The Full-Meal Deal of Diversification

As we introduced in our first installment, we’ve obtained the rights to share what we feel is an excellent series of articles: Evidence-Based Investment Insights. Here is the fifth post in this seven-part series. In our last piece, “Financial Gurus and Other Unicorns,” we concluded our exploration of the formidable odds you face if you (or your hired help) try to outsmart the market’s lightning-fast price-setting efficiencies. Today, we turn our attention to how you can harness these and other efficiencies to work for, rather than against you.

Among your most important financial friends is diversification. After all, what other single action can you take to simultaneously dampen your exposure to a number of investment risks while potentially improving your overall expected returns? While they may seem almost magical, the benefits of diversification have been well-documented and widely explained by some 60 years of academic inquiry. Its powers are both evidence-based and robust.

Global Diversification: Quantity AND Quality

What is diversification? In a general sense, it’s about spreading your risks around. In investing, that means that it’s more than just ensuring you have many holdings, it’s also about having many different kinds of holdings. If we compare this to the adage about not putting all your eggs in one basket, an apt comparison would be to ensure that your multiple baskets contain not only eggs but also a bounty of fruits, vegetables, grains, meats and cheese.While this may make intuitive sense, many investors come to us believing they are well-diversified when they are not. They may own a large number of stocks or stock funds across numerous accounts. But upon closer analysis, we find that the bulk of their holdings are concentrated in large-company U.S. stocks.Think of a concentrated portfolio as the undiversified equivalent of many basketsful of plain, white eggs. Over-exposure to what should be only one ingredient among many in your financial diet is not only unappetizing, it can be detrimental to your financial health. Lack of diversification:

- Increases your vulnerability to specific, avoidable risks

- Creates a bumpier, less reliable overall investment experience

- Makes you more susceptible to second-guessing your investment decisions

Combined, these three strikes tend to generate unnecessary costs, lowered expected returns and, perhaps most important of all, increased anxiety. You’re back to trying to beat instead of play along with a powerful market.

A World of Opportunities

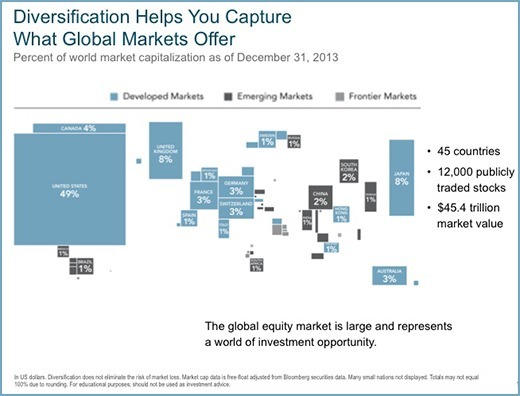

Instead, consider that there is a wide world of investment opportunities available these days from tightly managed mutual funds intentionally designed to facilitate meaningful diversification. They offer efficient, low-cost exposure to capital markets found all around the globe.

Your Take-Home

To best capture the full benefits that global diversification has to offer, we advise turning to the sorts of fund managers who focus their energies – and yours – on efficiently capturing diversified dimensions of global returns.In our last piece, we described why brokers or fund managers who are instead fixated on trying to beat the market are likely wasting their time and your money on fruitless activities. You may still be able to achieve diversification, but your experience will be hampered by unnecessary efforts, extraneous costs and irritating distractions to your resolve as a long-term investor. Who needs that, when diversification alone can help you have your cake and eat it too?In our next post, we’ll explore in more detail why diversification is sometimes referred to as one of the only “free lunches” in investing.

Secure Document Sharing

Secure Document Sharing