Money Tips for Parents Sending Children Off to College

Money Tips for Parents Sending Children Off to College

You’ve done a great job teaching your children vital life lessons and instilling values that will last a lifetime. As summer ends and a new school year begins, one thing that shouldn’t be overlooked, especially for college-bound children, is the money talk. Having open and honest discussions about finances can help shape your child’s long-term relationship with money, which might set them up for financial success in later life.

Understanding Money

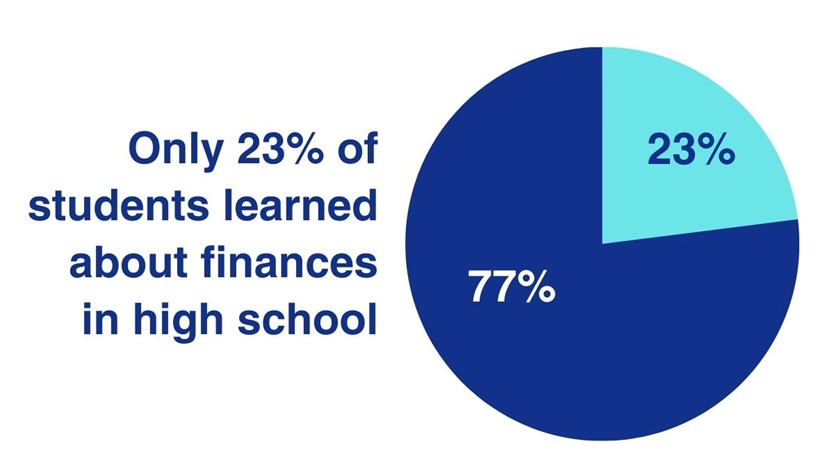

Insights.CollegePulse.com, 2023

Financial literacy is one of the most crucial yet often overlooked skills that young individuals can develop. Unfortunately, most high schools do not offer financial education. According to the Council for Economic Education, only 21 states have personal finance coursework requirements in their high schools. Although this number has increased in recent years, parents still bear much of the responsibility for providing financial education to today’s college students.1

Although teaching basic money management skills is helpful, introducing more advanced financial literacy concepts to your children is important. While this may appear to be overwhelming, it does not have to be. Here are some steps you can take to prepare your college-bound children or grandchildren:

Financial Steps to Take With Your College-Bound Children

Starting with the basics, such as banking and budgeting, can establish a solid foundation for your children’s financial futures. Consider the following ideas:

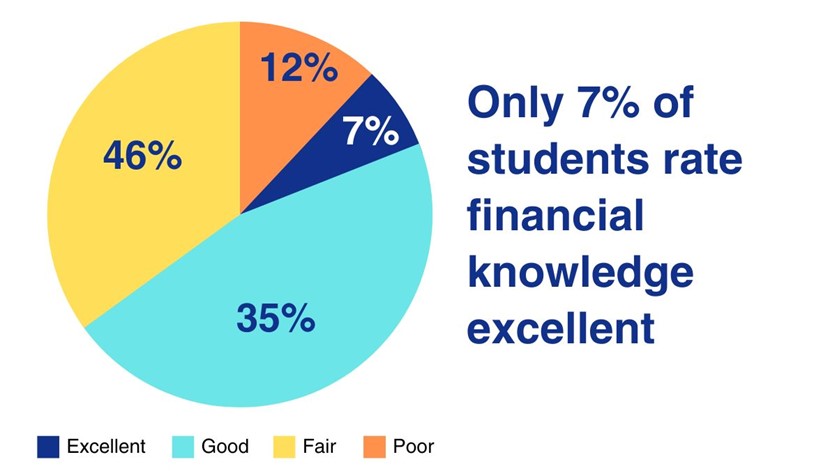

Adding up Confidence

Insights.CollegePulse.com, 2023

Step 1: Open a checking account for your child

Your college student may need access to cash, so opening a checking account for them is worth considering. Even if your child does not have a steady job or income, a checking account can still be useful for accessing automated teller machines or paying bills each month. Online banking and mobile apps have made managing accounts significantly easier than before, and your child will likely adapt quickly to these technologies (and probably be able to teach you a few things before long!).

You may want to set up an account that allows your accounts to be connected. This arrangement enables you to monitor your child’s balance and track their spending, while they cannot view the activity in your account. Overdraft fees can accumulate in a checking account, but by keeping an eye on your child’s account, you can receive notifications when the balance falls below a specified amount. At that point, you can seamlessly transfer money from your account to your child’s account.

Step 2: Consider a Monthly Allowance for Your College Student

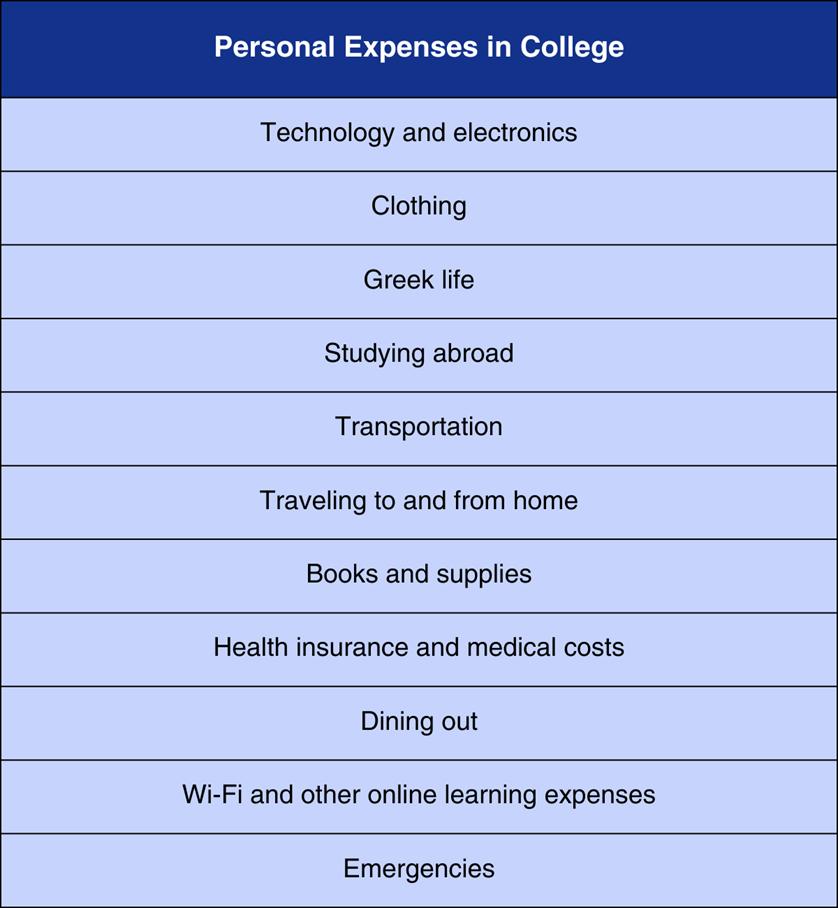

In addition to the budget you have established for your child’s college expenses, such as tuition, room, board, and books, it is important to recognize that there will be additional costs throughout their college career. These expenses may include transportation, clothing, personal items, and entertainment. According to the College Board, for the 2022–2023 academic year, these expenses can range from $1,830 at private colleges to $2,200 at public universities. However, these figures can be underestimated, especially if your child opts for takeout instead of dining hall meals.2

To manage these costs effectively while teaching your child the value of money, providing them with a monthly allowance can be a helpful approach. Although the concept of an allowance may seem old-fashioned, it can serve as a valuable tool for college students. It is important to discuss the purpose of the allowance upfront, including the types of expenses it should cover and those it should not cover.

Once you estimate the amount your child may need to cover expenses, consider depositing that amount into their account at the same time each month. Communicate to your child that they are responsible for managing all their expenses, and if they run out of money before the end of the month, they will need to prioritize their spending.

Preparing a monthly allowance can offer several benefits, including:

- Introducing a limited income that requires making financial choices.

- Providing consistency and predictability in monthly cash flow, which can help alleviate financial anxiety.

- Allowing students to learn about managing monthly cash flow before entering the professional world.

- Offering an opportunity to practice budgeting skills that will be valuable throughout their lives.

While your child may not initially appreciate the fiscal discipline enforced through an allowance, they will eventually understand the importance of the structure you have provided.

Step 3: Encourage a Part-Time Job

Encouraging your child to work part-time can be an excellent way for them to develop time-management skills and gain access to additional spending money beyond what you can provide. It can also provide valuable lessons in responsibility and work ethic. They may have the freedom to use their own earnings to attend concerts or purchase the latest merchandise from the school bookstore.

Step 4: Consider Student Credit Cards

Student credit cards are specifically designed for college students who have limited experience with credit cards. Some student credit cards offer cashback rewards for good grades and have lower annual fees. If you teach your child to use a credit card for small purchases or emergencies and emphasize the importance of paying off the balance in full every month, they can begin building a credit score.3

However, credit cards are not suitable for everyone. If you feel that your child is not yet ready to have a credit card in their name, you can add them as an authorized user on your credit card. As a parent, you know your child better than anyone, so if you believe that having a credit card may lead to unhealthy financial behaviors, it may be wise to forgo it altogether.

A Real-Life Example

One of our clients consulted with us last fall as their oldest child headed off to college. They recently shared their experience and the steps they took to prepare their child:4

1. Set up a bank account for their daughter and linked it to theirs.

2. Got her a debit card and a credit card from her bank in her name to start building credit.

3. Made her an authorized user on one of their credit cards for emergencies.

4. Showed their daughter how to monitor her balances and transfer money from checking to pay off her credit card.

5. Helped her set up her own Amazon account with her credit card.

6. Helped her set up her own PayPal and Venmo account.

7. Helped her set up her own Uber account.

8. Changed all of their passwords on their Amazon, Paypal, and Uber accounts.

9. Scheduled an auto deposit of an allowance of $150 every other week (to mirror a typical bi-weekly payroll process).

10. Clarified ahead of time what they would contribute to Spring Break, Sorority dues, excursions, and other potentially gray areas of expenses.

Overall, they found this approach to be successful, although some negotiation was required along the way. They learned a valuable lesson about not giving their daughter access to their credit card for emergencies, as it led to abuse. They subsequently shifted to having their daughter pay for everything on her own credit card, and if they agreed to cover an expense, they would transfer the money into her checking account. This adjustment resulted in fewer requests from their daughter.

Don’t Wait to Have the Money Talk

Even if your child is already heading off to college this fall, it is not too late to have important conversations about finances and set them on the path to financial success. We hope that these suggestions and the real-life example provided are helpful to you. Implementing these measures can greatly benefit your children in the years to come. Remember, we are here to help. If you have any questions or would like us to meet with your college-bound child, please do not hesitate to contact us.

1. MoneyRates.com, June 6, 2023

2. CollegeData.com, 2023

3. MoneyGeek.com, December 21, 2022

4. Any companies mentioned are for illustrative purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Any investment should be consistent with your objectives, timeframe, and risk tolerance.

Secure Document Sharing

Secure Document Sharing