Time Is Money: Start Saving for Retirement Now – Summer Refresher Series

Let us count the ways that we still love this post about the benefits of youthful investing in a Roth IRA.

First, there are few investment lessons more powerful than the importance of starting to save and invest when you’re young, with time, compound returns and tax sheltering opportunities on your side. Second, it’s been heartening to see how far guest author Chris Annello and Sheri’s niece Jessica (who inspired the post) have come since we first posted this. Chris has since picked up his CFP® credentials and is mentoring other young financial enthusiasts. You can read an update about Jessica’s graduation and career growth here.

Last but not least, since Chris wrote this post, Sheri got to take a bit of a break from her blogging. Sweet. Check it out … again.

Time Is Money – Start Saving Now

The Benefit of Starting to Save for Retirement Early

Originally posted: May 22, 2013, by guest author Chris Annello, CFP®

This article was inspired by Sheri’s niece, Jessica Iannetta, a newspaper and online journalism and political science major at Syracuse University, class of 2015.

When I was in college, my dad gave me a “cool” gift – or so I thought at the time. Looking back on the gift now, it was the BEST gift. Before I tell you exactly what it was, I will tell you this:

- It came with a bunch of paper stuffed in an envelope.

- I won’t be able to use the gift until more than 40 years from now.

- It requires me to make financial sacrifices for years to come.

I know what you are thinking: “That’s not a cool gift. It seems closer to ‘getting the ugly sweater from your Grandmother’ type of gift.”

So what was it? It was a Roth IRA funded with $500. As a bonus, it included pages of calculations showing the magic of compounding interest over time, as well as some SAGE advice from my Dad, who said to me:

“If you start saving for retirement now, you’ll have to save less and you’ll have a lot more money in the end.”

It’s too bad my dad couldn’t share his wisdom with the entire world, because we hear in the news all of the time that Americans are failing to save enough for retirement. A recent Wall Street Journal article, “Workers Saving Too Little for Retirement,” cited a March 2013 study from the Employee Benefit Research Institute: “The percentage of workers who have saved for retirement plunged to 66% from 75% in 2009.”

Perhaps we need to give my dad a megaphone. Or maybe they just need to remember the adage we’ve all heard: Time is money. To illustrate:

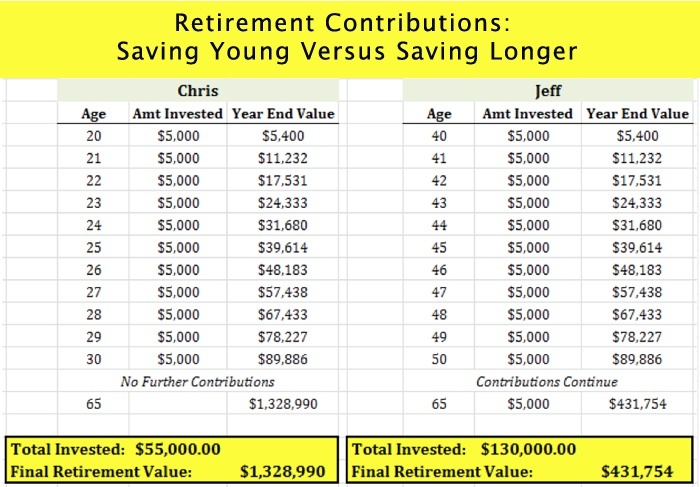

Both Chris and Jeff work and earn at least $5,500 of income each year. Chris, age 20, decides to contribute $5,500 per year to a Roth IRA until he is 30 years old. Then he stops contributing. Chris’ brother Jeff decides to wait until he is 40 years old and then starts contributing $5,500 to his retirement account until age 65. Jeff’s rationale is that, because retirement is so far away and he’s so young, he’ll have plenty of time to save for retirement later. Assuming Chris and Jeff both earn an 8 percent annual return on our investment, who will have more money?

The numbers say it all. If you are a young adult who just brought home your first paycheck or if you’re the proud parent of such a young saver, now’s the time to start. If you can begin saving young and contribute regularly throughout your life, the possibilities are even more dramatically in your favor. In this day and age, with disappearing pensions and extended life expectancy, it’s all the more important that you start to plan for your retirement early in your career. And yes, it really does make that much of a difference.

SAGE Serendipity: Excited for the Olympics? NBC and Telemundo are the broadcast networks and have the major viewing hours. NBC.com has “How to Watch the 2016 Olympic Games,” organized by day as well as sport. It also has articles on the athletes. Because Rio is only one hour ahead of our Eastern Time Zone, this will be a very “live” Olympics. The Opening Ceremony is Friday August 5 but the games begin August 3. On that day the US Women’s Soccer Team begin their journey towards their fourth straight gold medal. Go Team USA!

SAGE Serendipity: Excited for the Olympics? NBC and Telemundo are the broadcast networks and have the major viewing hours. NBC.com has “How to Watch the 2016 Olympic Games,” organized by day as well as sport. It also has articles on the athletes. Because Rio is only one hour ahead of our Eastern Time Zone, this will be a very “live” Olympics. The Opening Ceremony is Friday August 5 but the games begin August 3. On that day the US Women’s Soccer Team begin their journey towards their fourth straight gold medal. Go Team USA!

Secure Document Sharing

Secure Document Sharing