Don’t Get Creamed by Inflation Risk

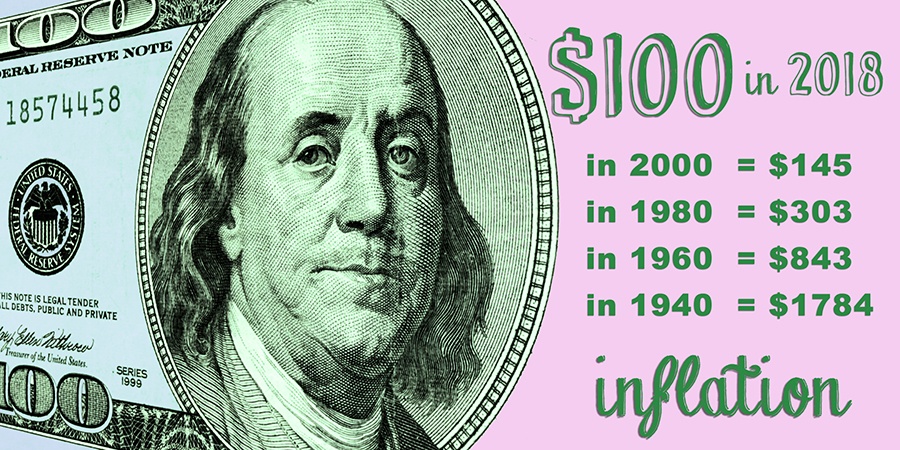

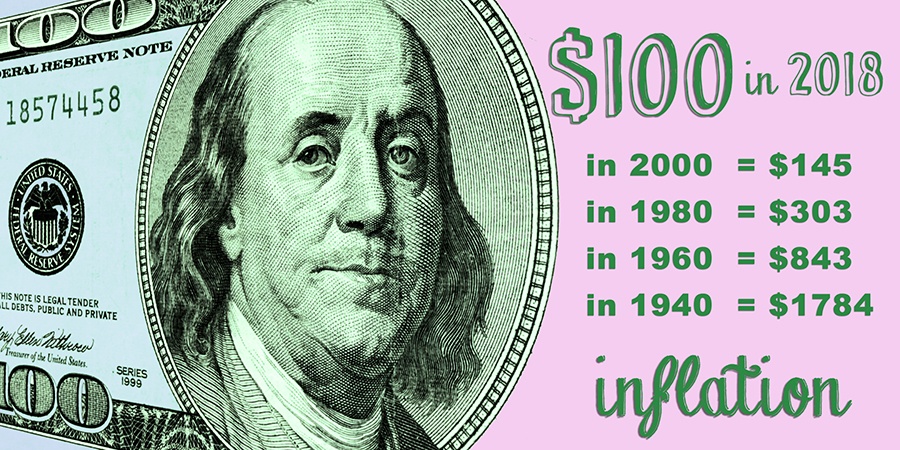

The Impact of Inflation

Over the long run, stock markets are expected to deliver returns well beyond the rate of inflation. That is, the $1 you invest in today’s stock markets should still provide $1 or more worth of purchasing power decades into the future. In exchange, you must tolerate volatility risk, which can cause your account balances to bounce around wildly, often uncomfortably, along the way.

In contrast, “safe” Treasury bonds or similar investments keep your account balance on a more even keel. While this can be comforting during stormy markets, it actually exposes you to a different kind of risk. With considerably lower expected returns, you could end up getting milked by inflation risk.

A recent article from Dimensional Fund Advisor illustrates the impact of inflation risk. How much milk do you think you could buy today for the cost of a quart from 100 years ago? You’ll find the answer in Dimensional’s paper, along with suggestions on how to manage volatility and inflation risks with a globally diversified investment strategy.

Interested in keeping the conversation flowing? Give us a call anytime.

SAGE Serendipity: Enjoy art outdoors this summer at Storm King Art Center in Cornwall, New York. The 500-acre open air museum is currently hosting Indicators: Artists on Climate Change. Core works include those by Alexander Calder, Richard Serra, Henry Moore, and Maya Lin. The museum is an hour north of New York City.

SAGE Serendipity: Enjoy art outdoors this summer at Storm King Art Center in Cornwall, New York. The 500-acre open air museum is currently hosting Indicators: Artists on Climate Change. Core works include those by Alexander Calder, Richard Serra, Henry Moore, and Maya Lin. The museum is an hour north of New York City.

Secure Document Sharing

Secure Document Sharing