SBV Curated Content | A Weekly Update of Enlightening & Intriguing Information | July 14, 2021

Businesses, Stock Markets & the Economy

Doing Nothing is Hard Work “Why soccer goalies should stay in the middle more on penalty kicks….” (Ben Carlson)

“Successful investing tends to be boring and long-term in nature but it’s hard to look cool with a boring, long-term strategy. Where’s the fun in that?”

Your Finances & other Wealth Management links

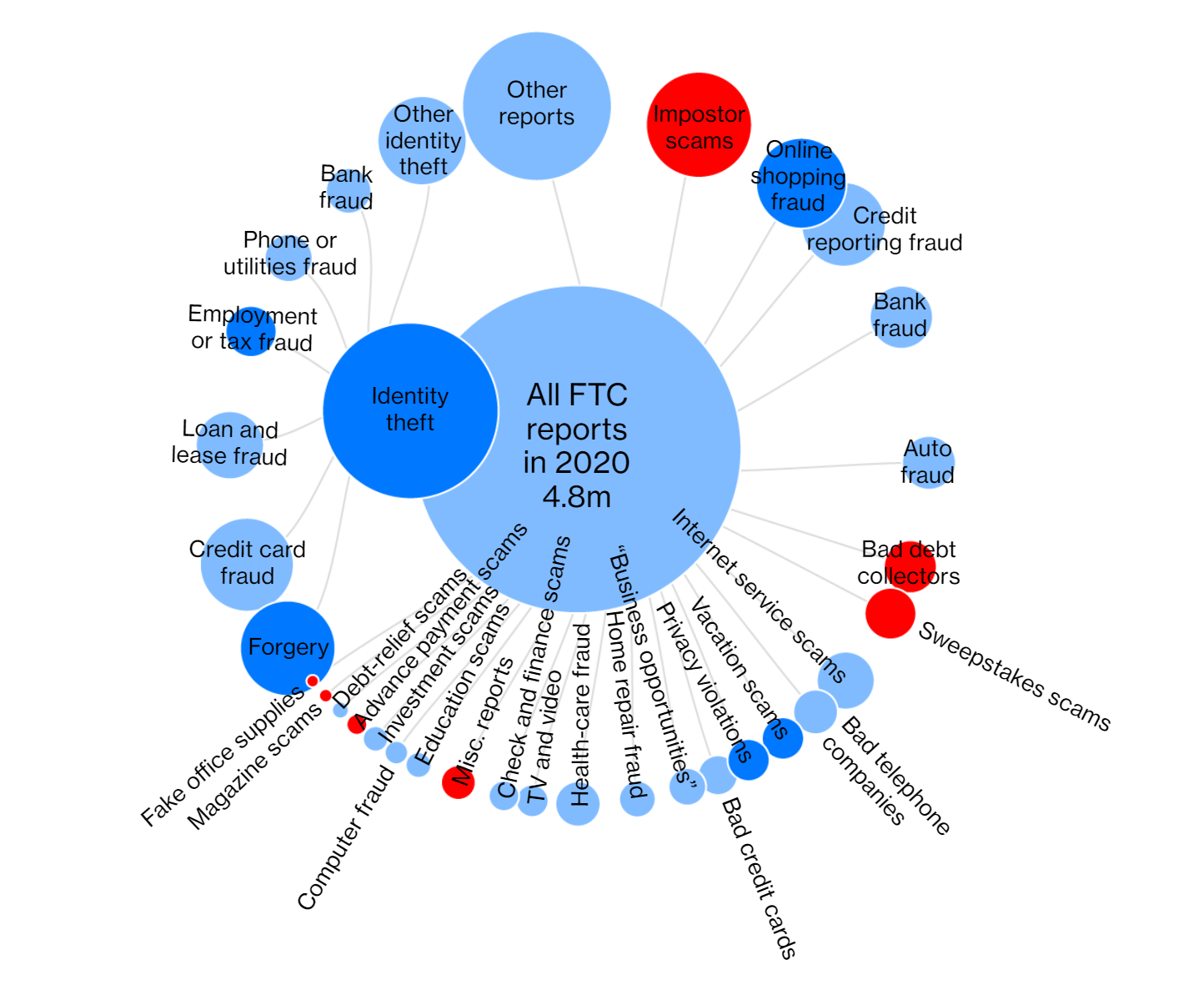

What 4.8 Million Scams Look Like “Here are all the ways to get defrauded, according to the U.S. government.” (Bloomberg Businessweek)

Top 10 Rules for Money (Barry Ritholtz)

- Investing Is Both Simple and Hard

- Behavior Is Everything

- Moderation In All Things

- Risk and Reward Are Inseparable

- Spend Less Than You Earn

- Leverage Kills

- Understand Your Role

- Be Aware of Your Limitations

- Own It

- Invest In Yourself

Morgan Housel’s “Money Rules”.” (collaborativefund.com)

“Barry Ritholtz asked people for their top 10 money rules last week. Here are mine…

- What money can and can’t do for you isn’t intuitive, so most people are surprised at how they feel when they suddenly have more or less than before.

- Money makes it easy to mistake optimism (good) with gullibility (dangerous) and overconfidence (disastrous).

- Getting rich and staying rich are different things that require different skills.

- The formula for how to do well with money is simple. The behaviors you battle while implementing that formula are hard.

- “Save more money and be more patient” is too simple for most people to take seriously, but it’s the best solution to most financial problems.

- Expectations move slower than reality on the ground, so it’s easy to become frustrated when clinging to the economic trends of a previous era.

- Everything is relative. John D. Rockefeller was asked how much money was enough and said, “Just a little bit more.” Everyone, at every income, tends to feel the same.

- Spending money to show people how much money you have is the fastest way to have less money.

- Debt removes options, savings add them.

- No one is impressed with your possessions as much as you are.

The Environment & ESG (Environmental, Social & Governance) Investing

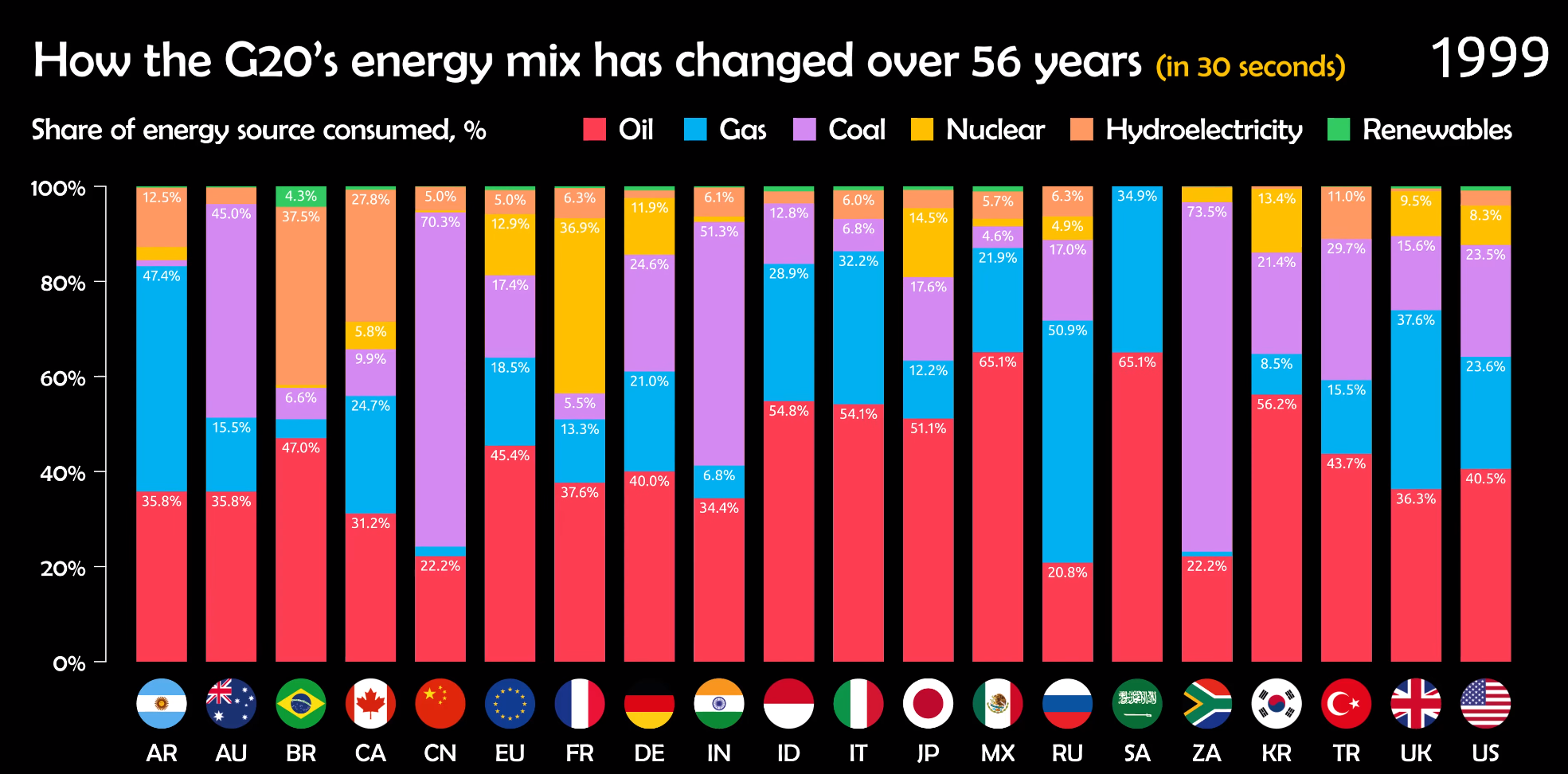

Watch in 30 seconds?Visualizing 50+ Years of the G20’s Energy Mix (Visual Capitalist)

Your Physical & Mental Well-being

Who Needs the Grand Canyon? Try a Microadventure. “How to find a sense of awe and discover a miraculous world right outside your door.” (The New York Times)

This Week’s Serendipity

Ready for a challenge? Try The Times’s spelling quiz. (The New York Times)

Secure Document Sharing

Secure Document Sharing