Tax planning is among the most overlooked components in wealth management.

Unfortunately, it can represent a significant “gotcha” if it is not carefully integrated into your financial road map. This is why tax management is woven throughout your SAGEbroadview experience:

- Initial Wealth Management Year — During initial planning, we review your prior-year tax returns for tax-planning opportunities and prepare a tax projection for the current year.

- Ongoing Wealth Management –

-

- We include an annual, current-year tax projection to remain on top of tax-planning opportunities.

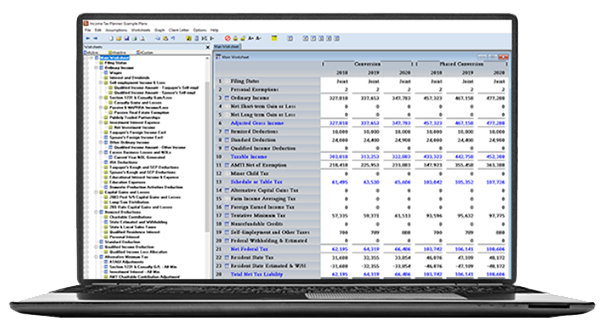

- We help you plan for tax implications resulting from marriage, Roth conversions, stock option exercises & vesting of restricted stock grants, and other events by modeling different side-by-side “what-if” scenarios.

- We ensure that liquid assets are available when and as needed, so your taxes due don’t trigger poorly timed trades in your investment accounts.

- Portfolio Management – As we plan, build, and maintain your investment portfolio, we routinely incorporate tax-management strategies.

-

- If you are in a high tax bracket, we might determine that year-round tax-loss harvesting will help minimize taxes owed.

- Alternatively, it could be tax-smart to harvest capital gains in your portfolio to take advantage of a low-income tax rate year.

- We may hold on to a legacy stock or mutual fund position as liquidating it could trigger high capital gains taxes. Or we may liquidate it over time to minimize taxes owed on the sales. Or we may use it when you want to gift to your favorite charity, or start a Donor Advised Fund.

- Tax return preparation – Larry Annello, CPA/PFS, CFP® has nearly 40 years of experience as a CPA and financial professional. Larry is also a partner in our affiliated firm, SAGEbroadview Tax, where, as a separate service, he assists SAGEbroadview Wealth Management clients with their income tax return preparation.

Secure Document Sharing

Secure Document Sharing

Tax Planning & Tax Preparation

Tax Planning & Tax Preparation