Fixed Income: Should I Stay or Should I Go?

SAGEbroadview:

An Eternal Question from The Clash

Interest rates are at historic lows and, for several years now, numerous market pundits have been forecasting an upward move. This leaves many investors fretting about what might happen when rates rise. Some contemplate whether they should be making dramatic changes to their portfolios as a result. It reminds us of that Clash song: “Should I stay or should I go?” This blog post is dedicated to helping you understand the essentials that go into making SAGE decisions about your fixed income.

Fixed Income: The Big Picture

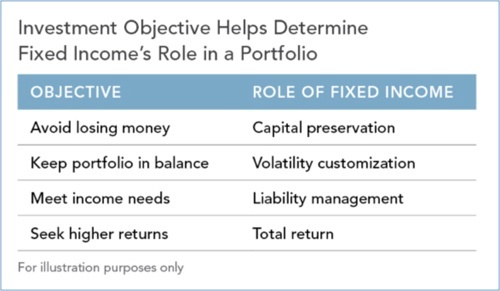

Why fixed income to begin with? It plays important roles in most investors’ portfolio – roles that vary according to your financial needs and concerns. For example, you may look to fixed income for various combinations of safety, income, and/or more stability in your portfolio. And, as we’re seeing against the backdrop of current events, you must weigh these overarching priorities against concerns over future interest rates, inflation, government debt, and other factors that affect fixed income returns.

Striking this balance can be a challenge in any market environment; the current environment is certainly no exception. So, what’s an investor to do? How can you make prudent fixed income decisions while also addressing today’s climate of uncertain interest rates? It helps to remember the following core investment principles, all of which apply in any market environment.

Markets Are Efficient … and Unpredictable

One key principle is that in a well-functioning capital market, securities prices reflect all available information. Today’s bond values reflect everything the market knows about current economic conditions, growth expectations, inflation, Fed monetary policy, etc. That means that the market’s best estimate on whether interest rates are going to rise, fall or stay the same is already factored into today’s prices.

Despite many pundits’ claims that they have what it takes to see into the future, the reality is, no one really knows when and by how much interest rates will change. Some have been forecasting an upward move for several years now but, clearly, forecasting it doesn’t always make it so. Rather than trying to make such forecasts, you’re better off focusing on the variables within your control.

Start with a Clearly Defined Goal

One thing you can control is defining the role of fixed income in your own portfolio, as illustrated in this nifty chart from our friends at Dimensional Fund Advisors. Unfortunately, it’s far more common for investors to chase past performance or perceived popularity than to invest according to their own disciplined plans. Among our key roles at SAGE is to help clients establish and maintain a fixed income plan within their portfolio.

Understand the Tradeoffs

In the fixed income arena, there are two primary ways to increase expected yield and returns on bonds. You can:

1. Extend the overall maturity of your bond portfolio (take more term risk).

2. Hold bonds of lower credit quality (take more credit risk).

Depending on your financial goals, either or both of these may be reasonable actions. But it’s important to go in with eyes wide open about any added risk you’re taking on. The ends may justify the means, but you may need to be willing to tolerate increased volatility as well as greater odds that your bond holdings might default. This is another area where a professional advisor can help you accurately assess the critical tradeoffs.

Pay Attention to Costs

Investment-related costs weigh heavily on your end results. This applies especially to fixed income securities. In fact, research has shown that a bond mutual fund’s expense ratio helps explain much of its net performance, and funds with the highest expenses tended to have the lowest performance within their peer group.1

Spread Your Risks Around

Don’t limit your bond holdings exclusively to those found close to home. Just as with your stock portfolio, you can expect to smooth out a bumpy ride and potentially enhance returns on the fixed income side by owning bonds issued by governments and companies from around the globe. Both empiric analysis and casual observation inform us that risks appear in different countries, to different degrees at different times. While not every country’s bonds are appropriate for a globally diversified portfolio, there’s still a world of them to choose from – in alliance with managers who specialize in constructing well-diversified, low-cost global bond funds.

Keep Your Eye on the Ball (i.e., Your Own Goals)

In short, in pondering the eternal question from The Clash, “Should I stay or should I go?”, don’t break up with your investing plan as long as you are letting your financial goals serve as its foundation. Most investors are best-served by building a fixed income strategy to complement their broader portfolio objectives, paying attention to fees, and looking beyond their own country to capture yields in other countries’ markets. That’s the best way to build a portfolio that rocks.

In our next blog post, we’re going to provide a more detailed illustration of the folly of attempting to chase past returns or popular trends by investing in actively managed bond funds.

SAGE Serendipity: For more inspirational quotes inspired by my rock & roll heart, you can revisit our past blog post, Head-banging Financial Wisdom.

1The study examined monthly alpha and expense ratios for bond funds in the CRSP survivorship-bias-free mutual fund database from January 1992 to December 2011. Source: Dimensional Fund Advisors.

Secure Document Sharing

Secure Document Sharing