Summer Refresher: The 3.8% Medicare Surtax

One favorite guest re-post deserves another. This next one originally arrived just in time for Halloween. Authored by Larry Annello (shortly before our two firms merged into SAGEbroadview), the witching season went well with the theme of the then-new, potential 3.8% Medicare surtax on portions of an investor’s income.

At least for the foreseeable future, the Medicare surtax remains alive and well. Fail to plan for it in any given tax year, and the results on your tax returns could still be scary. You can get a leg up on the 2017 tax season by exploring this “gotcha” with your investment advisor and your tax professional alike.

Boo! The Lurking 3.8% Medicare (Medi-scare) Surtax

Originally posted: October 30, 2013, by guest author Larry Annello, CPA/PFS, CFP®

While diminutive, candy-seeking ghosts and goblins are soon to haunt our doorsteps, my real fears lie elsewhere this Halloween: I’m afraid there are a lot of Americans who have not planned ahead for the NEW 3.8% Medicare Surtax on Investment Income. If you’ve not yet had such planning conversations with your financial and tax advisers, this year’s witching season is an excellent time to prepare.

What Is the 3.8% Medicare Surtax and When Is It Due?

As a key provision of the 2010 Patient Protection and Affordable Care Act (ACA or Obamacare), the 3.8 percent Medicare surtax is a new tax, in addition to the traditional income tax that you are accustomed to paying. It was signed into law over three years ago, but it didn’t apply until January 1, 2013, which means we are only now beginning to feel its effects.

Typically, taxpayers have associated the term “Medicare tax” with the taxes withheld from their paychecks to cover their future Medicare needs. So a word of caution here: The 3.8 percent Medicare surtax is a new animal. It has not been withheld from your paycheck or anywhere else. Rather, if the tax applies to you, you’ll include it on your Form 1040 and pay it in full with the rest of your taxes owed on April 15.

To Whom Does It Apply?

You need to concern yourself with this tax if you fall into one of these categories:

- Married couples filing jointly with adjusted gross income (AGI) over $250,000 (or $125,000 for married-filing-single)

- Single taxpayers with AGI over $200,000

- Trusts and estates with undistributed income over $12,400

How Much Might You Owe?

Again, we encourage you to discuss your particular circumstances with your professional advisers; applying the nitty-gritty details can get messy. But here’s a broad overview to help you prepare.

First, it’s important to emphasize that the 3.8% Medicare surtax only applies to a certain amount of your total investment income that is in excess of the above AGI thresholds. It is not an additional 3.8% tax on all of your other income, such as wages, Social Security benefits, pensions and IRA distributions.

The 3.8% Medicare surtax is assessed on the lesser of (a) net investment income (NII) or (b) AGI in excess of the thresholds listed above. It will be assessed on the following:

- Taxable interest income (but not tax-exempt interest income)

- Dividends (qualified and nonqualified)

- Investment capital gains (short- and long-term)

- Royalties

- Taxable passive income (such as from a trade, business or rental real estate venture in which you are not actively involved)

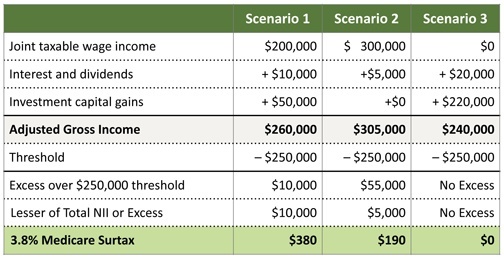

To attach some numbers to the general theory, here are a few examples of how the tax would apply for a married filing jointly return.1

Scenarios 1 and 2: The taxpayers in Scenario 2 have a higher AGI than the taxpayers in Scenario 1, so traditional logic would assume that they’d pay more. Surprise! Not in this case, since the 3.8% Medicare tax is applied on the lesser of NII or the amount AGI exceeds the threshold. The couple in Scenario 1 ends up paying more of the Medicare surtax, although likely less in traditional income tax.

Scenario 3: This retired couple has net investment income of $240,000, which is just under the threshold, so they pay no Medicare surtax.

1For simplicity in the examples above, we omitted any investment expenses and allocable state income taxes that would potentially reduce the amount of investment income subject to the surtax.

How Can You Prepare?

While the element of surprise can be fun (to a point) when you’re out trick-or-treating, most of us are best off avoiding the same when it comes to our tax preparation. Year-end tax planning offers you an excellent opportunity to reduce the amount of Medicare surtax owed, or to at least be aware of the amounts, so you can manage your cash flows accordingly.

Here’s what I suggest to get started:

- Project where you stand.Have your tax adviser prepare an initial tax projection scenario to determine whether the surtax applies to you.

- Manage your income.Especially if you expect to be “borderline” on whether the surtax applies, consider doing what you can to reduce your AGI and/or NII. For example, you might:

- Maximize your contributions to your employer-sponsored retirement plan

- Harvest any capital losses in your investment portfolio

- Identify investment expenses to reduce your NII (such as investment management fees)

- Reassess and strategize.Have your tax adviser prepare a second tax projection scenario considering some of these potential strategies:

- Prepay your fourth-quarter state income tax estimates.

- Defer exercising stock options to a subsequent year.

- For sole proprietors, partnerships and small businesses, accelerate the payment of expenses to reduce your AGI.

- Take advantage of the benefits of accelerated and bonus depreciation as another potential AGI-reduction technique.

- Use installment sale rules for property sales.

- Relocate assets.Relocate tax-inefficient assets to your qualified retirement accounts as described in our previous post, “The Art of Asset Location.” By locating your most heavily taxed investments within your tax-sheltered accounts, you can minimize the dividend, interest and investment capital gain income that contribute to your NII bottom line.

- Give it away. Another way to minimize capital gains is to consider gifting highly appreciated assets to your favorite charity.

- Pay it over time.If you’d rather not pay a lump sum, you can soften the blow by increasing your Federal income tax withholding on your remaining 2013 paychecks to help cover the additional amount of Medicare surtax you expect to owe in April.

- Step up your estate planning.There are other, more complicated estate planning strategies that can be employed to reduce the amount of the Medicare surtax. Charitable remainder trusts are one example. Without going into detail here, any wealth transfer initiatives should be completed under the guidance of a qualified estate planning attorney.

So give yourself the sweet treat of a well-thought-out tax strategy this and every Halloween. By getting a fourth-quarter leg up on your tax planning, you stand a better chance to minimize taxes owed and conduct sensible cash-flow planning for those that remain. That’s a good idea with or without a spooky new surtax.

SAGE Serendipity: In the Stick It Out column of Quartz.com, Amanda Crowell, a writer, and improvement coach with a Ph.D. in cognitive psychology, tackled her “inability” to stay on a fitness regime. If you can relate, then the article “Psychology has identified three mindsets shared by people who actually follow through on their goals” is for you! It can actually be applied to more than just fitness goals. Good luck!

SAGE Serendipity: In the Stick It Out column of Quartz.com, Amanda Crowell, a writer, and improvement coach with a Ph.D. in cognitive psychology, tackled her “inability” to stay on a fitness regime. If you can relate, then the article “Psychology has identified three mindsets shared by people who actually follow through on their goals” is for you! It can actually be applied to more than just fitness goals. Good luck!

Secure Document Sharing

Secure Document Sharing