3 Things: The market as an excitable dog on a leash

The market as an excitable dog on a leash

1. One of my favorite financial bloggers, Ben Carlson, writes in Market Earthquakes:

“Ralph Wanger, the eccentric portfolio manager of the Acorn Fund, once summed up the stock market to Bill Bernstein with an analogy about walking a dog:

He likens the market to an excitable dog on a very long leash in New York City, darting randomly in every direction. The dog’s owner is walking from Columbus Circle, through Central Park, to the Metropolitan Museum. At any one moment, there is no predicting which way the pooch will lurch. But in the long run, you know he’s heading northeast at an average speed of three miles per hour. What is astonishing is that almost all of the market players, big and small, seem to have their eye on the dog, and not the owner.

Maynard is focusing on the owner, but most investors are preoccupied with the dog. It’s easy to say you should ignore the noise in the markets, but this is nearly impossible in today’s world because information is all around us. Your plan should include ways to eliminate the amount of noise that finds its way into your portfolio, even though you’ll never be able to completely escape it. The trick is being able to sift through the noise and figure out the difference between what’s actionable and what’s entertainment.

This is why portfolios should be managed for risk, not returns, a simple yet important distinction.”

Market Earthquakes ( (A Wealth of Common Sense, 11/6/2014)

Bonus: One of my favorite cartoons

Cartoon source: Some Random Observations on the Market Correction (A Wealth of Common Sense, 2/11/2018)

Welcoming market pullbacks

2. “… if you are at a point in your career when you are saving, you should welcome a market pullback, because it allows you to buy at lower prices.”

Headlines and Head Games (Humble Dollar, 2/12/2018)

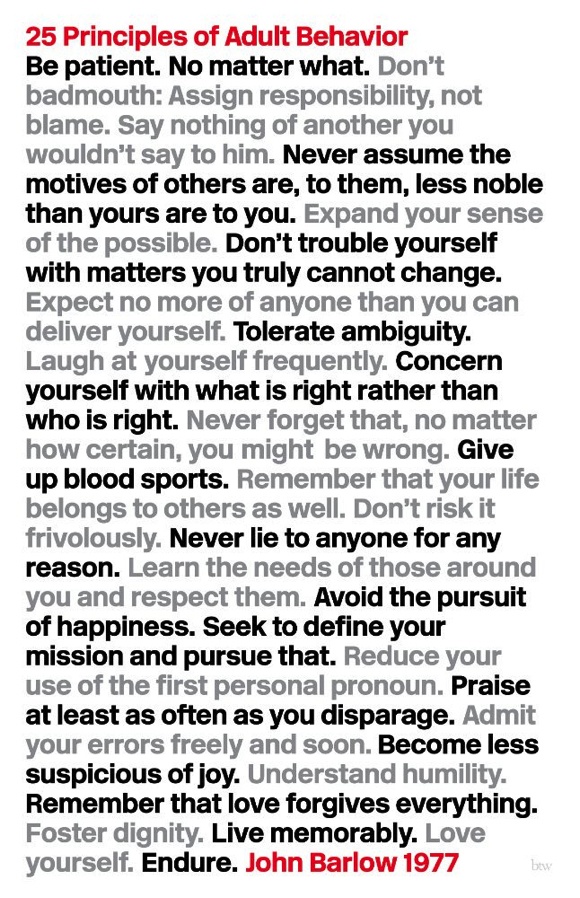

RIP John Perry Barlow

(October 3,1947 — February 7, 2018)

3. An American poet and essayist, a political activist, a lyricist for the Grateful Dead, a Fellow Emeritus at Harvard University‘s Berkman Center for Internet and Society and more.

I leave you with his Principles of adult behaviour

SAGE Serendipity: Continuing with the theme of reflecting on adult behaviour, we loved this article, Why Trying to Be Less Awkward Never Works, in the Smarter Living section of The New York Times. Melissa Dahl writes:

Much of the time, our awkwardness is self-induced because we’re overthinking our behavior so much that it becomes our only focus.

Dr. Hendriksen has a little experiment she sometimes asks her social anxiety patients to try.

“Have two separate conversations — and it could be with anybody. It could be with a guy at the gas station, or a co-worker or your barista. Whoever,” she said. “And in one of those conversations, focus on you, you, you. Focus on how you’re coming across, what’s happening in your body, monitor what you’re saying.

“And then, in the second conversation, focus on them, them, them,” she said.

Afterward, ask yourself: Which conversation was more pleasant? And in which did you feel more at ease?

Secure Document Sharing

Secure Document Sharing