SBV Curated Content | A Weekly Update of Enlightening & Intriguing Information | March 2, 2022

Businesses, Stock Markets & the Economy

Ukraine and the changing market environment (Vanguard Perspective)

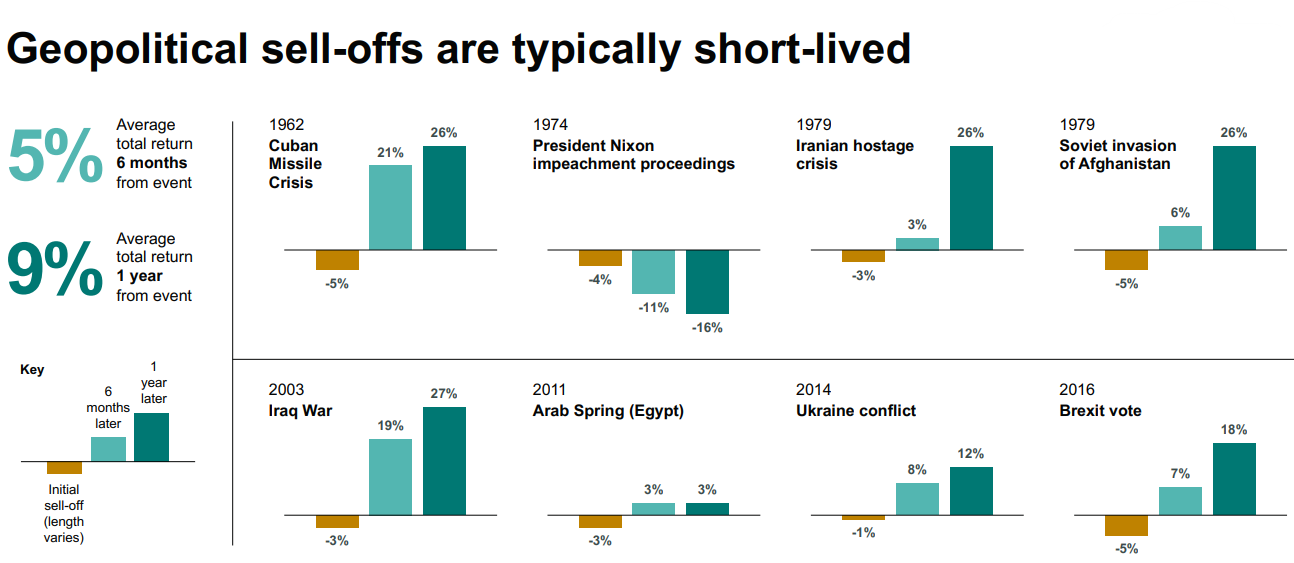

“With geopolitical tensions such as the conflict between Russia and Ukraine, investors often ask whether a link exists between current events and financial market performance. However, when we examined major geopolitical events over the past 60 years, we found that while equity markets often reacted negatively to the initial news, geopolitical sell-offs were typically short-lived and returns over the following 6- and 12-month periods were largely in line with long-term average returns. On average, stocks returned 5% in the 6 months following the events and 9% in the 12 months after the events as shown below.”

The Stock Market is Heartless “The counterintuitive nature of the stock market during war….” (Ben Carlson)

“It seems odd to worry about the stock market at a time of war when people are dying, losing their homes and potentially the country they love.

The point here is the stock market is heartless. It often goes up in the face of godawful events when it almost doesn’t seem right.”

Your Finances & other Wealth Management links

How to work with an IPO windfall. (blairbellecurve.com)

Caring for older adults can be financially debilitating. (wsj.com)

The Environment & ESG (Environmental, Social & Governance) Investing

Using Science and Celtic Wisdom to Save Trees (and Souls) (The New York Times)

“Diana Beresford-Kroeger, a botanist and author, has created a forest with tree species handpicked for their ability to withstand a warming planet.”

Your Physical & Mental Well-being

Creating meal care packages to store in the freezer for family & friends dealing with illnesses (Dinner A Love Story)

Freezing the clock: Nationwide push for permanent daylight saving time gains momentum (Washington Post)

This Week’s Serendipity

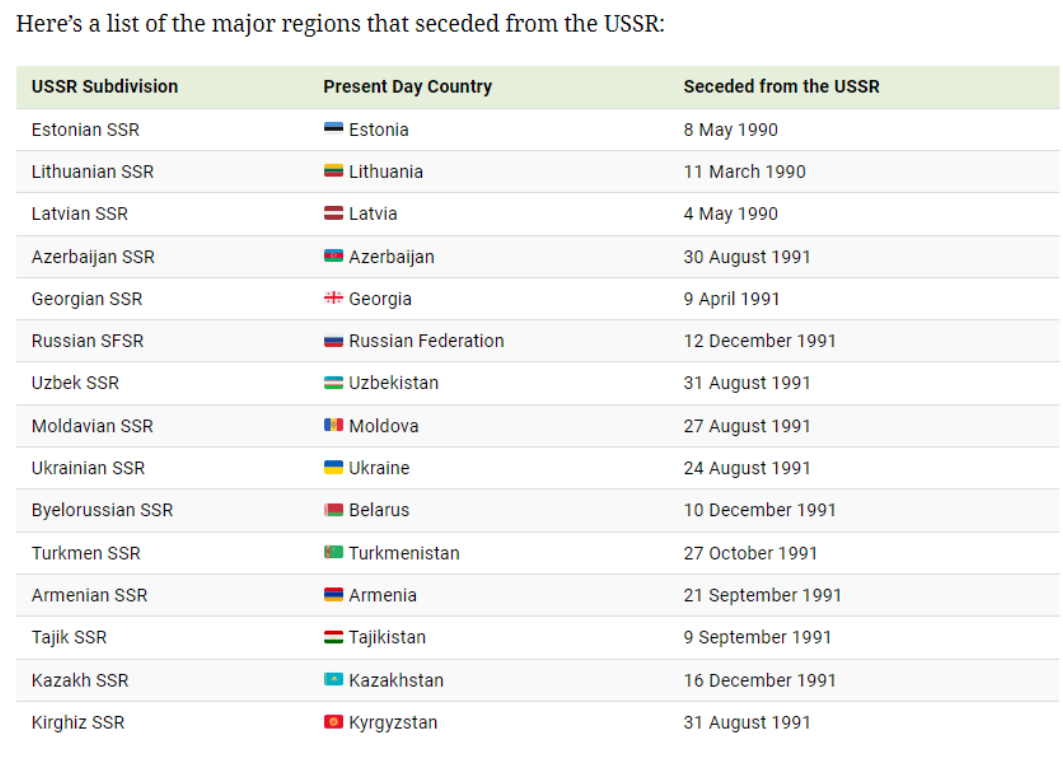

4 Historical Maps that Explain the USSR (Visual Capitalist)

Source: Visual Capitalist

Secure Document Sharing

Secure Document Sharing