Investment Basics Series: What Is Asset Location?

What is asset location and why does it matter to you as an investor?

Let’s begin by noting that asset location should not be confused with asset allocation, which we addressed in last week’s post. The two are related, but each makes its own contribution to your investment experience.

- Asset allocation (as described here) is about spreading your money among different asset classes, based on the amount of market risk and expected reward inherent to each.

- Asset location is deciding where to locate your stocks, bonds and other holdings across your taxable and tax-sheltered accounts, to maximize your overall tax efficiency.

Why Do It?

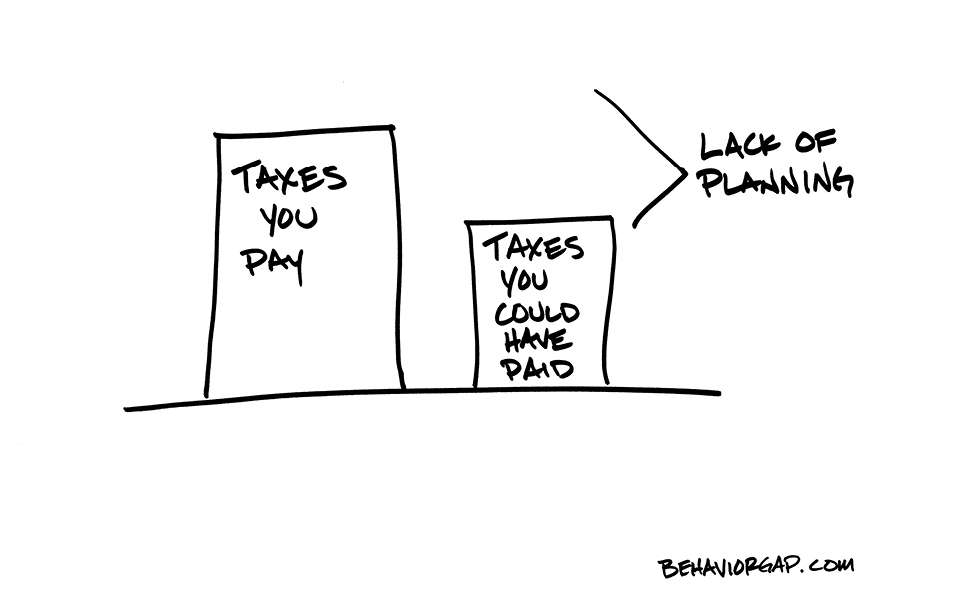

There’s empirical evidence that asset location is worth the extra effort it takes in terms of the tax savings it can yield. In his article, “Many investors could do more to reduce their taxes,” Vanguard Group’s Chuck Riley points to a Vanguard research paper that crunches the numbers on several possible scenarios for putting the power of asset location to work for you, depending on your circumstances. Riley concludes: “Asset location enhances potential returns without increasing risk. … More return, same risk. Who doesn’t want that?”

Weighing Your Options

It makes intuitive sense that, by locating your most heavily taxed investments within your tax-sheltered accounts, you can minimize or even eliminate their tax inefficiencies. But effective implementation is important, and typically requires more than an auto-pilot approach.

First, there is only so much room within your tax-sheltered accounts. After all, if there were unlimited opportunity to tax-shelter your money, you’d simply move everything there and be done with it. Trade-offs must be made to make the best use of your tax-sheltered “space.”

Second, you don’t tax-manage your assets in a vacuum. Determining the best balance for you and your unique circumstances involves several moving parts, as well as remaining abreast of any tax code changes that may alter your plans.

- Your big picture – Before you locate your assets, you’ll want to determine your proper asset allocation based on your unique goals and risk tolerances. Asset allocation comes first; tax-efficient asset location is next.

- Your goals and timeframe – Is retirement near or far? Do you want to leave a legacy? Are your circumstances likely to change in the next few years? Spending, estate planning or other needs may override optimal asset location.

- Your tax-sheltered account options – What tax-sheltered accounts are available to you: such as Roth versus traditional IRAs versus company retirement plans? How much room do you have in each and what investment choices are available?

- Your tax-planning needs for stocks – There are additional considerations related to holding stocks within taxable accounts, such as the ability to harvest capital losses, donate appreciated shares to charity, implement a step-up in basis and take foreign tax credits. While these opportunities have more or less importance depending on your goals and circumstances, they become unavailable for stocks held in tax-sheltered accounts.

In short, it can pay to partner with your investment advisor and tax professional to help you optimize tax-efficient asset location, upfront and ongoing. While you may not know when you are missing out on effective asset location opportunities, the money you may be losing to unnecessary taxes can be very real.

Win a copy of Carl Richards’ new book, One-Page Financial Plan

As we mentioned in our Investment Basics introduction, send us an e-mail with a question or comment about today’s post, and you’ll be entered to win this week’s drawing for a copy of Carl Richards’ One Page Financial Plan. Happy summer reading!

Sage Serendipity: The Upshot in The New York Times asked 17 economists to forecast the US economy for the Presidential Elections in November 2016. In the article Forecasters Expect a Strong Economy for the 2016 Presidential Election, economics correspondent Neil Irwin writes “A wide range of political science research suggests that if you want to know who will win the presidency, the state of the economy — and especially how economic conditions are changing — matters a great deal, perhaps even more than how charismatic the candidates are or how much money they raise.”

Sage Serendipity: The Upshot in The New York Times asked 17 economists to forecast the US economy for the Presidential Elections in November 2016. In the article Forecasters Expect a Strong Economy for the 2016 Presidential Election, economics correspondent Neil Irwin writes “A wide range of political science research suggests that if you want to know who will win the presidency, the state of the economy — and especially how economic conditions are changing — matters a great deal, perhaps even more than how charismatic the candidates are or how much money they raise.”

Secure Document Sharing

Secure Document Sharing