Stocks or Bonds: Active Management Is Ill-Advised

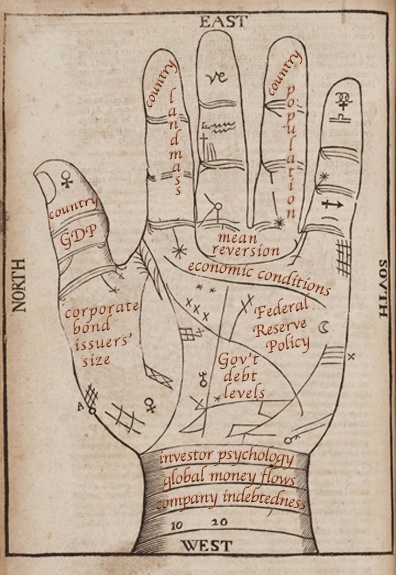

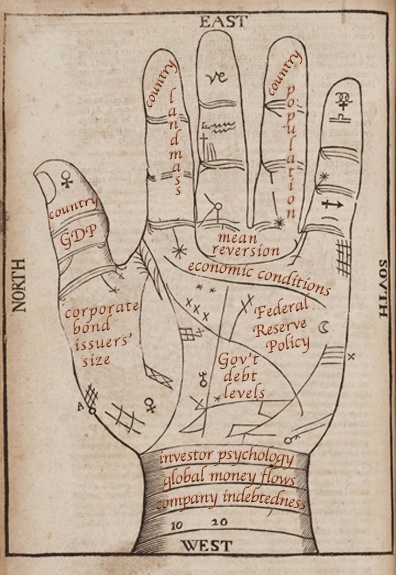

Investors are better served by patient, passively managed participation in bond and stock markets, leave the foreseeing to a palm reader.

In our last blog post, we shared the timeless principles we suggest for your fixed income investing. We also previously presented a Vanguard Funds report demonstrating that actively managed stock funds face punishing odds in their quest to outperform appropriate market benchmarks. But what about in the bond markets, especially in the current climate of potentially rising interest rates? Can active management shine? An additional report from Vanguard helps us understand why investors are still better served by patient, passively managed participation in bond and stock markets alike.

In September, Vanguard published an additional report, “Rising rates shine a dull light on active bond funds.” In stock markets, active managers seek to predict stock or sector price movements based on factors ranging from logical (dividends, earnings, etc.) to laughable (who won the Super Bowl). In bond markets, active managers often seek to outperform their benchmarks by successfully predicting near-term changes in interest rates. That’s because, as interest rates rise, bond prices usually – but not always – fall.

Which brings us to today’s climate of potentially rising rates, and those who propose that active managers have particularly good opportunities to outperform in the current environment. As Vanguard’s report proposes: “Given that active managers have the tools and expertise in their arsenal to maneuver portfolios in anticipation of a rise in interest rates, shouldn’t they have an advantage?”

Upon analysis, the answer seems to yet again be, not so much.

- Vanguard looked at the rising-rate period June 2012–August 2013 and found that 81% of active bond managers underperformed their benchmarks during this period.

- They also looked at a subset capturing the most recent interest rate surge from May 2013–August 2013, and found 70% of active bond managers underperformed.

- Assessing the rising-rate period October 7, 2010 – February 8, 2011, active managers fared better, with 61 percent outperforming their benchmarks. But the median excess return was a shaky 0.30%, with the majority going on to underperform in the subsequent 3-month, 6-month and 12-month periods. The results were essentially a wash.

- Vanguard further notes: “In prior research, we looked at seven rising-rate periods since 1981, and the majority of active bond funds, on average, historically failed to outperform their benchmarks.”

Thus, particularly after considering the costs involved, we see little evidence that actively managed bond funds are expected to consistently outperform our recommended approach. We continue to help SAGE investors build a low-cost, globally well-diversified portfolio of passively managed funds based on personal goals and risk tolerances … and recommend that you leave the prognosticating to your local neighborhood palm reader.

SAGE Serendipity: Here’s an irreverent look at 40 things you never get to see anymore … some of them for the best!

Secure Document Sharing

Secure Document Sharing