SBV Curated Content | A Weekly Update of Enlightening & Intriguing Information | December 2, 2020

COVID-19 & Your Health

Real-time Coronavirus Advice from an MD – Dr. Lucy McBride: Sign up here

If you want to catch up on some of her prior writings, here’s a good place to start:

- A practical strategy (and handy acronym!) to mitigate risk of coronavirus infection

- COVID School Series: Your daily dose of facts and guidance on COVID-19

- Back to basics: self-care in the pandemic

- A true story of COVID-19 infection

Dolly Parton, Country Saint, Funded Moderna’s Coronavirus Vaccine (Vulture)

What You Need to Know Now About Travel Insurance. “A spate of new travel insurance policies have begun covering Covid-19, just as many international destinations begin to require it. Here’s what to look for.” (The New York Times)

Please watch. As COVID19 surges across the US, it’s hard to describe the situation inside hospitals for healthcare providers & patients. Craig Spencer MD MPH and company made this video depicting 1 day in the ER to show the painful reality & to remind us why we must remain vigilant.

Your Finances & other Wealth Management links

Bigger Problem: Student Loans or Credit Card Debt? (Ben Carlson, CFA)

“Regardless of what the government does with student loan debt, someone will end up angry.

Young people who are saddled with much higher debt than previous generations are already fed up while those who have paid off their loans likely wouldn’t consider it fair that they didn’t receive the same treatment.

Wiping out student loan debt doesn’t solve the bigger issue of ever-rising tuition at colleges but that’s a topic for another time.

My biggest problem with both forms of debt is this — why are the interest rates so high?

I came out of school with around $25,000 in student loan debt. But the interest rate I paid on that debt was a shade over 2%. Today rates are around 6%.

Why doesn’t the government take the rates down from the current 6% or so to the 10-year treasury rate? Or maybe closer to mortgage rates?

What’s the point of charging our young people such egregious borrowing rates when the government is administering most of these loans?

And why has every interest rate on the planet fallen since the Great Financial Crisis except for credit card rates?

Maybe a good first step for helping out those borrowers in need would be to lower their borrowing rates to make the debt burden easier to stomach.”

What Biden’s Election Could Mean for Student Loans. “The incoming administration has proposed a series of changes that could affect more than 42 million student loan borrowers. Here’s what to expect.” (The New York Times)

Businesses, Stock Markets & the Economy

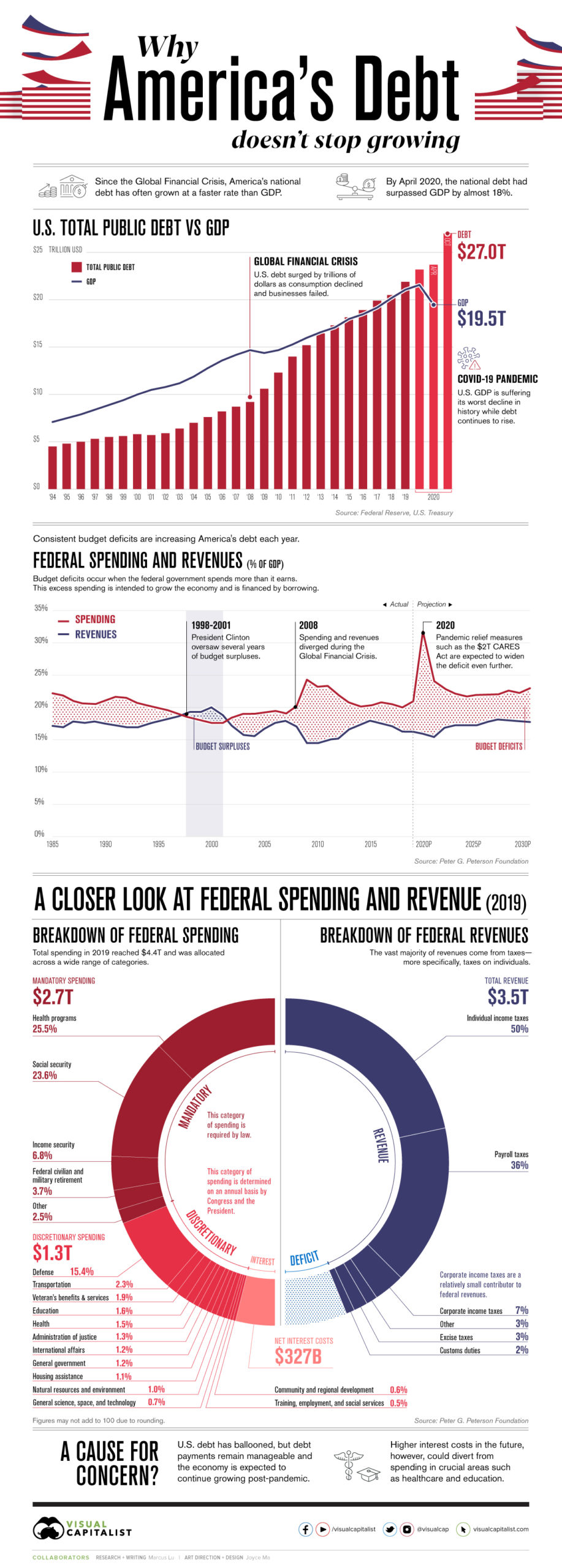

Charting America’s Debt: $27 Trillion and Counting (Visual Capitalist)

Watch here: “Dimensional’s Mitch Chamberlain hit an emotional high with his lottery win—but the low that followed was even more powerful. The journey helped teach him there’s a better way to invest.”

The Environment & ESG (Environmental, Social & Governance) Investing

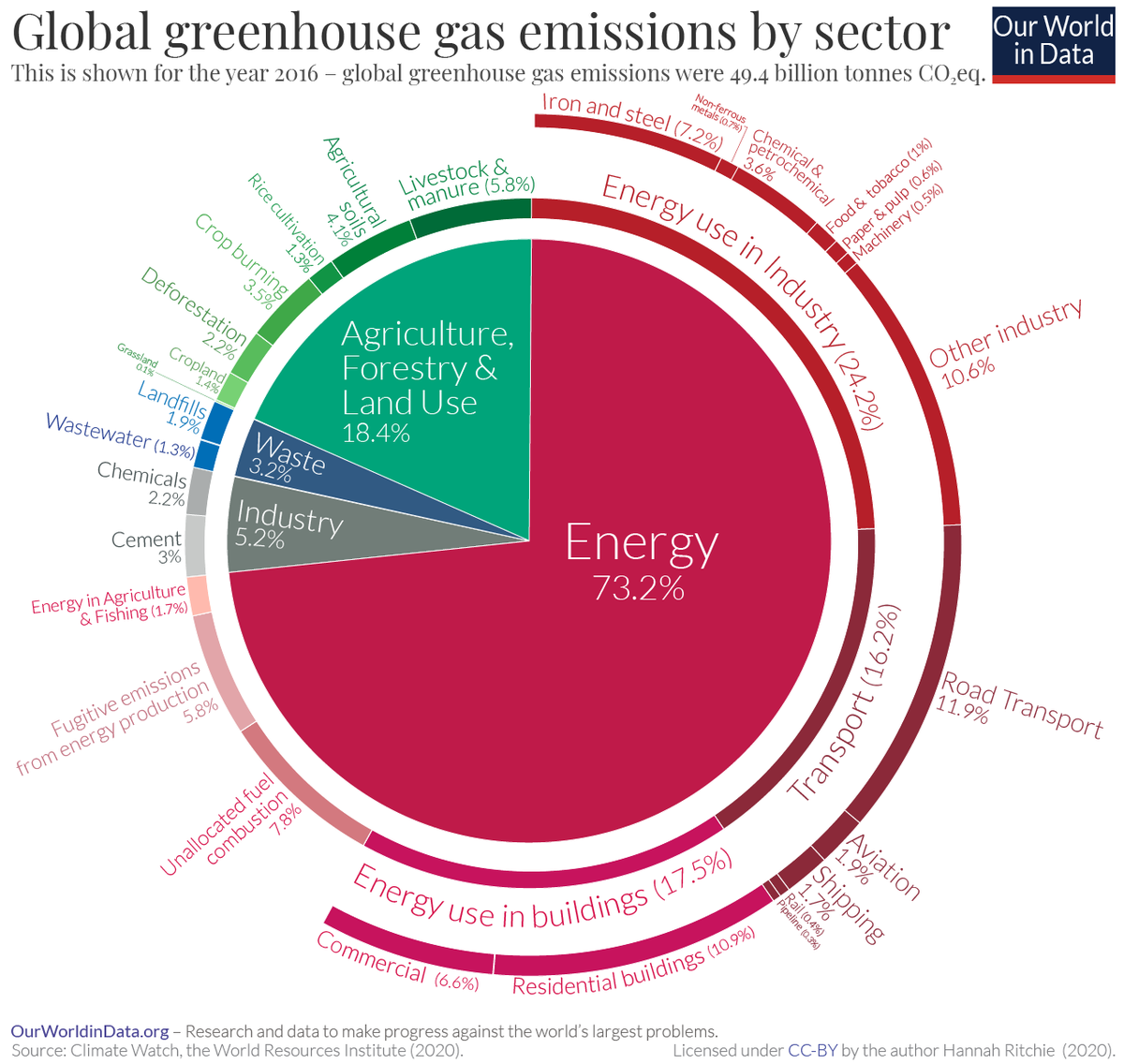

A Global Breakdown of Greenhouse Gas Emissions by Sector (Visual Capitalist)

Your Physical & Mental Well-being

Merriam-Webster’s Word of the Year 2020 Any guesses? (Merriam-Webster.com)

Choose a Gift That Changes Lives. “Educate a girl. Send a young person to college. Restore a person’s sight.” (The New York Times)

Four Ways to Wire Your Brain for Gratitude. “Gratitude can have a last impact on your well-being. Here’s how to foster it all day long.” (Mindful.com)

Today’s WFH office

Sheri’s sons were home recently. (And yes, we were careful. Dominic quarantined for two weeks, and Devon got tested for Covid twice before arriving in NJ.)

Leo made it just a tad difficult for Dominic to join his work conference call.

Then Leo promptly took a nap on Devon’s legs. (How is that at all comfortable ??? )

Leo misses the boys when they are away.

Secure Document Sharing

Secure Document Sharing