Demystifying Evidence-Based Investing

As Nobel laureate Eugene Fama once said, “Investment theory simplifies things that are otherwise shrouded in mystery and confusion.”

We couldn’t agree more … but sustaining that level of simplification is a way of life, not a one-time task. That’s why we regularly attend educational forums that allow us to expand our knowledge base and sharpen our critical thinking. In fact, as members of National Association of Personal Financial Advisors (NAPFA), we are committed to pursuing at least 60 hours of continuing education every two years.

Most recently, Chris Annello and I joined several hundred like-minded financial professionals at the inaugural Evidence-Based Investment Conference in New York City. We attend a number of educational events every year, but this one stood out as the first of its kind to explore a wide range of evidence-based perspectives in one, very action-packed day. Or, as expressed more informally by “Wealth of Common Sense” blogger Ben Carlson, “This was the first investment conference I’ve ever been to where there wasn’t at least one BS macro forecast.”

Many Perspectives: Two Big Take-Aways

There was certainly no lack of opinions aired, delivered by thought leaders ranging from Vanguard’s Chairman and CEO Bill McNabb, to veteran champion of “The Index Revolution,” Charles Ellis.

Given the range of brainiacs in attendance, it’s no wonder that not everyone agreed on everything – not by a long shot! But several important themes emerged. “Teachable Moment” blogger Tony Isola did a good job of summarizing some of the biggest ones. We’d like to focus on two of particular importance to us.

- Investing can be simple (as Professor Fama suggests), but it’s not easy.

“There is no one right portfolio for everyone – the right one is one you’ll stick to and rebalance.” – Dan Egan, Betterment

“We [investors] are not rational. Not even close … We overreact to news, ignore norms, and overweight recent events.” – Charles Ellis

“There’s too many variables in the short run to try and guess at [future market pricing]. Don’t let emotion overwhelm you.” – Bill McNabb

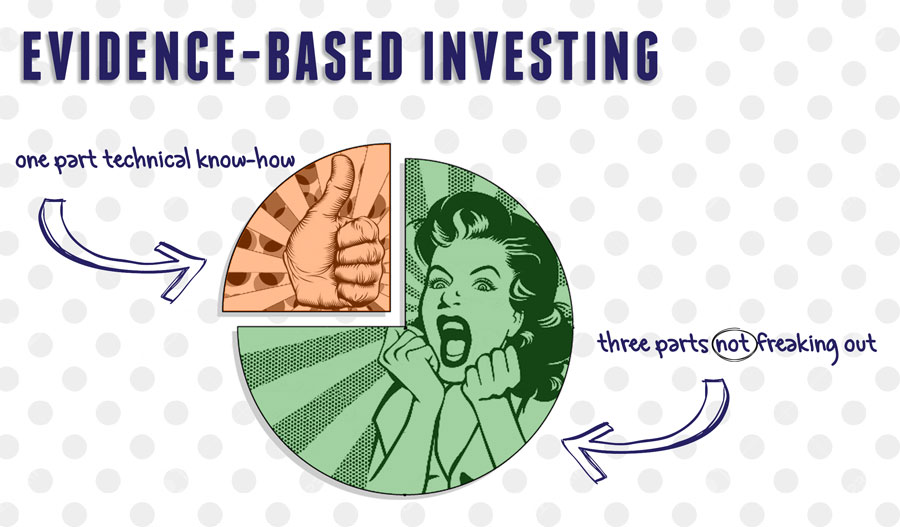

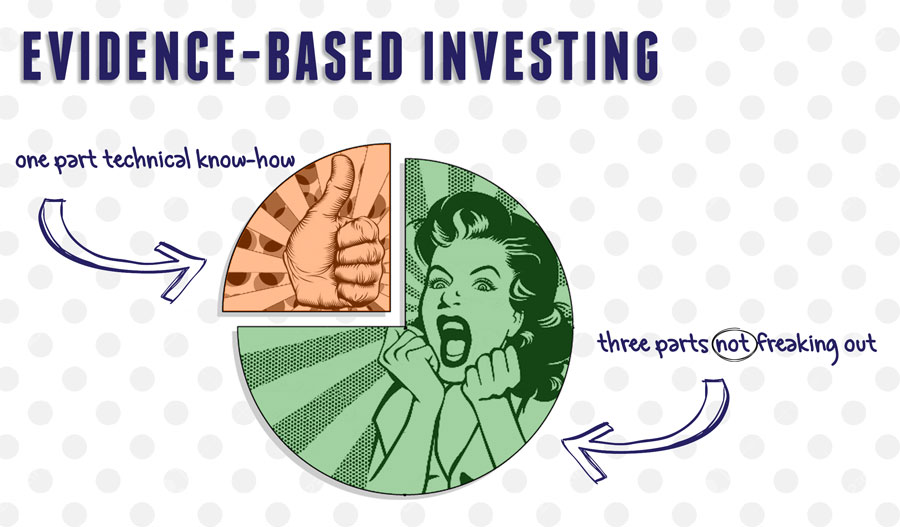

Sheri’s take: Investing is one part technical know-how and three parts not freaking out as the near-term market sends out its never-ending mixed messages. Not freaking out takes practice and poise. Understanding the intellectual part strengthens you for the much greater challenge of maintaining your emotional resolve.

Which leads us to our next big take-away …

- There’s still plenty of room for good advice.

“A good advisor tailors the client’s portfolio to what the client can stick to.” – Dan Egan

“We need more people to move from investment management to being investment counselors…Think of how you can help someone and get them on the right path.” – Charles Ellis

“Setting realistic expectations and having an understanding about what is a normal period of poor performance and what is a poor investment strategy is key. Even then, the bottom line is that successful investing is hard.” – Wesley Gray

Sheri’s take: While the raw ingredients for building and maintaining an investment portfolio are increasingly accessible in the form of robo-technology, successful investing ultimately requires so much more.

Learning the technique of investing is always fun and fascinating … for me, anyway. But the most gratifying part comes when I get to use the experience to help others strengthen their financial stamina. That’s one of the biggest take-aways I seek whenever attending an educational event like this one.

SAGE Serendipity: It’s “cyberweek” and our inboxes are packed with deals! In honor of all things cyber in our lives we would like to share this very informative infographic from The Cooper Review, 12 Tricks to Appear Smart in Emails. The tagline for the site is “Funny because it’s true” and we couldn’t agree more.

SAGE Serendipity: It’s “cyberweek” and our inboxes are packed with deals! In honor of all things cyber in our lives we would like to share this very informative infographic from The Cooper Review, 12 Tricks to Appear Smart in Emails. The tagline for the site is “Funny because it’s true” and we couldn’t agree more.

Secure Document Sharing

Secure Document Sharing