Dimensional Fund Advisors: 2015 Review

To counteract some of the stress that the markets have been putting us through lately, we’d like to share a short, upbeat tale with you about risks and expected rewards.

“Once upon a time in 1981, there were two young men in Brooklyn who created a fund management company based on a set of ideas that were “bigger than the firm itself.” Its funds would be new and groundbreaking, but they would be guided by evidence-based insights that had been decades in the making. It would be the first fund manager (and still one of the few) with scientific discipline and academic oversight built into its strategies.

The firm has since flourished, with a global family of funds structured to efficiently capture worldwide dimensions of market returns. But during its early years, success was far from guaranteed. Its first fund was designed to isolate U.S. small-cap returns, which frequently defied expectations by underperforming U.S. large-caps for multiple, multiyear periods. During these trials by fire, its founders didn’t know when – or even if – their confidence in the science of investing would be rewarded.

But there was one thing they did know. If they abandoned their well-reasoned plan without giving it the test of time it deserved, failure would be certain. So they stuck to their evidence-based guns; the rest, as they say, is history.”

As you might have guessed, this is the tale of Dimensional Fund Advisors. It’s a tale to take to heart for your own resolve. In that context, we are pleased to share Dimensional’s freshly released 2015 Market Review. Dimensional’s PDF : 2015 Review – Economy & Markets

With an evidence-based rigor, the data is the data. We don’t attempt to whitewash it. At a quick take, 2015 was marred by nearly universal negative-to-low returns, especially from small-cap and value stocks; continued declines in the world oil market; and weak economic growth in China and elsewhere. Investors who held globally diversified portfolios tilted toward riskier sources of market returns were not rewarded. Not last year, anyway.

The stage-setting in 2015 may or may not also explain the rough ride we’re experiencing so far in 2016. But if you add Dimensional’s current annual review to the ones it has been publishing since 2011, the sensible take-home becomes clear: Markets have been on an overall uphill trajectory for as long as anyone has been tracking them. But they’ve also exhibited wild unpredictably nearly every step of the way. In that respect, the current climate is no exception to our evidence-based expectations. It’s the “risk” part of the risk/reward equation.

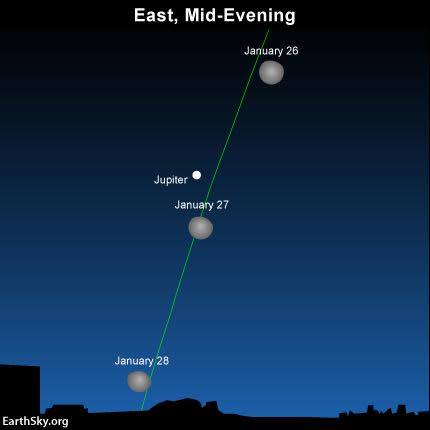

Sage Serendipity: Instead of looking back and ahead, let’s change our focus and look up! For the next few weeks the pre-dawn sky will give us the treat of 5 planets (Jupiter, Mars, Saturn, Venus, and Mercury) aligned. Sky & Telescope has a nice account map on their webpage. And EarthSky.org has a daily map (right) to keep you informed as to where the moon is in relationship to Jupiter so you can find the line-up.

Sage Serendipity: Instead of looking back and ahead, let’s change our focus and look up! For the next few weeks the pre-dawn sky will give us the treat of 5 planets (Jupiter, Mars, Saturn, Venus, and Mercury) aligned. Sky & Telescope has a nice account map on their webpage. And EarthSky.org has a daily map (right) to keep you informed as to where the moon is in relationship to Jupiter so you can find the line-up.

Secure Document Sharing

Secure Document Sharing