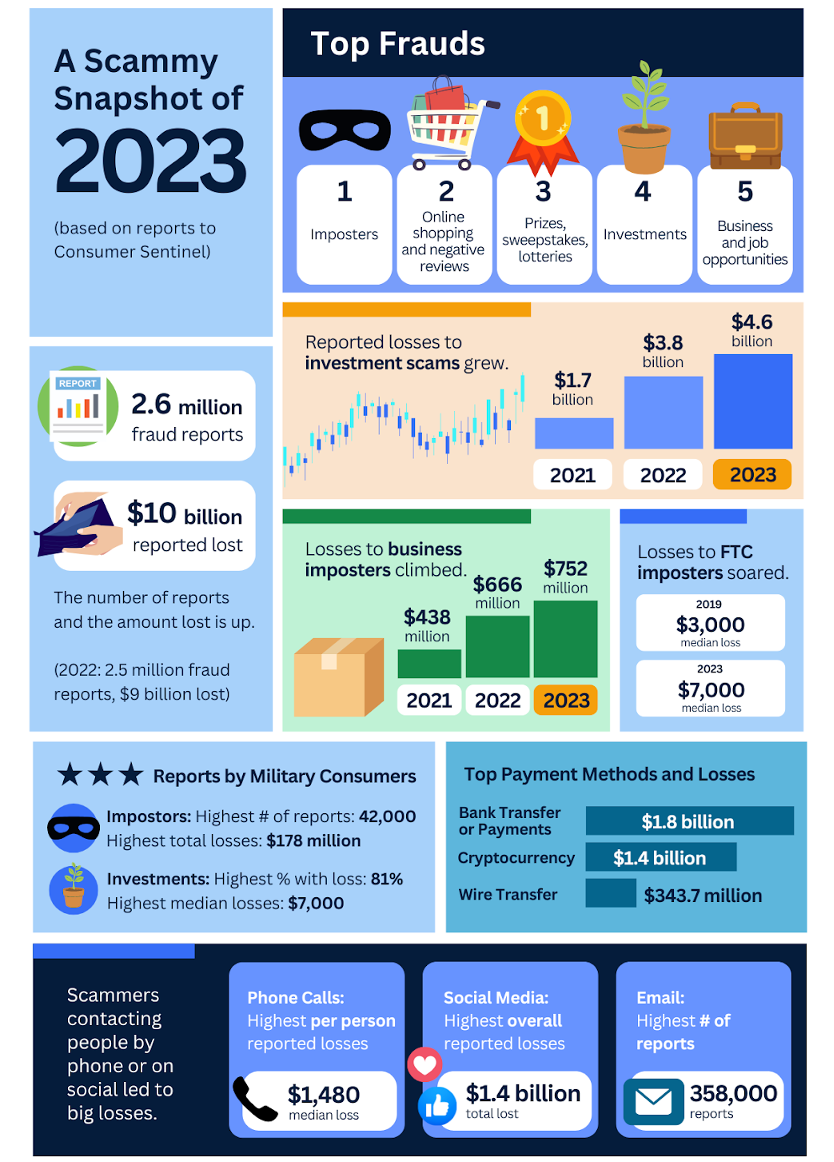

Tax season brings a new wave of identity theft risks, with criminals ready to exploit your personal data to file fraudulent tax returns in your name. Imagine the shock of discovering that a criminal beat you to filing your taxes—potentially reaping your refund or creating serious headaches with the Internal Revenue Service (IRS). Unfortunately, this scenario is becoming increasingly common and serves as a stark reminder of why vigilance is...Key Financial Insights from 2024 and Looking Ahead of 2025

As we approach the end of 2024, it's an opportune time to reflect on the year's financial developments and consider what 2025 may bring. We believe in understanding both the past and potential future of our economic landscape, which may help inform financial decisions. This year has brought its share of financial developments, from market fluctuations to policy changes that have shaped the economic environment. Shifts in various sectors, interest rate...QUARTERLY MARKET REVIEW (Q3 2024)

We are pleased to provide you with our Quarterly Market Review. Well, it finally happened. After months of will-they-or-won’t-they speculation, the Federal Reserve cut interest rates in September. And it was a relatively big one: The half-percentage-point decrease was the biggest the Fed has made since its emergency rate reductions in March 2020 at the onset of the pandemic. The good news: With these cuts, policymakers acknowledged the progress they’ve made in...The Impact of Elections on the Markets and Tax Policy

The Impact of Elections on the Markets and Tax Policy With Labor Day behind us, we're in the final stretch of the 2024 presidential election race. As we follow the news and parse the most recent polls, some may ask, "How might what happens on November 5 impact my finances?” As financial professionals, we’ve done some homework and come to the following conclusion: you may care passionately about who wins, but your...SAGEBROADVIEW WELCOMES TAX MANAGER, SARAH ST. PIERRE

August 13, 2024

in SageBroadview News

As our Tax Manager, Sarah will be working closely with our clients on tax planning strategies to complement the financial plans and investment strategies that we have developed as part of the overall fee-only wealth management process we provide. She will also be actively involved with our affiliate, SAGEbroadview Tax, preparing all forms of tax returns for our clients, their businesses, and their families.

Sarah has 12 years of practical, hands-on...

Preparing to Send a Child Off to College? Don’t Forget These Important Topics

August 9, 2024

in College Planning

Sending a child off to college is a major milestone for any family, whether you’re a parent, grandparent, or close friend. It’s an exciting time, filled with anticipation and perhaps a bit of trepidation. There’s so much to do, and time seems to fly by.

As the big day approaches, you might find yourself helping to check off items on their list (extra-long sheets, shower caddy, microwave mac & cheese, etc.)....

Secure Document Sharing

Secure Document Sharing