Managing Held-Away Retirement Plans and Annuity Accounts: Part II

SAGEbroadview:

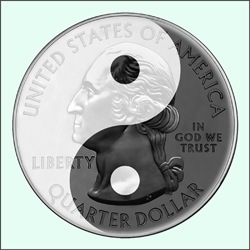

Achieving Financial Harmony

Part II: From Hodge-Podge Investing to Financial Harmony

In our last blog post, we introduced the concept of organizing the building blocks of your household assets under the unified oversight of a financial professional. These include your primary investment portfolio as well as held-away accounts such as retirement plans or unmanaged annuities. Today, we’ll dig deeper into how coordinated oversight can be expected to enhance your investment

Harmonious Versus Piecemeal Investing: Avoiding Gaps and Overlaps

At SAGEbroadview, we determine the desired asset allocation for clients’ household portfolios using our evidence-based approach to investing, taking each family’s unique goals and risk tolerance into consideration. We feel we can best attain those desired allocations if we can ensure that all investment accounts – including held-aways – are consistently invested according to this household plan.

The common alternative is piecemeal investing. Your managed portfolio may be properly allocated between stocks and bonds. But your 401(k)s, 403(b)s and other held-away accounts tend to become orphans, invested however made sense at the time, according to separate, stand-alone decisions. Without household investment planning, you end up experiencing gaps and overlaps in which you are either under- or over-allocated to desired asset classes. This can lead to your taking on more market risk than you had in mind, or not enough risk to pursue the returns you need to achieve your goals.

Evidence-Based Investing

Why is it so important to pursue an evidence-based approach to begin with? Our aim is to combine sound strategy with objective advice on how to best apply it, so you can tune out harmful distractions and confidently pursue your own highest financial goals. Key tenets to our strategy include the following:

- Risk and return are related. By taking on increased market risks in your investments, you can expect to earn increased market returns over time.

- “Asset class” investing helps you efficiently capture expected returns while minimizing associated risks. Asset class investing is based on the premise that particular market asset classes exhibit particular risk/return characteristics over time. (For example stocks versus bonds, small company stocks versus large, U.S. versus international, etc.) How you allocate your portfolio across various asset classes plays an enormous role in determining your expected long-term performance.

- Global diversification helps further dampen risks. By spreading your investments around the world and across the risk/reward characteristics of diverse asset classes, you can further dampen market risks while seeking their expected returns.

- Costs matter. By investing in passively managed funds that focus on efficiently targeting specific asset classes, we minimize the costs that otherwise detract from your end returns.

The Take-Away

It makes good sense to invest according to evidence and reason over emotions and guesswork – applied within and across all of your accounts for maximum effect.

In next week’s post, we’ll complete our three-part series on managing held-away accounts by exploring some additional advantages found in adopting a unified approach.

Sage Serendipity: Speaking of heartfelt harmony, if anyone can pull off a successful cover of a classic, it’s Ann and Nancy Wilson of Heart, performing Led Zeppelin’s “Stairway to Heaven.” Jason Bonham was on drums. Rock on!

Secure Document Sharing

Secure Document Sharing