3 Things: Inflation, Fact-checking, & State Tax Rates

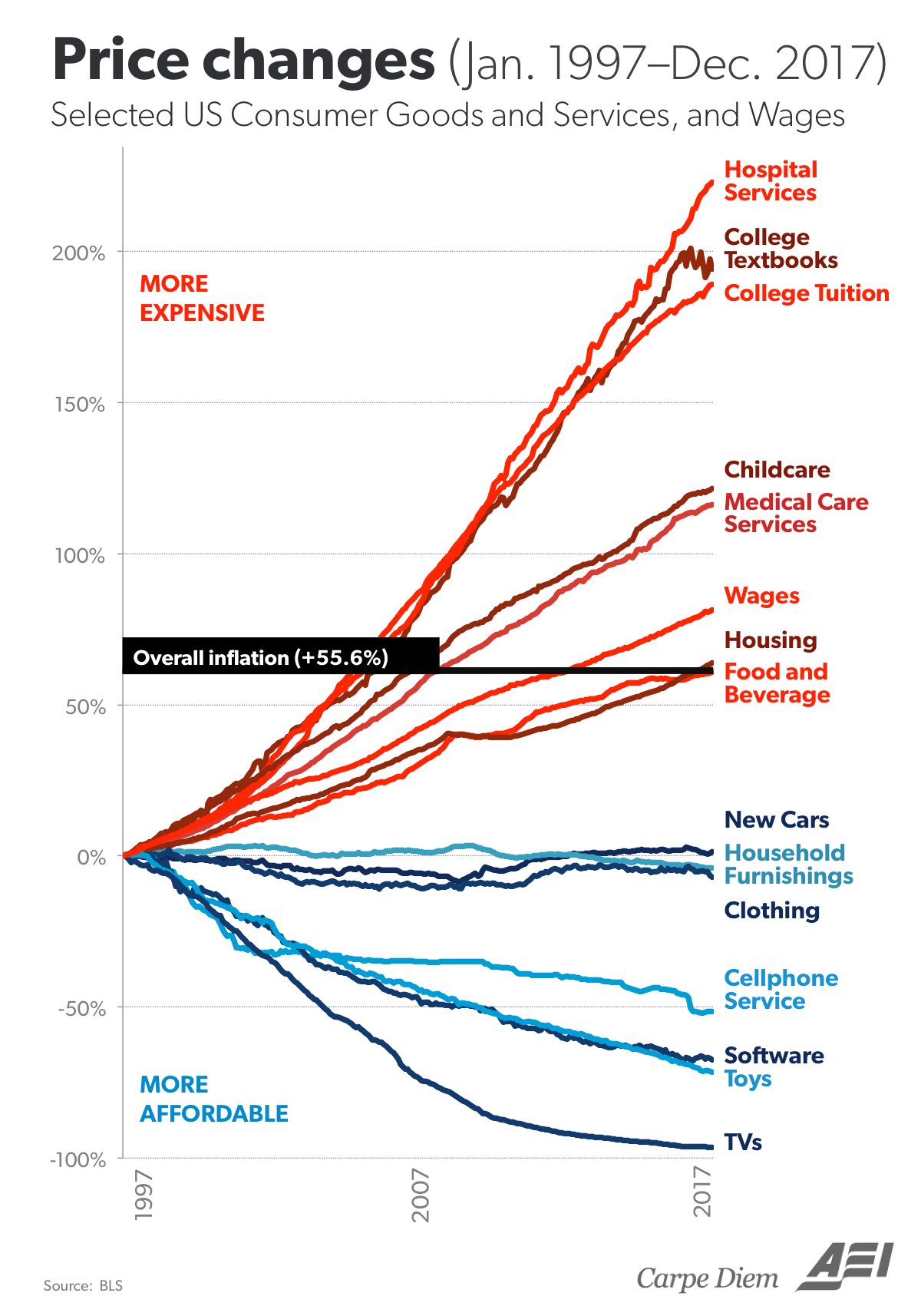

A “stunning” chart on inflation

- Barry Ritholtz shares a chart showing Inflation: Price Changes 1997 to 2017

What do you notice about the cost of college as well as health care?

“Wages have barely ticked over the median inflation measure, but that did not stop some people from blaming the correction on rising wages.”

Chart Source: Chart of the day (century?): Price changes 1997 to 2017 (AEIdeas, Mark J. Perry, 2/2/2018)

90-second fact-checking what you read online

- The author, Mike Caulfield, outlines how to fact-check an article and includes this video demonstrating it in real time.

Good net citizens:

- Source-check what they share

- Share from the best source possible

- Provide source/claim context to people they share with when necessary

“Think of it as information hygiene, the metaphorical handwashing you engage in to prevent the spread of misinformation.”

It Can Take As Little As Thirty Seconds, Seriously (Mike Caulfield, 1/23/2018)

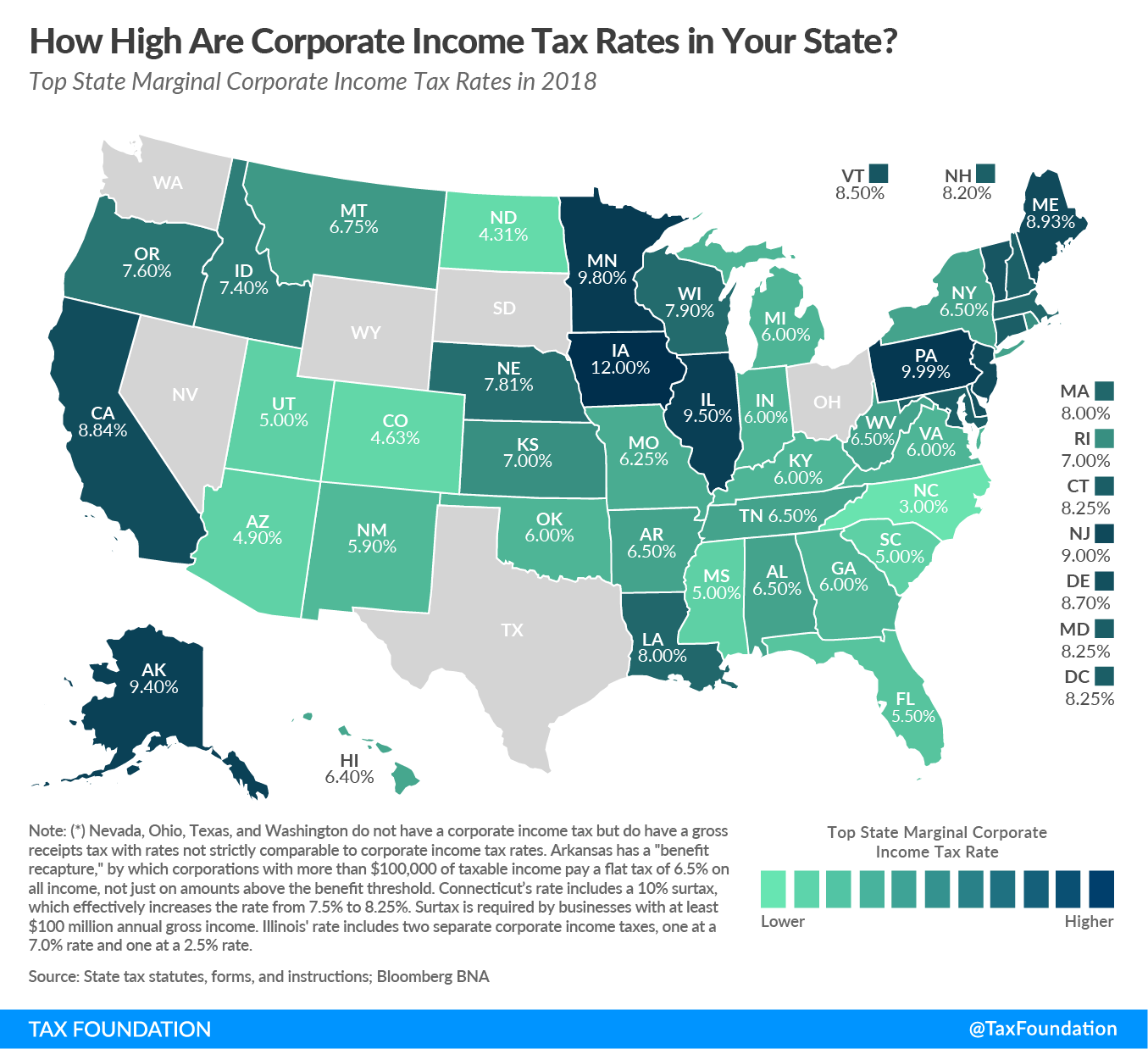

Corporate Income Tax Rates by State

- Key Findings by the Tax Foundation:

- Forty-four states levy a corporate income tax. Rates range from 3 percent in North Carolina to 12 percent in Iowa.

- Six states — Alaska, Illinois, Iowa, Minnesota, New Jersey, and Pennsylvania— levy top marginal corporate income tax rates of 9 percent or higher.

- Seven states — Arizona, Colorado, Mississippi, North Carolina, North Dakota, South Carolina, and Utah — have top rates at or below 5 percent.

Chart Source: State Corporate Income Tax Rates and Brackets for 2018 (Tax Foundation, 2/2/2018)

SAGE Serendipity: National Geographic’s article – Long Before Trump, We Were Obsessed With Presidential Hair, says that “Back in the day, getting a lock of a president’s hair was cool, not creepy.” In fact the Academy of Natural Sciences in Philadelphia has hair samples from the first twelve presidents, and Jimmy Carter.

SAGE Serendipity: National Geographic’s article – Long Before Trump, We Were Obsessed With Presidential Hair, says that “Back in the day, getting a lock of a president’s hair was cool, not creepy.” In fact the Academy of Natural Sciences in Philadelphia has hair samples from the first twelve presidents, and Jimmy Carter.

Secure Document Sharing

Secure Document Sharing