You, Your Investments, and the Coronavirus

We want to take a moment to share our thoughts related to the coronavirus, its impact on the financial markets, and, ultimately, on your personal financial situation.

The coronavirus has triggered a steep stock market selloff around the world. As of this writing, major market indexes in the US, Europe, Japan, and Australia are down 10% or more from recent all-time highs, according to The Wall Street Journal.

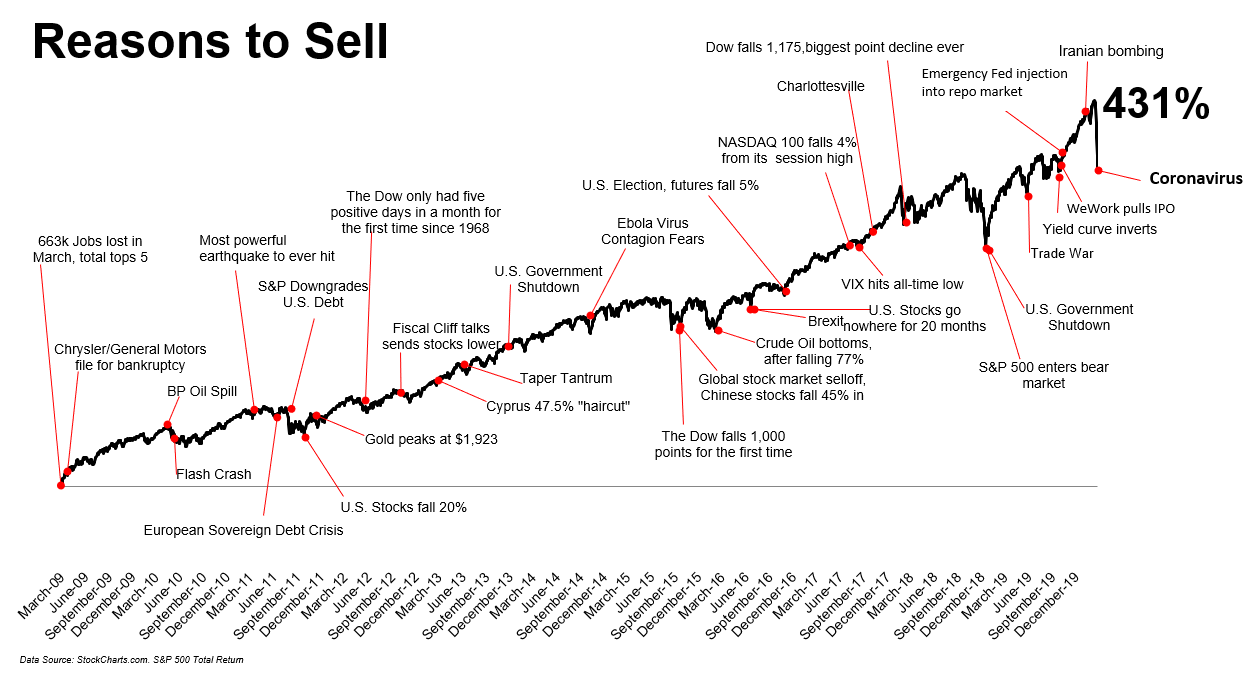

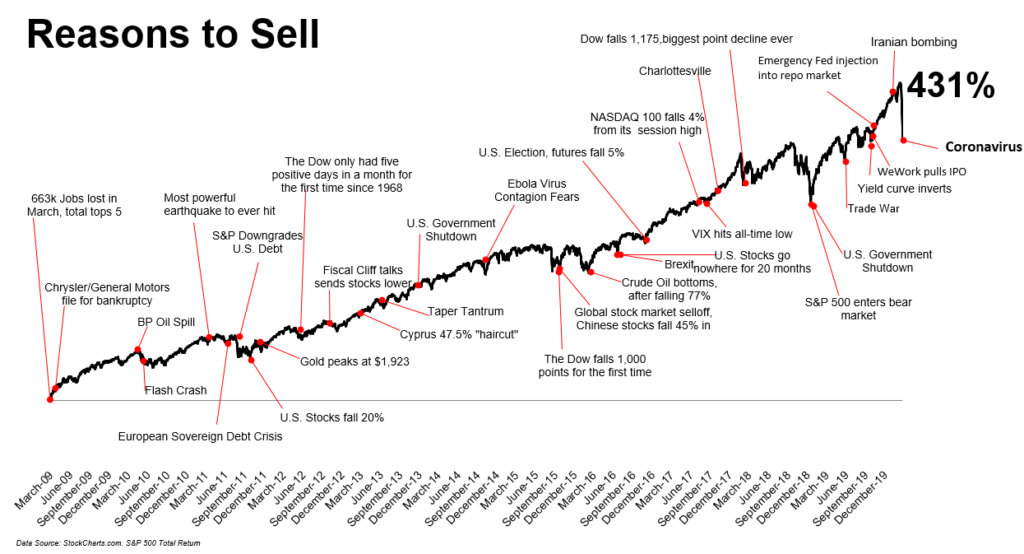

But here is some perspective: If you view the “Reasons to Sell” chart above, you can see that even with the recent negative market activity, we’re at the same levels we saw last fall. And back then most folks were feeling pretty good about their portfolios.

Three Things We’d Like You to Keep in Mind

First, fear is a natural reaction, but markets endure. We’re human and as humans, we react to situations that threaten us. Here we have a double whammy of fear — there’s the virus that can cause us bodily harm and the market reaction that can cause us financial loss.

Our advice is first and foremost to take care of yourself and your families. Wash your hands often. Cover your mouth when you cough. Eat well, exercise, and get plenty of sleep. Play with your pets. Meditate. Breathe. You and your good health are what is most important.

We by no means wish to downplay the suffering coronavirus has created. But even in relatively recent memory, we’ve endured similar events – from SARS, to Zika, to Ebola. Each is terrible, tragic, and frightening as it plays out. But each time, markets have moved on. Whether coronavirus spreads further or we can quickly tamp it down, overwhelming historical evidence suggests capital markets will once again endure.The good news is, as stewards of your financial well-being, we prepare for situations like this even though we never know what may trigger them. Your portfolios are designed to weather these types of storms.

Second, situations like this can create buying opportunities for you. For example, as prices drop, we may have an opportunity to “rebalance” your portfolio, “sell one thing and buy another” to get your portfolio back to your desired mix of stocks and bonds. Or we can put cash to work that is not needed for spending in the next few years.

Third, be prepared for more volatility. In today’s financial markets, many trades are triggered automatically by algorithmically driven computers. Once certain “technical levels” are reached, these computers, often run by large hedge funds, start selling (or buying) indiscriminately. And many of them are programmed to “trigger” based on the same technical levels. This “piling on” can lead to very eye-popping volatility—both on the downside and upside.

As investors, the challenge is to not let the difficulties of the short term prevent us from reaping the potential benefits of sound, long-term investing.

We’re Here to Help

Your financial well-being is our number one objective. We continue to work hard behind the scenes to monitor this unfolding situation and take actions as appropriate. If you have any questions about your specific situation, please reach out. We are here to help. Thank you for your continued trust and confidence.

Your SAGEbroadview Team

Sheri, Larry, David, Chris, Karina, Danny, and Lynn

Additional Resources

11 Questions about the COVID-19 outbreak, answered

Is it safe to travel? Is this going to be a pandemic? How will the outbreak end?

The Coronavirus and Market Declines provides helpful perspective from Dimensional.

“We can’t tell you when things will turn or by how much, but our expectation is that bearing today’s risk will be compensated with positive expected returns. That’s been a lesson of past health crises, such as the Ebola and swine-flu outbreaks earlier this century, and of market disruptions, such as the global financial crisis of 2008–2009.”

Coronavirus COVID-19 Global Cases by Johns Hopkins CSSE shows cases around the world.

Q&A on COVID-19: The Economy, Markets and What Investors Should Do provides helpful perspective from Schwab.

Key Points

- While it is hard to predict the economic impact from COVID-19 in the first quarter given little yet reported and many unknowns, most economists are anticipating a rebound later this year.

- Two of the best performing stock markets in the world so far this year are China and Italy, where COVID-19 outbreaks have been focused—reminding us that headlines often don’t make for good investment advice.

- Rather than trying to call a bottom, a more effective way to think about investing now is to focus more on the duration than the decline. Markets may have further to fall, but they may not stay down for the rest of the year barring a severe pandemic.

Note: Reasons to Sell is from the Director of Research at Ritholtz Wealth Management, Michael Batnick. (2/28/2020)

Secure Document Sharing

Secure Document Sharing